Spread is one of the most important concepts in forex trading. In this article, we are going to examine the concept of spread in forex and its calculation method including:

- What is a spread?

- Forex spread broker

- Broker with the lowest spread

- Brokers’ income is from spreads

- The concept of spread in forex

- What is a pipe?

- Different types of spreads in forex

- What is a fixed spread in forex?

- What is a floating spread in forex?

- The most important indicators determining the spread in forex

- What is the broker with the lowest spread?

- Advantages of choosing a broker with the lowest spread in forex

- The risk of choosing a broker with the lowest spread in forex

- Which forex account has the lowest spread?

- The method of trading with brokers who have the lowest spread

- The method of reducing the spread in forex

- Choosing forex brokers with floating or variable spreads

- Trading currency pairs that have high liquidity

- Refrain from trading before or after the publication of important political and economic news

- Trading at the right time

- Trading with the highest spread

- The method of measuring the spread in forex

- The most important advantages of trading with a fixed spread in Forex

- The most important disadvantages of trading with a fixed spread in Forex

- The most important advantages of trading with floating spreads in Forex

- The most important disadvantages of trading with floating spreads in Forex

- Comparison of fixed and floating spreads in Forex

- Introduction of different spreads in forex

- What is the bid and ask spread?

- What is an adjusted or discretionary spread?

- What is yield spread?

- What is zero spread?

- Why does the spread change in Forex?

- The amount of transactions

- Political and economical risks

- Currency fluctuations

- Banks and currency market brokers

- The best trading strategy with spreads in Forex

- What is spread risk?

- Real spread risk

- Credit spread risk

- Comparison of spreads in brokers

- What is a zero spread broker?

- An important point about the spread in Forex

- How important is the spread in forex according to brokers?

What is a spread?

First of all, we need to answer the question that has arisen in your mind. The question is, what is a spread?

Spread is a word that has different meanings in different financial and economic fields. In the market, the difference between the purchase and sale price by a real person or broker, such as a broker, is called a spread.

In general, the word spread is the difference between the offered price and the asking price (buying and selling price) of various assets such as bonds, stocks, or forex currency pairs.

Each of the brokers who are active in forex, consider two different prices for each of the currency pairs that they introduce to people, which are the bid and ask prices.

Suppose an exchange has set the price of a currency at 5000 dollar and you can buy that currency at the price of 5000 dollar. But without a doubt, if you intend to sell currency, that exchange will buy the same currency from you at the price of 4990 dollars.

In fact, the profit of the exchange is the difference between the purchase and sale price, which can be obtained from the purchase and sale of currencies as a commission or spread.

Forex spread broker

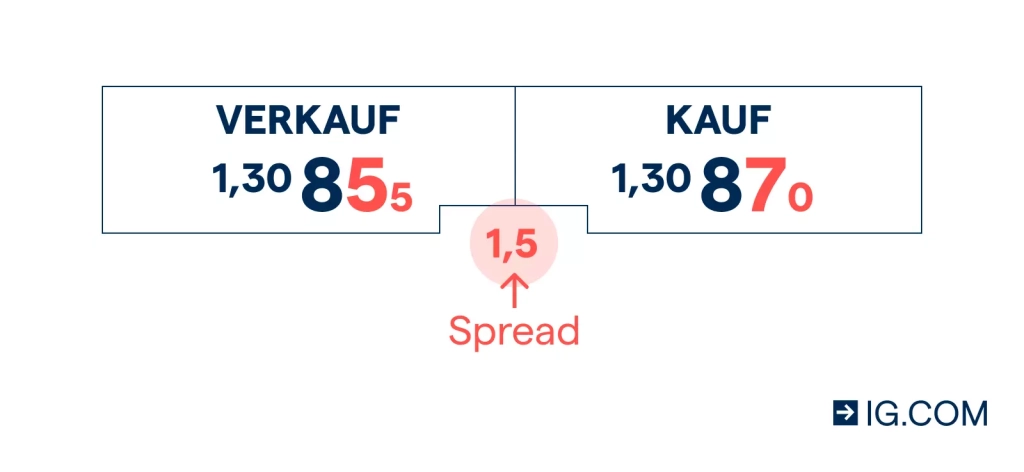

It is the same in forex and the price of different currency pairs is two different numbers at the same time. One is called ask (broker’s sell to us) and the other is called bid price (broker’s purchase from us). Ask price or broker sale is always slightly higher than bid price.

Broker with the lowest spread

From the point of view of traders, brokers that show the lowest spread are better. The bid price is the price that is considered for the base currency at the time of sale.

On the other hand, we have the asking price, which is the price of the base currency at the time of purchase. Now if you calculate the difference between these two prices, you have calculated the spread.

The spread is also referred to as the bid/ask spread.

Our recommended broker with low spread rate and good services is IFC Markets with over 17 years of experience in the market.

Brokers’ income is from spreads

Many accounts in different brokers do not receive any commission from traders for executing buy and sell orders.

The question that arises in calculating the spread is how each of the forex brokers and brokers earn money without receiving a commission?

A spread is a fee that brokers charge during a buy or sell transaction.

In some cases, instead of the term transaction cost, the term spread offered for purchase is used. In fact, each of the brokers instead of receiving a fee separately, this fee is placed on the price of the currency pair that you want to buy or sell.

This is quite logical, the broker provides you with a service and receives a fee for this service. In other words, brokers generate income when they sell currency to you at a price higher than the purchase price and also when they buy currency from you at a price lower than the sale price.

These price differences make up the meaning of the spread. In this way, brokers receive commission from you without mentioning it.

The concept of spread in forex

Regarding the meaning of spread, the concept of spread in forex is clear. Spread in forex is the small cost difference that is determined in the bid (buy) and ask (sell) prices during the transaction of each currency pair.

When you check the price set for a currency pair, you see the difference between the bid and ask prices. This is the same spread or bid/ask spread that we mentioned earlier.

In general, a currency pair is bought or sold in every forex transaction. The bid price in these transactions is the purchase price of the base currency, and the asking price shows the cost of selling it.

It is interesting to know that the trading of most currency pairs in Forex is done without fees. However, calculating the cost of the spread in forex is one of the requirements for conducting transactions and has the same rule as the spread.

The size determined for the spread in forex is influenced by various factors and is different. For example, the type of currency pair that is traded, the volatility of these currency pairs, the size of your transaction and other factors affect the size of the spread.

Among the main currency pairs whose trading size is larger than other currency pairs are EUR/USD (Euro and US Dollar), USD/JPY (US Dollar and Japanese Yen), GBP/USD (British Pound and US Dollar) and USD/CHF (US Dollar and Swiss Franc).

In the continuation of the text, we will examine a very important matter, namely the calculation of the spread in forex.

What is a pipe?

Changes in the spread in forex are measured by small price movements called pips. It should be noted that the overall price of a transaction on a currency pair is not determined solely by relying on the spread. The lot unit is also considered in these measurements. Learn more about pip in this article.

Different types of spreads in forex

There are different types of spreads in forex, and getting to know them is a very important topic that must be addressed before anything else in order to operate in the forex market.

Before that, it is necessary to mention the concept of yield spread, which is also known as credit spread.

The difference in the yield rate that exists between two types of investment items is called the yield spread. Many forex analysts refer to the yield spread as paying yield X over Y.

In fact, the yield spread is the percentage of the annual return of investment on one of the financial items minus the percentage of the annual return of investment on other items.

In order to be able to match the price of securities with the current market price and help to reduce these prices, it is necessary to add the yield spread to a yield curve that is considered as a benchmark curve. In general, yield spread and zero spread are different branches of spread.

However, the different types of spreads seen on a trading platform depend on the brokers and how they make money. In general, floating and fixed spreads are different types of spreads in forex.

Brokers who act as market makers in forex offer mostly fixed spreads. Floating spreads are also offered by brokers who operate non-dealing desk models. To fully understand the concept and application of each type of spread in the forex market, read on.

What is a fixed spread in forex?

A spread in forex is classified as a fixed spread if it is fixed in any situation. In fact, fixed spreads in forex are fixed and do not change regardless of market conditions and in certain time periods.

In other words, whether the market is fluctuating or not, the spread is not affected by these conditions and remains as it is. As mentioned, most market maker brokers that use the trading desk model offer fixed spreads.

Market maker brokers buy the best trading positions and offer them to traders in the forex market. In other words, in this case, the broker plays the role of the counterparty of his clients’ transactions.

The presence of a trading desk is a bonus for forex traders, and it allows brokers to offer fixed spreads. In this way, brokers can easily control the prices they offer to their customers.

What is a floating spread in forex?

According to the name of this type of spread in forex, you can understand its meaning and application. Floating or variable spreads in the forex market do not have a fixed state and are always changing.

Variable spreads show the continuously changing difference in bid and ask prices between different currency pairs.

Variable spreads are mostly offered by brokers who use non-dealing desks. These brokers receive the price of the currency pair they offer from several liquidity providers and pass the received price to traders without using trading desks.

In fact, in this case, the brokers have no control over the spreads and forex spreads change based on the supply and demand of currencies and general market fluctuations.

Typically, spreads increase when economic data is released and on other days when liquidity in the forex market decreases.

For example, you may be trading a currency pair right now, and the spread increases just at the moment you want to finalize your purchase. In general, it can be said that variable spreads change in real-time conditions.

The most important indicators determining the spread in forex

One of the most frequent questions regarding the spread in forex is what is the spread index in the forex market and how is the spread index determined?

The curve drawn on the chart, which determines the direction of the spread in relation to the requested and offered price, is the same as the spread index in forex.

Through these indicators, it is possible to understand the changes of the spread over time. We mentioned earlier that the spread in forex can change depending on the market conditions and various factors are involved in creating these changes.

If the market is not stable, the liquidity of currency pairs will decrease and the spread will change. For example, the economic news of the world is one of the important factors that play a role in these changes, so by following these news, you can learn about the existence of wide spreads in the forex market.

A helpful point to keep in mind is that if the demand for trading on different currency pairs increases, there will be lower spreads for these currency pairs. Of course, the amount of liquidity for these currency pairs will be higher.

The amount of supply and demand for different currency pairs are also factors that affect forex spreads.

What is the broker with the lowest spread?

Considering what the spread is in forex, you can understand what features the broker with the lowest spread has. The spread received by the brokers may seem very small and there is no need to calculate it, the value of this spread often reaches a few pips or a fraction of a percentage of the value of the currency.

Of course, spreads involve significant operating costs for traders, especially if traders have very large trading positions. Hence, it is best to choose a forex broker that offers a lower spread. With this, the cost of transactions will be greatly reduced.

The lowest spread in forex is the lowest price difference between the bid and ask prices for a currency pair. The lower the spread, the lower the commission charged by the broker, which means the closer the actual price of a currency pair will be.

Getting information about forex brokers with the lowest spread will help you make more profitable trades. On the other hand, the higher the spread, the higher the cost that must be paid for trading in forex and buying currency, and when you sell the same currencies to market makers, the less profit you will have.

In this way, forex brokers who operate without commission, determine the spread themselves. Our recommended broker for low spread rates along with other services is International IFC Markets which is in the industry for over 17 years.

Advantages of choosing a broker with the lowest spread in forex

So far, we have said several times that the lowest spread in Forex means the highest profit in trading. But the main question is what are the benefits of choosing a broker with the lowest spread in Forex?

One of the most obvious advantages of choosing a brokerage or brokers with the lowest spread in forex is the reduction of initial costs.

Since the spread can be referred to as a kind of commission for stock brokers, the lowest spreads for you indicate the lowest paid prices to pay as a commission.

In addition, brokerages with lower spreads offer various services for their clients to conduct transactions in a more direct way. This is because a lower spread means that the spreads offered are closer to the actual price of a currency pair in the forex market.

Brokers with lower spreads make it easier for traders to calculate the potential profit and loss of various trades and allow them to choose their trading strategy more consciously.

So, if you are willing to trade on a daily basis and want to benefit from the constant fluctuations in the currency price in the market, choosing lower spreads is what you should prioritize in your choices.

The risk of choosing a broker with the lowest spread in forex

Choosing brokers with the lowest spread in forex, in addition to bringing countless benefits, has risks that you must accept.

Spreads are calculated to determine the amount of liquidity in the forex market. Liquidity means traders have access to a particular currency pair for supply or demand in the market.

For example, currencies like the US dollar, which are traded a lot, have high liquidity. In other words, traders can buy or sell these currencies at the exact price they want in the forex market whenever they want.

On the other hand, for currencies that have less liquidity, it is more difficult to access them in specific market conditions. These currency pairs require more spread with less liquidity. Because the cost of facilitating transactions with these currencies is higher for brokers.

Which forex account has the lowest spread?

One of the helpful information for you to perform useful and productive activity in the forex market is to know which forex account has the lowest spread?

Obviously, the amount of spread is different in different forex brokers or accounts, comparing brokers can be a great solution for making profitable deals for you.

First of all, you need to know that the broker with the lowest spread is not necessarily the best broker. It can be difficult and challenging to find brokers that have the lowest spreads and operate without additional commissions and fees.

In general, the number of forex accounts that have the lowest spread is high, however, it is not possible to consider the same features and benefits for all these accounts.

The forex trading market in today’s world acts as an ecosystem that has high diversity and is mainly driven by the brokers and traders who operate in it.

The flow that is going on in the forex market today is completely different from the flow that was going on in the 19th century. In the past, only elites, government officials, politicians and financial institutions were able to carry out various transactions in the forex market.

Today, with the change of conditions, it is possible to make a transaction for all people who want to invest in forex, and investing in forex is no longer something far from the mind.

However, people who wish to operate in the forex market must register in one of the forex brokerage institutions or brokers. These brokers are companies that provide a suitable platform for traders to conduct transactions on the currencies of foreign countries.

When you choose a forex broker, you should not only think about choosing brokers that have the lowest spread. The amount of spread in different brokers is different, so when choosing, in addition to paying attention to the amount of spread in forex brokers, you should choose a broker that matches your needs. Paying attention to the services provided by different brokers will help you make the best choice.

In short, pay attention to features such as spread, minimum allowed deposit, allowed base currencies, different types of accounts provided by brokers, bonuses and deposit and withdrawal options.

The method of trading with brokers who have the lowest spread

Now that you have learned about the benefits and risks of choosing brokers with the lowest spread in forex, you may ask what is the method of trading with brokers who have the lowest spread?

When you choose a broker with the lowest spread in forex that offers its own pips, you actually have the best opportunity to trade in forex.

By finding a currency pair in forex, you need to track the difference between its buying and selling price and include this price difference, which is the spread, in your business. Because if the price of this currency pair changes according to your wish, this price change will give you a clear idea of how to make transactions to earn more profit.

For a better understanding, pay attention to this example. Suppose you want to trade the EUR/USD currency pair, where the asking price and the offer price set by your broker for this currency pair are 1.0664 and 1.0661, respectively. You can see that the pip size is 3 here.

If you want to buy the EUR/USD currency pair and sell it directly to your broker, you will not receive any profit due to the 3 pip spread.

So, to sell and earn profit, the desired currency pair should increase by 4 pips. A low pip means there are fewer obstacles and more profit from making a trade.

The method of reducing the spread in forex

To become a successful forex trader who profits from every trade he makes, you need to learn how to trade in a cost-effective way.

Experienced forex traders calculate the profit and measure its value before entering any trade. In fact, their main position in a transaction is how much it costs them to do this transaction and how much profit they receive from doing it. These traders trade only with the brokers that set the highest spreads.

The main question is how to reduce the spread?

There are several different methods for trading with the lowest spread and the so-called spread reduction, which we will examine further.

Choosing forex brokers with floating or variable spreads

Considering the concept and efficiency of variable spreads, you must have realized the benefits of trading with these types of spreads. Interestingly, most Forex traders as well as brokerages prefer fixed spreads to floating spreads.

Of course, many brokerages use fixed spreads to attract investors and attract more customers. It is necessary to know that using a fixed spread is not always useful and sometimes it can lead to many losses.

In most cases, brokers use fixed spreads advertising as a marketing technique to entice traders who are new to the forex market to join and register with their broker.

Instead of transferring orders to the market flow, these brokers create several different positions for their clients.

This creates a conflict between the interests of these brokerages and their clients and in some way changes the common goal, and it is clear that the brokerages do not prefer the clients’ interests to their own profit.

Another point is that many brokerages that operate with fixed spreads refuse to do transactions for clients under certain circumstances.

Brokerages with fixed spreads target mostly beginner traders who are not familiar with the trading process and do not have enough experience.

Trading currency pairs that have high liquidity

If you are interested in making affordable trades, the best idea you can consider for making your trades is to mainly trade currency pairs that have high liquidity.

Of course, exotic currency pairs that are not so famous may seem more attractive to traders because of the large fluctuations that occur in their prices. For example, strange currency pairs like USD/ZAR that have more spreads.

However, it is clear that investing in these currency pairs is a volatile and unstable business, and those who are new to the forex market should not take such a risk.

It is better for novice traders to start their activity in forex with currency pairs that have the most liquidity (such as EUR/GBP, AUD/JPY, AUD/USD, EUR/JPY, USD/CHF and EUR/USD). These pairs can be traded with the most suitable and affordable spreads.

In general, the main rule of the forex market is that the larger the trading volume of a currency pair, when the market is in normal conditions, brokers are more inclined to lower spreads.

Refrain from trading before or after the publication of important political and economic news

One of the very important points that you should keep in mind is that the spreads are not always in a normal state and may sometimes experience extreme fluctuations. This issue may occur even when a person is trading the main currency pairs with a reputable and reliable broker.

These desires and wishes of investors to make transactions peak just when important political and economic news is published. In some situations, the impact of these news on currency price fluctuations is very high, and forex brokers, in order to reduce the riskiness of transactions, increase the spread significantly before and after the publication of these news.

As a result, traders should always pay attention to their trading calendar and in this way have the ability to recognize the times when the publication of various news can have negative effects on the market situation, and refrain from making any trades before or after the publication of these news.

Trading at the right time

One of the measures that can help novice traders to make profitable trades is choosing the right trading hours. In fact, time and day also have a direct effect on the size of the spreads.

Due to the fact that a large volume of currency pairs are traded during the day, the cost of trading in the main trading sessions (New York, Tokyo, London and Sydney) is very low.

Many veteran traders who have a lot of experience in forex trading prefer to trade during these hours so that they get the lowest spreads. In addition, the price of some currencies, such as the euro, fluctuates less at a certain time of the day and is almost constant.

Expert traders use this situation to their advantage and trade only during periods when there is less volatility in the market.

Trading with the highest spread

One of the important issues regarding spreads in forex is that traders should not only think about making trades with the lowest spread.

Profitable trades don’t just come from looking for low spreads.

Another thing that is important in doing these transactions is the correct operation of brokerages and the execution of orders quickly and reliably. Orders placed by traders must be executed at the same price set at the time of clicking the buy or sell button.

With the slow execution of these orders, the price of the currency pair may move several pips in the wrong direction and reach a position with a wider spread.

This situation ends up costing traders a lot. On the other hand, when the execution of orders is fast, traders can be guaranteed that the orders will be executed at the rates set by the broker.

This prevents slippage in market conditions. In general, delays in the execution of orders have unpleasant consequences, the reason for which is related to the dynamics of currency markets and the possibility of price changes in seconds. Therefore, it can be concluded that wide and large spreads can also have an impact on high yield transactions.

The method of measuring the spread in forex

One of the most important factors that will help you choose a forex broker is the measurement of the spread in forex. In this section, we examine the method of measuring the spread in forex.

The unit for measuring the spread in Forex trading is called a pip. A pip is the smallest unit of price movement of a currency pair in the forex chart. For most currency pairs, a pip is at least 0.0001. For example, the spread of 2 pips for the EUR/USD currency pair is equal to 1.1051/1.1053.

It means that for this spread, the bid price is 1.1051 and the asking price is 1.1053. Japanese yen currency pairs are displayed with only 2 decimal places.

For example, for the currency pair USD/JPY, the spread of 4 pips will be the offer price of 110.00 and the ask price of 110.04.

The most important advantages of trading with a fixed spread in Forex

Now that we have learned about floating and fixed spreads in forex, you need to know that trading through each of these spreads in the forex market has various advantages and disadvantages that you should consider.

One of the most important advantages of trading with fixed spreads is the small capital required to trade with these spreads. If you have just become familiar with the forex market and have little capital to enter this global market and start various transactions, you can start trading in the forex market with the small amount of capital you have through fixed spreads.

Another advantage of using a fixed spread in forex is increasing people’s ability to calculate and predict the cost necessary to perform various transactions in forex.

Due to the fact that fixed spreads always remain fixed and do not change, by using these spreads to make different transactions, you will always know the minimum capital you need to enter when you enter the transaction.

The most important disadvantages of trading with a fixed spread in Forex

Choosing any type of spread in forex to trade on different currency pairs, in addition to bringing countless advantages, also brings disadvantages that are very important to be aware of. In this section, we will examine the disadvantages of trading using fixed spreads.

If you use fixed spreads to trade, there is a high probability that the broker will reprice. At some times, the trend of the forex market changes and becomes fluctuating.

Due to the stability of the spreads, it will not be possible to increase the spread and align it with the market conditions, and as a result, your opportunity to make a profitable transaction will be lost.

So, if you have chosen a certain price to enter a transaction, the broker will force you to accept the new price by blocking the transaction.

Another disadvantage of trading using a fixed type of spread in forex is the possibility of slippage. If prices are constantly changing, it becomes difficult for brokers to keep the spread constant, and if you enter a trade, the entry price will be very different from the price determined after entry.

In fact, there will be a time slip when the actual price is not the same as the price you were told.

The most important advantages of trading with floating spreads in Forex

By choosing floating spreads for trading, you will benefit from many advantages. One of the most important advantages of using these spreads is the elimination of constantly repeating prices. Since variable spreads change as market conditions change, so does the price, thus eliminating repetition in prices.

Another advantage of using this type of spread in forex is that traders can make their transactions at a more transparent price. As liquidity providers offer different prices to compete with each other, floating spreads determine the best price for you.

The most important disadvantages of trading with floating spreads in Forex

If you are scalping (buying and selling at high speed), it is better not to use variable or floating spreads. These types of spreads greatly reduce the profit from scalp trades.

Among other problems of trading using floating spreads, there are traders who trade based on the global news of the currency market. By using a variable spread, you may make a mistake in placing a trade and lose a trade that appears to be profitable at first.

Comparison of fixed and floating spreads in Forex

Considering the advantages and disadvantages of trading through any type of spread in forex, the question that arises for most traders is what type of spread should they trade with? In other words, which spread in forex is better for trading?

The answer is clear, you can choose the best type of spread according to your expectations from doing various transactions and keeping your needs in mind. Many traders prefer fixed spreads to the floating one, and many others choose brokers that consider floating spreads.

As we said, if you have a small amount of capital to enter the forex market and do not want to make large transactions, fixed spreads are better for you.

On the other hand, if you want to make large transactions and have invested a lot of capital in the forex market and you do your transactions during the period when the spreads are at their lowest possible, it is better to choose variable spreads.

Most traders who want to make quick trades choose variable spreads. These tips are a great guide for you to choose the best trading method.

Introduction of different spreads in forex

There are different types of spreads in the forex market. Bid and ask spreads, yield spreads, adjusted spreads and zero spreads are different types of spreads in forex, which we will introduce each of them below and examine their features.

What is the bid and ask spread?

The highest price that traders (buyers) are willing to pay to buy securities is the bid price.

Opposite is the ask price, which is the lower price that traders (sellers) are willing to receive to sell securities. The difference between these two prices is the bid and ask spread, which actually determines the main concept of the spread.

Investors can use bid-ask spreads to measure the liquidity of a stock. Given that larger spreads usually indicate less liquidity, this way you can check how much a stock can be bought or sold for.

What is an adjusted or discretionary spread?

The OAS option-adjusted spread, also known as the option spread, shows the difference between the price of a security embedded with an option and a security without this option. This option is linked to the price of securities that is effective in its redemption.

The spread embedded with this option can change the value of the securities and have a negative impact on it. For example, this option allows the issuer of securities to settle his debt before the maturity of the bonds.

With this happening, it is possible that the investor will suffer a loss while paying interest and the overall value of his capital will decrease. An option spread helps investors to understand whether trading a security at a given price will be profitable or not.

It is interesting to know that in situations where the cash flow of securities is not affected by future interest rates, the optional spread becomes a zero spread.

What is yield spread?

Another type of spread in forex is the yield spread. This type of spread is also referred to as a credit spread for bonds. Using the yield spread, the difference between two types of bonds with the same maturity is measured.

This type of spread helps investors determine the quality and value of two bonds. In this way, when entering into a transaction, investors consider both the yield spread and the risk, and in this way, they do the transaction with more confidence.

What is zero spread?

Zero spread is also referred to as yield curve expansion. By using this type of spread in forex, investors can calculate the value of bonds in the present time along with the cash flow of these bonds at certain points of the treasury yield curve, and they can also use the spread instead of focusing on a certain point in time.

Keep an eye on all the points of the treasury yield curve. (The Treasury yield chart shows how much money a fixed income Treasury would make to an investor.)

Why does the spread change in Forex?

Why and when does the spread change in Forex? The main reason for the change in the spread in forex is related to the change in the difference between the buying and selling price of a currency pair. In fact, the reason for the change in the spread in forex can be described as a variable or floating spread.

When trading the forex market, you will always be dealing with variable spreads. On the other hand, the news related to currency changes published in the world is one of the reasons that change the spread in forex and by creating fluctuations in the market, it increases the spread.

As we said before, this is one of the disadvantages of spread changes and using variable spreads that may cause you to lose your position to make a profitable trade.

In general, the factors that change the spread in forex are as follows:

The amount of transactions

The higher the volume of transactions in the market, the more liquidity the market will have. This means reducing the spread or the difference between the bid and ask price. As the spread decreases, the discrepancy between the buying and selling price of a currency pair will decrease.

In this way, brokers can make transactions much easier and find buyers with their suggested price. Also, buyers can easily find sellers who accept their offer to buy currency.

It can be said that higher currency spreads indicate lower trading volume and indicate that buyers and sellers are having trouble finding customers.

Political and economical risks

If the political and economic climate in different countries is unstable, the inflation rate is high and there is no suitable approach for financial policies in these countries, the spread of transactions on the currency of these countries will increase.

The main reason is that traders consider trading in the currency of these countries as a high-risk investment and sell the currency at a high price. On the other hand, in order to eliminate this high risk, buyers are looking for an opportunity to make their purchase with a discount.

Finally, traders will face an increase in the difference in the price offered, and as a result, the volume of trading in forex will decrease.

Currency fluctuations

Fluctuations in the currency value of different countries also affect the spread in forex, especially currencies that are not supported by the central bank of different countries. Hence, forex market traders increase the ask prices, which will increase the spread.

Banks and currency market brokers

Apart from the investors who buy and sell these currencies during the price fluctuations of different currencies in the market, some large financial institutions such as banks have appeared as brokers of the wide market and without keeping the value of a certain currency constant, for a long time using they profit from spreads.

The higher the number of these brokers, the lower the spreads will be. When investors’ competition for investment increases, brokers start to compress margins and eventually reduce spreads.

The best trading strategy with spreads in Forex

Each of the traders in the forex market can use a suitable and event-oriented strategy designed based on economic indicators, and in this way, make their transactions with the lowest spread and the momentary changes that occur in the forex market.

For example, any trader can follow the news of the world economy and predict the probability of any change in the forex market. In this way, find the best points to enter or exit and have an event-oriented business in Forex.

It is possible to strengthen this strategy by using a suitable trading indicator. A curve is used to display the forex spread indicator on the chart. In this way, the direction of the spread is shown according to the requested and suggested price.

In this way, it will be possible to visualize the spread in forex over time.

In such a way that for currency pairs that are traded in high volume (for example, currency pairs carrying the dollar) they have a lower spread and have more liquidity, and strange currency pairs that are not very common to trade on them have a wider spread.

What is spread risk?

One of the other important topics related to the spread in forex is to check the risk of the spread. In general, by choosing and trading using any type of spread, you should consider two types of risk. Real spread risk and credit risk.

Considering the spread risk, we can conclude that if the yield spread risk is not as high as it should be, investing in riskier bonds cannot be justified.

In the following, we will examine the characteristics of different types of risk spreads in forex.

Real spread risk

This type of spread risk measures the probability of losing the market value of the investment. The reason for the loss of the value of the investment market is that the bond issuer makes changes in the value of the issued bonds and reduces the value of these bonds due to making financial mistakes.

Credit spread risk

Earlier we defined the credit spread. Credit spread, also known as yield spread, compares the yield of two types of bonds that have different credit ratings and the same maturity.

Bonds that are of low quality, the risk that the issuer of this type of bond will not repay you is more. Of course, riskier bonds bring more profit. This high profit compensates for the increased risk of the investor to make the transaction.

On the other hand, bonds that have a high credit rating are associated with a lower chance of default. This type of investment is safer and more people are interested in doing it. In fact, the lower the default risk, the lower the return.

Comparison of spreads in brokers

Another topic about the types of spreads in forex that needs to be discussed is the comparison of spreads in different brokers. In order to have a successful entry and get the best returns, it is necessary to choose the broker with the best spread.

The question of most investors is which brokers are in this category, the broker with the lowest spread or the broker with the highest spread?

According to what has been mentioned so far, you have noticed that the spread has a kind of commission for brokers and forex agencies. Undoubtedly, the best broker offers a variety of services and includes a lower spread.

Finding such a broker can be difficult and challenging. Every year, different brokerages lower the service fees and fees they charge traders.

Of course, this is a competitive policy between brokers and forex brokers to attract more customers. Many brokers also promise trading brokers with zero spread to traders. You need to know that most of these are promises for marketing and attracting customers.

When you want to choose a broker, you need to know what you expect from the broker and what you are looking for.

What is a zero spread broker?

What are brokers or zero spread accounts, is one of the important topics related to the spread in forex, which will help you choose the best broker and get more returns.

These brokers are provided by brokers who, in contrast to providing trading services for their clients, consider them brokers with an average close to zero.

Of course, they may increase the spread of these brokers in the not too distant future. Of course, depending on the account and the broker you choose, the amount of commission you pay is different, and the possibility of increasing this commission is high.

Trading through a zero spread broker makes it easier to enter and exit a trade without worrying about trading fees. Of course, with the condition that the brokerage does not receive additional commission. Tickmill, CMC, IC, HYCM, and IG are among the brokers that provide zero spread brokers to traders.

An important point about the spread in Forex

The statements and tips related to the spread in forex will not end so easily. When doing various transactions in the forex market, you need to consider very important points regarding the spread in forex.

A very important point in this regard is that when the spread increases dramatically, a margin call will be sent to you by the broker.

This item, or the level of margin contact, is one of the most important topics that you need to fully understand if you want to make profitable and successful transactions in the forex market. In fact, the margin level shows the amount of capital you have to open a trading position.

In any case, by sending an email or SMS to the trader, the broker informs him that he needs to repay his account in order to keep trading positions open. This is the margin call or margin level call.

If the broker does not do this in time, the resulting position will be liquidated. Receiving a margin call is not pleasant and may create unfavorable conditions for investors. In such a situation, with a wrong decision to make transactions, you may not only lose money, but also incur debt.

You can take a series of actions to prevent margin calls from happening. Continuously tracking the margin, adjusting the loss limit and creating a sufficient balance in the forex account can largely prevent this call from occurring.

How important is the spread in forex according to brokers?

We need to make one thing clear here, the idea that brokerages make profit by charging commissions and increasing price spreads is completely wrong. Consider a brokerage firm whose only job is to issue quotes after traders sign up and fill their inventory.

If the clients of this brokerage make bad decisions in carrying out various transactions and suffer losses without withdrawing money from their account, the broker will make more profit by keeping the capital deposited by these traders in proportion to the commission received and the spreads created.

Of course, the bigger the spreads and the higher the commissions set for the brokers, the more profit the brokers get. Of course, the importance of the issue of spread in forex is greater for traders than forex brokers; Spreads are basically the price that traders have to pay to carry out their transactions in the forex market through brokers.

The more the number of transactions that are done, the more important the spread in forex will be, and besides, the effect that the spread will have on increasing your profits in the long term will also be greater.