In Forex, everyone is trying to figure out which currency to buy or sell. In fact, they want to see which currency will fall and which currency will grow. But how can you know when it is time to buy or sell a currency pair?

In the following examples, we are going to decide on buying and selling some currencies by using some fundamental analysis. Note that these are just examples.

The supply and demand for a currency changes according to various economic factors and causes the exchange rate to rise and fall. Each currency belongs to a country (or a region).

Therefore, the focus of Forex fundamental analysis is on the overall state of the country’s economy, such as production, employment, industry, international trade, and interest rates. The better the economic situation, the more valuable the corresponding currency.

In this article we will cover:

- Forex trading guide

- Forex trading checklist

- Forex trading method

- Trading currency pairs (EUR/USD)

- Currency pair trading (USD/JPY)

- Currency pair trading (GBP/USD)

- Trading currency pairs (USD/CHF)

- Lots in Forex

- Margin trading

- Overnight interest or swap

Forex trading guide

To start working in forex, you must go through various steps that we have discussed below.

1- In the forex market, first you need to choose a suitable broker.

Choosing a broker includes many components.

You can choose your suitable broker by referring to the broker selection page on our site.

Also, consider the methods of charging your account.

2- After choosing a broker, you need to open a demo or rail account.

If you have not yet acquired enough skills in this field, it is recommended to

First, trade in a demo account.

These accounts allow you to trade on a trial basis with virtual money.

3- Start learning

One of the most important issues in Forex trading is learning the right strategy.

4- Capital management

The most important reason why people cannot succeed in forex trading even after long efforts is the lack of capital management.

Without capital management, you are under the control of your emotions and you will be a complete loser in this market, so be sure to get training in this field.

5- Take a back test

To test your trading strategy and also to test your capital management principle, you should search and research the market in the past.

Check if your forex trading strategy has been profitable over a certain period of time.

For this, you can use back test and research tools in the market.

Forex trading checklist

After multiple tests of your trading strategy, you need to prepare a checklist of your daily trades.

In this checklist, you should write down the list of things you do during the day for your trades.

For example, at the beginning of the day, you should check the news sites to see if there is any important news happening in the market today.

Then note the time.

For more guidance in the field of news sites, you can refer to the Forex Factory training article.

Your forex trading checklist can also include the different stages of your strategy.

When you get involved in the market, sometimes the excitement of the market makes you forget part of your strategy.

To prevent this from happening, the best thing to do is prepare a checklist of your strategy steps.

After each step is approved, check the next step and do not enter the trade until you have received the final approval from the market.

Forex trading method

In forex, you are always buying one currency and selling another currency.

For example, if you make a purchase on the EURUSD currency pair, you have actually sold the dollar and bought the euro.

In order to enter a trade, you need to be familiar with the concept of volume.

The unit of measurement of your trading volume in Forex is the lot.

With the amount of trade volume and pip value chart, you can check the amount of your possible loss and profit in each transaction.

pip value shows you how much profit or loss you will make per pip if you enter into a transaction with a lot.

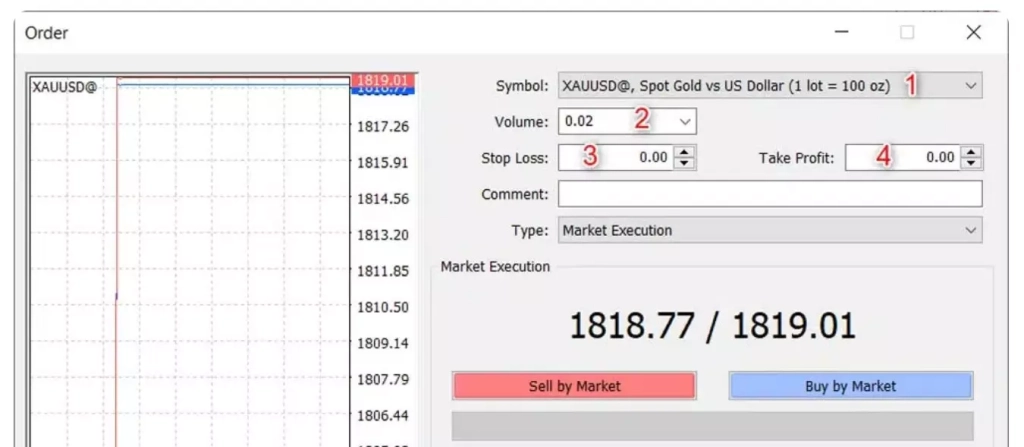

For example, in the image below, you can see the transaction entry window in the Metatrader software.

In point 1, it takes the name of the traded symbol from you.

Note that each symbol has a different pip value.

In point 2, you enter the transaction volume.

This amount is calculated per lot.

In the 3rd and 4th sections, you enter the price of your loss limit and profit limit and enter the transaction.

Trading currency pairs (EUR/USD)

In this example, the euro is the base currency and therefore the “basis” of the purchase or sale. If you believe that the US economy will continue to weaken, which is bad for the US dollar, you will place a buy order (EUR/USD). By doing this, you have bought euros with the hope that the value of the euro will rise against the US dollar.

If you believe that the US economy is strong and the euro is weakening against the US dollar, you execute a sell order (EUR/USD). By doing this, you have sold the euro in the hope that the euro will fall against the US dollar.

Currency pair trading (USD/JPY)

In this example, the US dollar is the base currency and therefore the “basis” of the purchase or sale. If you think that the Japanese government is going to weaken the yen to help its export industry, you will want to place a buy order (USD/JPY).

By doing this, by buying dollars, you expect the price of the US dollar to increase against the Japanese yen. If you think that Japanese investors are pulling money out of the US financial markets and converting their dollars into yen, and this is not good for the US dollar, you will execute a sell order on the currency pair (USD/JPY).

By doing this, by selling dollars, you expect the value of the US dollar to decrease against the Japanese yen.

Currency pair trading (GBP/USD)

In this example, the pound is the base currency and therefore the “basis” of the purchase or sale. If you think the UK economy will outperform the US in terms of economic growth, you will place a buy order (GBP/USD).

By doing this, you buy the pound in the hope that it will appreciate against the US dollar, but if you think that the UK economy is slowing down, while the US economy is as strong as Arnold Schwarzenegger, you execute a sell (GBP/USD) order.

By doing this you have sold the pound in the hope that it will depreciate against the US dollar.

Trading currency pairs (USD/CHF)

In this example, the US dollar is the base currency and therefore the “basis” of the purchase or sale. If you think the Swiss Franc is trading above its intrinsic value, you place a Buy (USD/CHF) order.

By doing this, you have bought the US dollar in the hope that it will appreciate against the Swiss franc. If you believe that the weakness of the US housing market will harm future economic growth and cause the dollar to weaken, you will execute a sell order (USD/CHF).

By doing this, you have sold the US dollar in the hope that it will depreciate against the Swiss franc.

Lots in Forex

It is not logical to buy or sell only 1 dollar in Forex. Therefore, the purchase or sale of currency is usually done in bundles or bundles of 1000 units (microlot), 10/000 units (minilot) or 100/000 units (standard lot), which will vary depending on the broker and the type of account you have.

Know that a standard lot is 100/000 units of the base currency of the currency pair you are trading.

Margin trading

“But I don’t have enough money to buy 10,000 euros! Can I still trade in Forex?”

Yes you can! Using a phenomenon called leverage!

There is no need to pay €10,000 upfront when you trade with Leverage. Instead, you make a small “deposit”, called “margin”. The ratio of the transaction size to the cash “trading deposit” used for margin is called leverage.

For example, a leverage of 1:50, also known as a 2% margin requirement, means that $2,000 of margin is required to open a trade worth $100,000.

Margin trading allows you to open large trades using only a small fraction of the capital normally required. With this method, you can open a $1.250 trade with only $25 or a $50.000 position with $1000.

You can actually make quite a lot of trades with a small amount of initial capital. Let us explain more.

Do you believe that the signals in the market indicate that the British pound will rise against the US dollar? You open a standard lot (100/000 units) on (GBP/USD) and buy the British Pound with a required margin of 2%. You wait for the exchange rate to go up.

When you buy a lot (100/000 units) (GBP/USD) at 1.50000, you are actually buying 100/000 pounds which is worth $150/000. (100/000 units of pounds x 1.50000)

Since the required margin was 2%, 3000 USD will be set aside in your account to open this trade. ($150/000 x 2%)

Now you have control of 100,000 pounds for only $3,000. Now you decide to take a 20-minute nap (of course if your stress allowed). Your predictions turn out to be correct and you decide to sell. You close the trade at 1.50500. You have made a profit of about 500 dollars.

When you close the trade, the “margin” deposit you paid in the beginning will be returned to you and your profit or loss will be calculated. This profit or loss is then credited to your account. Let’s look at the (GBP/USD) trade example above.

(GBP/USD) up just half a penny! Not even a penny! Half a penny! But you’ve made $500! how come? Because your transaction was not on 1 pound.

If your trade size was £1, your profit would be half a penny. But… when you opened the trade, your trade size was £100,000 (or $150,000). The interesting thing is that you did not need to put the whole amount in the middle.

Only $3000 margin was required to open this trade. Dollar profit from $3,000 initial investment is equivalent to 16.67% return! In twenty minutes!

This is the power of leveraged trading. But don’t rush! As much as it can be profitable, leveraged trading can be a drain on your capital.

A deposit with a low margin can lead to a large loss as well as a large profit. In fact, leverage is a double-edged sword. Leverage also means that a relatively small move can lead to a large loss or profit. In fact, you could have easily lost $500 in the same twenty minutes.

In this case, when you woke up, you were faced with a nightmare! It’s true that high leverage sounds attractive, but it can also be dangerous.

For example, you open a forex trading account with a small deposit of $1,000. Your broker offers leverage of 1:100 so you can open a position of $100/000 (EUR/USD). With only 100 pips, your account will reach $0! 100 pip swings easily happen throughout the day. As a result, you can easily lose $1000 in one day.

When trading on margin, it is important to understand that your risk is based on the full value of your trade size. If you don’t understand how margin works, you can quickly destroy your account.

Overnight interest or swap

For trades left open at 00:00 broker there is a “transaction fee”, also called “swap or overnight interest”, which a trader has to pay or receive depending on the open trades she has.

If you don’t want to earn or pay interest on your trades, just make sure they are all closed before 00:00 on your broker’s trading platform.

Since every forex trade involves borrowing one currency to buy another, carryover fees are part of forex trading. These costs depend directly on the bank interest of the currency you buy and sell.

The bank interest of the currency you buy is given to you and the bank interest of the currency you sell is charged to you. If you are buying a currency with a higher interest rate than the currency you are selling, then the difference in the net interest rate will be positive and as a result you will receive a profit, and on the contrary, if the difference in the interest rate is negative, then you should pay the difference pay the

Note that many forex brokers adjust their swap rates based on various factors. (For example, account leverage, interbank loan rate, etc.), so it’s better to visit your broker’s website to see the exact amount of swap that is assigned to your transactions.

In determining the interest rate swap of each country, it is the main criterion. One of the proposed strategies in forex is based on these swaps.