The lot is actually the unit of measurement of the transaction and is one of the most important parts of risk management that every trader should pay attention to, and even if the position seems to be very great, still operate in a controlled transaction volume.

If you enter into a transaction with the volume of one lot in the euro-dollar currency pair, the pip value will be 10 dollars. That means you will make a profit or loss of ten dollars per pip swing.

Lot size in forex is the size you choose as a trader to open a trade and it should be based on the amount of leverage, risk management and asset amount.

In this article we will discover together:

- Relationship between risk management and lot volume

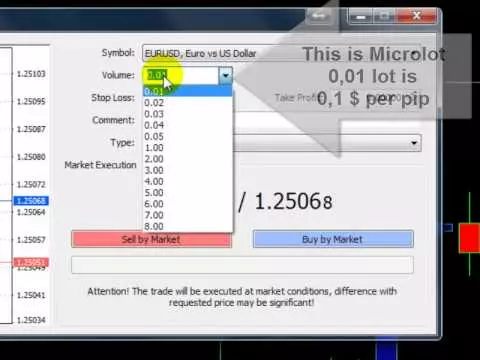

- Determining the lot size in Metatrader

- What’s the amount of each lot?

- How much is each lot?

- How much is each lot in forex currency pairs?

- How much is each lot of gold?

- How many ounces and grams is each lot of gold?

- How many dollars and how many barrels are per lot of oil?

- How much dollars are a Dow Jones lot?

- How much dollars are each silver lot?

- How much is each bitcoin lot?

- How much is each Ethereum lot?

- What is the best lot size?

Relationship between risk management and lot volume

Each trader has his own special strategy and chooses the lot amount based on the rules she has set for her own trading. Many beginners and novices who have not yet learned to draw a wall between emotions and trading rules choose a different lot each time based on their emotions.

The most common risk management that is suggested in many strategies is that the amount of capital for a new position should not exceed 1% of the asset amount.

Of course, depending on the experience of people, this one percent can be increased up to three percent. But you should not allow yourself to take too much risk in one trade.

Because if, for example, you risk ten percent of your total balance in one transaction, you may lose your capital after only ten transactions.

Determining the lot size in Metatrader

In MetaTrader, you can determine how much you want to trade. The volume of transactions in the forex market is measured by lots.

What’s the amount of each lot?

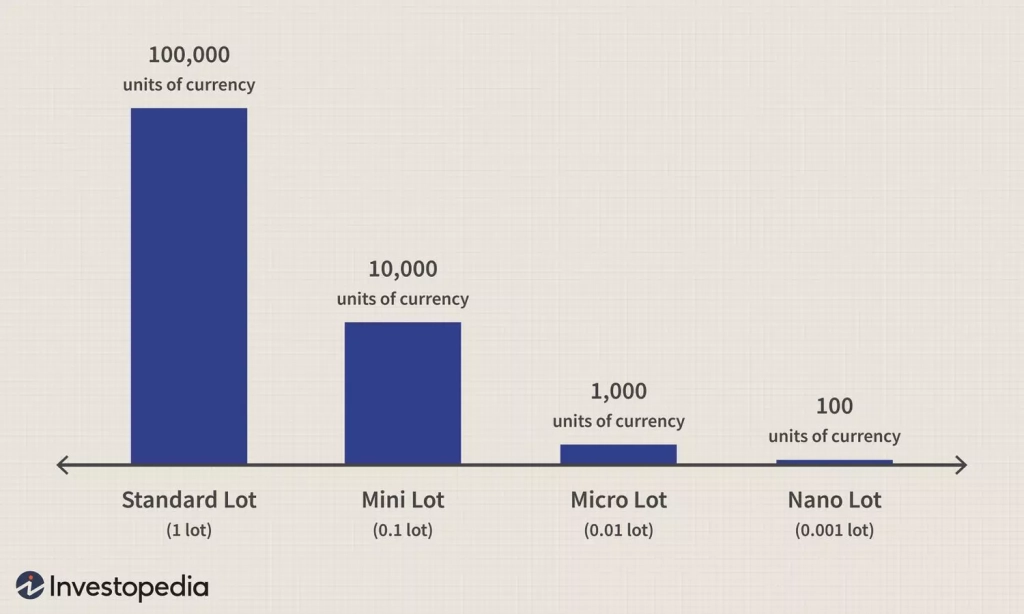

In the past, forex was traded in specific amounts called “lots”. The standard size for each lot is 100,000 (one hundred thousand) currency units.

There are also mini, micro, and nano lot sizes, which are 10,000, 1,000, and 100 units, respectively.

As you probably know, the change in the value of one currency against another is measured in pips, which are a very, very small percentage of a currency’s value. Different currency pairs do not fluctuate much during a day. Their volatility is usually less than 100 pips.

To take advantage of this small change in value, you need to trade large amounts of a given currency in order to make an acceptable profit or loss.

Well, a big question arises.

How can we trade huge amounts with this little capital?

The answer lies in the concept of leverage.

Think of your broker as a bank that basically gives you $100,000 to buy currencies.

All the bank asks you to do is give them $1,000 as a deposit.

This method of trading forex using leverage is called “leverage”.

The amount of leverage you use depends on your broker and the amount you want.

How much is each lot?

So far, you have learned how much is the standard amount of each lot. To convert lots to dollars, just multiply the amount of lots for each symbol by its price to get the dollar value of each symbol.

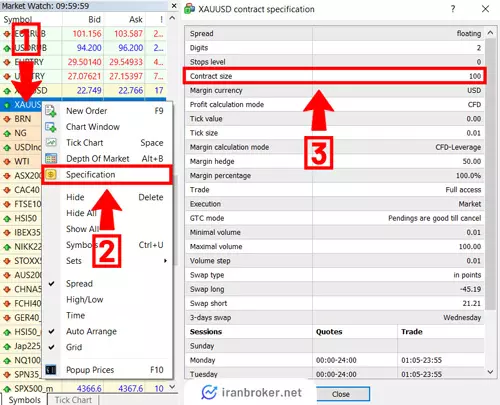

To find the lot amount of each symbol in Metatrader, just right-click on the name of each symbol and select the Specification option. On the opened page, you can see the amount of that symbol per lot in the Contract Size section.

The amount of lot in each of the forex symbols is not the same. Next, we want to discuss the amount of each lot in each of the forex symbols.

How much is each lot in forex currency pairs?

Standardly, each lot for currency pairs is equivalent to converting 100 thousand units from one currency to another.

For example, when you buy a lot in the euro-dollar currency pair, that means you have converted 100,000 units of euros into dollars. At this time, if the price moves up by 50 pips, you will receive a profit of $500.

How much is each lot of gold?

Each lot of gold in Forex is worth 100 ounces of gold. If we assume that the price of gold per ounce is $1904, then each lot of gold is equivalent to $190,400.

For example, when you buy one lot in the XAUUSD symbol, you have bought 100 ounces of gold. At this time, if the price on the gold chart moves up by 10 pips, you will make a profit equal to 100 dollars.

How many ounces and grams is each lot of gold?

As mentioned, each lot of gold is equivalent to 100 ounces of gold. Since each ounce of gold is approximately 31.1 grams of gold, therefore, the amount of each lot of gold is approximately equivalent to 3110 grams of gold.

How many dollars and how many barrels are per lot of oil?

Each lot of oil in forex transactions in brokers is equivalent to 1000 barrels of oil. If we assume that each barrel of oil is worth 80 dollars, then we can say that each lot of oil is worth 80,000 dollars.

How much dollars are a Dow Jones lot?

In the Dow Jones index, each lot is calculated by the number of Dow Jones contracts. Each lot of Dow Jones is equal to 1 Dow Jones contract.

If we assume that the price of each Dow Jones contract is equal to $34,300, then we can say that each Dow Jones lot is worth $34,300.

How much dollars are each silver lot?

Each lot of silver in Forex is equivalent to 5 thousand ounces of silver. That is, if we buy 1 lot in the symbol XAG/USD, it means that we have bought 5 thousand ounces of silver.

If, hypothetically, the price of one ounce of silver is equal to 22.7 dollars, then each lot of silver will be equal to 113,500 dollars.

How much is each bitcoin lot?

The volume of trading in digital currencies such as Bitcoin in the forex market is calculated per lot unit. Each lot of Bitcoin purchase in Forex is equivalent to buying 1 Bitcoin in the world of digital currencies.

In fact, if the price of each bitcoin is $26,000, then each lot of bitcoin is worth $26,000.

How much is each Ethereum lot?

In Ethereum transactions of the forex market, just like Bitcoin, each lot of Ethereum purchase is equivalent to buying 1 unit of this digital currency.

If, for example, each Ethereum unit is equivalent to $1,700, then each lot of Ethereum will be $1,700.

What is the best lot size?

In the forex market, depending on the amount of loss that you specify in a transaction based on your strategy, the lot amount of your transaction will be determined.

For example, if your total capital is 1000 dollars and your stop loss is 50 pips away from the current price, and you want to risk only 1%, you should only enter into the transaction with 0.02 of the lot. Because if your stop loss is touched, you have only lost ten dollars and you have followed the rule of 1% of the total capital.

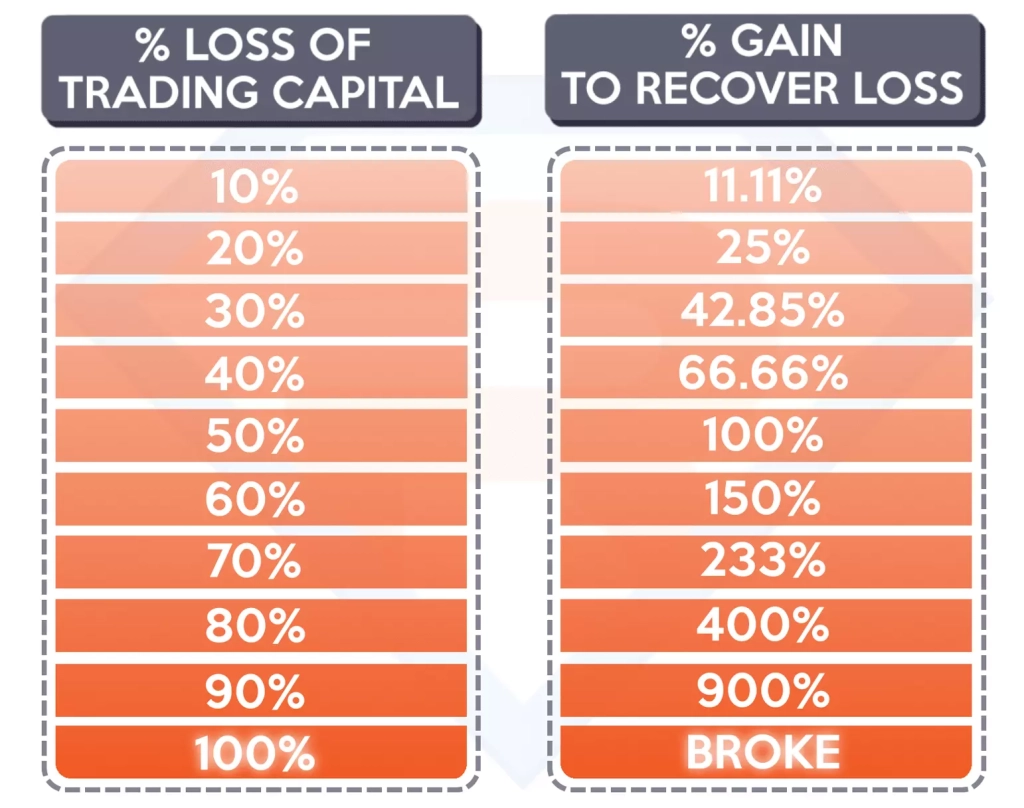

You must be careful to observe risk management in the market, because if you lose 50% of your capital, you must make 100% profit to compensate for it!

Pay attention to the table below. This table shows the amount of profit that is needed to compensate for different percentages of loss.

Many traders do not pay attention to the fact that compensation for losses is not that simple. Actually, to compensate 90% loss, you have to make 900% profit!