It has probably happened to you that the price of an asset is falling and you have started buying that asset thinking that the prices have become very reasonable.

But contrary to expectations, unfortunately, the price drop has continued beyond your imagination and instead of profit, you have suffered a loss.

Such a situation is called a falling knife (Falling Knife) and this term is common in investment or trading.

In this article, we will explain the reasons for the Falling Knife, along with its advantages and disadvantages, and examine examples of the formation of this pattern in the digital currency market.

Let’s dive in and explore together:

- What is Falling Knife?

- Falling Knife pattern

- Bitcoin Falling Knife

- Reasons for forming the Falling Knife pattern

- An example of the Falling Knife pattern: the Terra-LUNA crisis

- Dos and don’ts of Falling Knife, Advantages and Disadvantages

- Tips for trading the Falling Knife pattern

- Trading with the Falling Knife pattern? Yes or No

What is Falling Knife?

Falling Knife is a trading pattern or rather a trading fact that refers to an asset or digital currency whose value is drastically decreasing.

There is no definitive number for how much the price declines, but generally speaking, the term refers to a situation where the price of an asset has rapidly declined by more than 20% from its 52-week high.

The term “catching a falling knife” is used to warn traders and investors not to rush into buying an asset, Simply because it has been reduced in price and therefore looks cheap. Buying in a falling market can be very risky, Just like trying to catch a falling knife that could hurt your hand.

There is a simple reason for this risk:

“The fact that the price of an asset drops by 30% to 50% does not mean that it cannot go down by another 80%.”

For example, during the dot com bubble crisis of 2000, when the stock price of Internet startups fell by more than 50%, traders began buying them because they thought they would make huge profits. But a long time after that, the price of many of these shares reached zero.

Falling Knife pattern

A falling knife pattern is often formed after a large price move and appears on the price chart as a sharp drop that goes straight down without stabilization or pause.

As shown in the chart below, a falling knife pattern is formed by a series of consecutive bullish and bearish candlesticks.

Bitcoin Falling Knife

Inexperienced traders believe that the formation of a falling knife pattern provides an opportunity to buy an asset at a discount. One of their common mistakes is to buy at the first level of the next support without paying enough attention to the momentum of the price movement.

The reason for this mistake is that if the price falls below that support level, it will likely continue to decline until it finds new support at lower levels.

A good example was in April 2022, when Bitcoin fell from around $45,000 to $39,000. Some traders saw this as an opportunity to buy cheap bitcoins. But a month later, the price of Bitcoin dropped another $10,000 and reached below $30,000. Just a few days later, the price fell below the $20,000 level.

Reasons for forming the Falling Knife pattern

The factors that cause an asset’s price to free fall are complex. Some of them are:

- Technical Factors: For some crypto assets, support levels are very close together. Therefore, if a level is broken with high selling pressure, the probability of overcoming the other levels will be very high.

- Market Sentiment: When China implemented a crackdown on crypto mining in 2021, it was a driver for market sentiment. So that the price of Bitcoin decreased by more than 50% in less than 60 days.

- Imbalance of supply and demand: It is when the supply of a currency increases beyond market expectations, such as the unlocking of a token, and can be a trigger event for an imbalance of supply and demand. Another example is when people start buying an asset due to an emotional impulse that leads to an increase in demand.

- Long squeezes: Leveraged trading, especially in crypto, can carry risks of forced liquidation. When the price of an asset is rising for a while and most people start taking long positions (leveraged purchases), suddenly the price drops and crashes.

- Market Manipulation: Institutions that hold crypto assets may trade that asset to manipulate prices. In December 2017, a massive sell order worth 30,000 BTC on the Bitstamp exchange led to a sharp price drop.

- Financial reports: Crypto companies publish quarterly financial reports. A weak financial report is associated with a negative market sentiment, which will lead to a sharp drop in prices.

- Macroeconomic factors: Like other markets, the crypto market is affected by the rate of inflation data such as the Consume Price Index (CPI) and the announcement of an interest rate hike by the Federal Reserve.

- False Support Levels: In a Falling Knife situation, traders may mistakenly believe that the decline is over. This brings us to the concept of fake or false support levels.

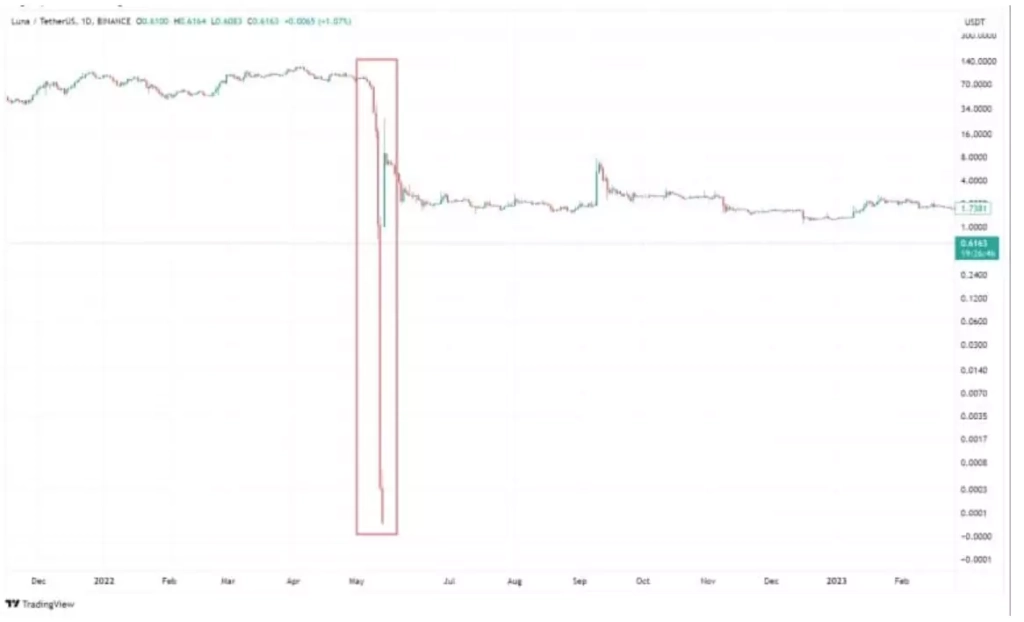

An example of the Falling Knife pattern: the Terra-LUNA crisis

One of the best recent examples of the formation of the Falling Knife pattern is the Terra-Luna project crisis, which completely collapsed within 10 days:

- May 7, 2022: The Terra Ecosystem Algorithmic Stablecoin UST price reached $0.985.

- May 8, 2022: Do Kwon, the CEO of Luna, joked about the risk of this stablecoin being depegged. The Luna Foundation announced plans to prevent this from happening, even buying Bitcoin to support the LUNA digital currency.

- May 9, 2022: UST price drops to $0.35 against the dollar. LUNA cryptocurrency started to fall.

- May 11, 2022: More than $100 million of Luna cryptocurrency transactions were liquidated.

- May 12, 2022: LUNA price drops below $0.10.

- May 16, 2022: A new fork was announced. But the price of LUNA almost reached its lowest point and lost 99% of its value.

Dos and don’ts of Falling Knife, Advantages and Disadvantages

Trading with this model has its own advantages and disadvantages, which we mention both. However, the disadvantages of Falling Knife outweigh its advantages:

- If you enter the transaction at the right point, it can be profitable

- Very high risk

- Low profit due to possible market manipulation

- It is very difficult to find a price floor after which the trend will go up

- It may take a long time for the price to start growing again, discouraging investors

- The possibility of the project being suspicious due to Rug Pull

Tips for trading the Falling Knife pattern

Trading the Falling Knife pattern is a risky strategy that can be very profitable if done correctly. But note that this work requires a lot of patience, discipline and skill.

Here are some tips for catching a falling knife without getting hurt:

Use of technical analysis

Use technical analysis by observing these signals:

- When the price reached its lowest level in the last 52 weeks

- When there is a sharp increase in volume

- When there are signs of price improvement or trend reversal

Watch out for the Dead Cat Bounce pattern

A dead cat bounce pattern is when the price drops quickly and then suddenly reverses and starts to rise. However, this rise is usually temporary and the price will continue to decline.

This can be a trap for investors who think the price has dropped and start buying.

Using the Dollar Cost Averaging (DCA) strategy

When you see an asset drop in price by 50%, it’s very tempting to buy all at once, but doing so can be a big mistake. Because the reason that the price of an asset has decreased by 50% does not mean that it cannot decrease by another 50% or 60%.

Buying in increments helps you still have money to buy even when prices drop.

Using limit loss and limit orders

If the price continues to fall, using these types of orders will help reduce your losses.

The Falling Knife investment strategy can be a risky way to make a profit that rarely happens. However, remember to use it with caution and not take too many risks.

In what cases should you not trade with the Falling Knife pattern?

In these cases, do not try to catch the falling knife, when:

- You do not know the reason for the price reduction

- The reason for the drop is due to internal problems, controversy in the project or lack of technology, and it is unlikely that the price will recover anytime soon.

- You are a short-term investor. Falling Knife is more suitable for long-term investors with high risk tolerance

Trading with the Falling Knife pattern? Yes or No

Buying and selling with the Falling Knife pattern is not easy at all. The best course of action is to wait for prices to correct, pull back, and resume an uptrend before you start buying.

However, if you have a high risk tolerance and are not afraid of catching a falling knife, we recommend that you grab the knife by the top of the handle. This means that in such a situation, instead of buying and long trading positions, go for a selling position.

You have to be skilled enough to make sure this pattern is a Falling Knife and not a Bear Trap though.

The main rule is not to pick up a falling knife. There are many trading positions in the market. Our advice is to avoid high risk.