Due to the high volume of transactions in forex, currency parity rates are usually calculated up to five decimal places. In most cases, in the main currencies except “Japanese yen”, currency parity is given in the form of one whole number and four decimal places.

In currency pairs whose parity rate is calculated up to four decimal places, the fourth place after the decimal place is called pips.

For example, if the price of euro to dollar reaches from 1.3382 to 1.3384, we say that it has increased by 2 pips.

As another example, if the pound to dollar price reaches 1.8855 to 1.8757, then the pound to dollar parity rate has decreased by 98 pips.

In currency pairs that include “Japanese yen” and are calculated up to two decimal places, the second digit after the decimal point is called pip.

For example, if the price (GBP/JPY) reaches 188.99 to 188.88, we say it has increased by 11 pips.

What is a pip? What is a pipette?

What does pip mean in forex? At this stage, we have to do some mathematical operations.

You’ve probably heard the terms pip, pipette, and lot. Now we show their definition and how to calculate them. Take your time with this information because this knowledge is essential for all forex market traders and we have compiled everything you need to know about pips and pips in this article.

Don’t even think about trading until you understand the concept of pip value and profit and loss calculation.

The unit of measurement used to express the change in value between two currencies is called pip. If (EUR/USD) moves from 1.2250 to 1.2251, a 0.0001 increase in USD is called a pip.

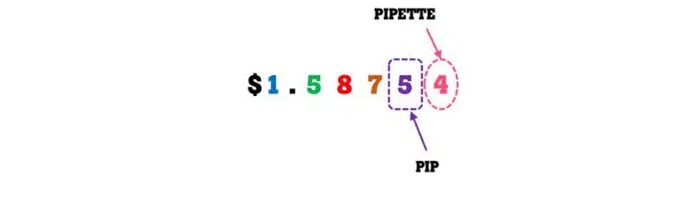

Some brokers declare currency pairs beyond the standard 2 and 4 decimal places and with 3 and 5 decimal places. They announce fractional pips or pipettes. For example, if (GBP/USD) moves from 1.51542 to 1.51543, a 0.00001 increase in USD is called a pip. Since each currency has its own relative value, it is necessary to calculate the value of a pip for that particular currency pair. In the following example, we use the price with 4 decimal places. In order to make calculations better, exchange rates are expressed as ratios.

That is, (EUR/USD) at 1.2500 is written as 1 EUR / 1.2500 USD. The exchange rate ratio of the above example is read as follows: USD/CAD=1.0200 (value change in the opposite currency) multiplied by the exchange rate ratio=pip value (in base currency)

For each unit traded using this example, if we were to trade 10,000 units (USD/CAD), then a one pip change in the exchange rate would be approximately a $0.98 USD change in the spot price.

Here is another example using a currency pair with the Japanese Yen as the opposite currency. (GBP/JPY) at 123.00

Note that this currency pair has a value of 1 pip with only two decimal places, while many other currencies have four decimal places. In this case, a pip change would be 0.01 JPY.

(value change in the opposite currency) multiplied by the exchange rate ratio = pip value (based on the base currency)

Therefore, when trading 10,000 units (GBP/JPY), each pip change in value is roughly equivalent to a value of about GBP 0.813.

How much dollar is a pip?

In the forex market, there is a calculator to calculate the dollar value of each pip. But there is no need to involve your mind with these calculations.

Know that each pip change in the trading volume of one lot is usually worth ten dollars. That is, if you enter a trade with the volume of one lot and the market moves ten pips, you will make a profit or loss of one hundred dollars.

Of course, this is not always the case. This is for gold and EURUSD and GBPUSD trades. But the value of each fluctuation pip per lot in currency pairs like USDCAD – AUDUSD – NZDUSD – USDJPY is less than ten dollars. That means something between seven and eight dollars per pip.

Why there is such a difference is not very important to begin with. This amount changes due to price changes. but do not worry. Even many professional traders sometimes use ready-made calculators. There are many calculators for this. Just search the term Pip value calculator in Google.

Our recommendation for forex calculator is this free plugin which can be added to any browser including Edge, Firefox, Chrome and also WordPress and it will be on your disposal whenever you need it.