Whenever there is a discussion of investment and financial transactions, the factor of emotions, especially fear and greed, cannot be neglected.

Many players in the financial world, especially in the world of digital currency, enter this market based on emotions, and their decisions are based on these human emotions.

The fear and greed index is defined to measure these emotions and has a great impact on the buying and selling of Bitcoin and other currencies.

In this article, we are going to answer the question, what is the fear and greed index?

Let’s dive in and learn:

- Current Bitcoin Fear and Greed Index (Real-time)

- What is the Fear & Greed Index?

- How to see the fear and greed index?

- What role do fomo and fud play in the fear and greed index?

- Examining different states of the fear and greed index

- Influential factors in the index of fear and greed

- Fluctuations in the digital currency market

- Trading volume in a certain period

- Media

- Market dominance

- Tendency or trend

- The coefficient of influence of different components of fear and greed index

- Increased effect on the index of fear and greed

- How Fear and Greed affects the market

- The benefits of using the fear and greed index

- Should the fear and greed index be used in digital currency transactions?

- An indicator of fear and greed, a double-edged sword

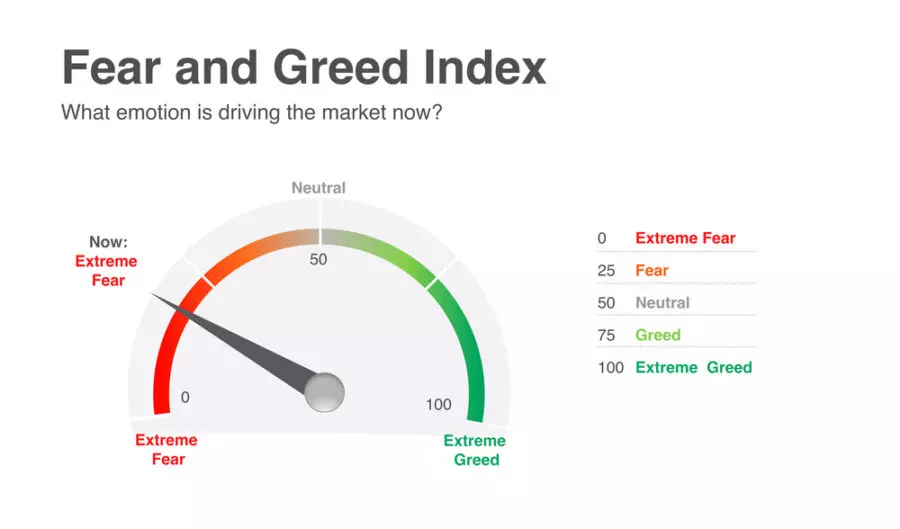

Current Bitcoin Fear and Greed Index (Real-time)

- 0 to 24: extreme fear (red range)

- 25 to 49: Fear (yellow range)

- 50 to 74: greed (pale green range)

- 75 to 100: extreme greed (green range)

What is the Fear & Greed Index?

This index measures two of the most basic human emotions, fear and greed, and measures how it affects the market.

This index was created by CNN Money to examine the emotional behavior of traders in the financial markets. The more fear there is in a market, the value of that share will decrease, and naturally, the more greed for investment, the value of that market will increase.

But this measurement tool cannot be measured so easily and there are many factors to consider.

How to see the fear and greed index?

Digital currency analysis websites usually update this index on a daily basis. One thing that should be noted is that usually the fear and greed index will be separated by currency on different sites.

For example, the site btctools.io has provided the only indicator related to Bitcoin. Or the website cryptocurrencytracker.info

What role do fomo and fud play in the fear and greed index?

There are two important terms in the cryptocurrency world that are directly related to human emotions.

FOMO means fear of missing out and is said to be a situation where the price of a currency is increasing and the investor buys in order not to miss out on the opportunity to buy or, so-called, not to lose the investment opportunity.

Fud, on the other hand, means skepticism in investing. As you can guess, these two important human factors definitely have a direct impact on the cryptocurrency fear and greed index.

These two emotions has great impact on the entire cryptocurrency market.

Examining different states of the fear and greed index

This digital currency index consists of several important sections, which we examine separately in this section:

Extreme Fear

This part means the growing fear among users and investors in the market. If the index number falls below 20, the index will be on Extreme Fear mode and users have a strong desire to sell capital and exit the market.

Fear

Fear has a numerical index between 20 and 40, which indicates the state of fear for cryptocurrency users. The desire of users in this sector is to sell and leave the market.

Neutral

Neutral state is a number between 40 and 50 in the chart. This state occurs when nothing important has happened in the market and the so-called behavior of users is completely neutral.

Greed

Greed refers to the state in which users are willing to buy and invest in a currency. The number of this state is usually between 50 and 70 on the chart.

Extreme Greed

This part means the high greed of users to buy and invest in the market. Extreme Greed on the chart ranges from 70 to 100.

Influential factors in the index of fear and greed

The range of measuring fear and greed is categorized between zero and one hundred. The closer the number is to zero, it indicates fear in the market, and the closer this number is to 100, it indicates greed in the market.

Fluctuations in the digital currency market

Market volatility is a tool to see the amount of share changes in certain periods of time. For example, if Bitcoin has had a stable price in the last 3 weeks, its volatility is definitely low, and if it has experienced significant price changes in the same period of time, it has experienced more volatility.

If the fluctuations of a currency are severe, then the fear and greed measurement index will also change a lot.

Trading volume in a certain period

Trading volume is measured solely by the amount of money traded in that market. If a small amount of cryptocurrency like Ethereum has been bought in a certain period of time, the market volume has obviously decreased.

If the increase in the purchase and sale of Ethereum in the same market indicates the high volume of transactions. The change in trading volume has a direct effect on the fear and greed index.

Media

Social networks have a significant impact on the valuation of the cryptocurrency market. By examining the year 2020, it is easy to examine the impact of one of these social networks, Twitter.

Market dominance

When a cryptocurrency takes over the largest share of the market in buying and selling, the dominance of that currency in the market will be very high.

For example, if the Bitcoin cryptocurrency has an upward trend, other altcoins will have a smaller volume of transactions. This dominance causes the index to move towards being timid because investors will believe that Bitcoin is a more suitable and safer market for investment.

Tendency or trend

By searching the Internet, it is easy to find the interest of users on a certain topic. For example, if the word Bitcoin has a large volume of searches in cyberspace, the index of fear and greed will be towards Bitcoin being greedy.

The coefficient of influence of different components of fear and greed index

In the table below, we check the effectiveness of each of the introduced sections.

| Influential factor | The percentage of influence on the index |

|---|---|

| Fluctuations in the digital currency market | 25% |

| Trading volume in a certain period | 25% |

| Media | 15% |

| Market dominance | 25% |

| Tendency or trend | 10% |

Increased effect on the index of fear and greed

Each of the sections mentioned above has a separate effect on the fear and greed index, and the importance of each can be seen in the movement process of this index.

For example, the impact of social networks on the growth of Dogecoin cannot be denied. Elon Musk raised the price of this meme coin with a tweet, and the market witnessed a high volume of purchases.

Or if you have followed the discussion of dominance or market dominance, you will definitely notice that if the dominance of Bitcoin is high in the market, then other altcoins will also have a positive trend.

In some cases, these changes on the fear and greed index are to the extent that they lead users to increasing fear or greed, which is called Extreme Fear or Extreme Greed.

How Fear and Greed affects the market

It is assumed that if the fear index is stronger in the Bitcoin market, the buying and selling rate of Bitcoin in that market will be a little lower than the real value of that market, and vice versa, if investors’ greed is very high at some point, the market value will be lower than its real value. It will go beyond.

Experts believe that the Fear and Greed index will help investors who are only looking for the right time to enter or exit the market, and using this index for buying and holding will not be appropriate. Of course, the fear and greed index also affects the market cap.

If there is a bull market, FOMO will increase in users, which will move the indicator towards being greedy. If the index shows excessive fear, it can represent users’ fear of investing at this stage and fear of financial risk.

The benefits of using the fear and greed index

Academic theorists believe that fear and greed are basic instincts among all human beings and affect our rational functioning in many situations. When it comes to money and investment, fear and greed are two very strong motivating factors.

But why the use of this index may benefit users in some cases?

Many investors do not follow any precise strategy and are more subject to their emotions than predetermined goals. This case by itself may not have an impact on investors’ decisions, but by examining the fear and greed index, the market conditions can be estimated to some extent.

Financial market experts are of the opinion that not only the fear and greed index is very useful, but investors should always monitor this index.

If the index shows fear, it will mean a good opportunity to buy because most users are afraid to buy and they are more likely to sell their shares.

Should the fear and greed index be used in digital currency transactions?

The best way to invest and enter the market of digital currencies such as Cardano or Shiba is to have a predetermined goal and strategy and control emotions in trading.

The use of one or more indicators, which is the fear and greed index, cannot be a suitable option for investment, but this index should be used for predetermined goals.

Warren Buffett has an interesting point about the fear and greed index:

Be afraid when the market is greedy and be greedy when the market is cowardly.

An indicator of fear and greed, a double-edged sword

Perhaps one can place the index of measuring fear and greed along with thousands of other instruments of exchange in the financial markets.

But like other tools, the Fear and Greed indicator must be used with the right strategy, and you can’t just use this tool to travel the path of success.

The use of this index is more suitable for people who have enough experience in the cryptocurrency market and can use other analytical tools well, because if this index is calculated incorrectly, they may suffer heavy losses.

What do you think is the best way to use the fear and greed indicator? Do you use this indicator in your trading?