Forex is short for Foreign Exchange and refers to buying or selling one currency for another currency. Forex can be considered the most traded market in the world, because natural persons, businesses and different countries all participate in it, and on the other hand, forex trading does not require much capital.

A simple example of participating in the global market of foreign exchange or forex is when you travel to another country and convert your currencies into different currency. Therefore, you can easily play the role of one of the pillars of the forex market.

The characteristic of this market is that whenever the demand for a specific currency changes, the price of that currency will decrease or increase compared to other currencies.

In the forex training article, we are going to introduce you to some basic concepts in the forex market. Reading these materials will help you to take more effective steps in the field of buying and selling in this attractive market.

In this article we will cover:

- What is a forex broker?

- Different types of analysis in the forex market

- Understanding forex market symbols

- Currency pairs in the forex market

- Definition of Leverage in Forex

- What is swap in the forex market?

- Unit of changes, Pips, points and ticks in forex

- Different types of orders in the forex market

- Trading volume and lot in the forex market

What is a forex broker?

In order for investors to be able to buy or sell shares of a company in stock exchange market, it is necessary to register in a reputable brokerage and place their order. In this way, the broker performs the transaction for the user and receives a fee from him in exchange for his services.

Also, in the digital currency market where users buy and sell digital currencies, it is necessary for the users to first register in an exchange and register their order so that the exchange can carry out their transaction.

Similar concepts exist in the world stock market, which is known as Forex.

In fact, in order to be able to carry out their transactions, traders must go through the process of registering in Forex and register their order with brokers – who play the role of an intermediary – so that the broker can make the transaction as an intermediary between the buyer and the seller.

Different types of analysis in the forex market

Technical analysis

In order to perform well in the financial markets, you must be able to analyze the price charts of various assets. The analysis that is done on the price chart and with analytical tools such as trend line, channels, etc., is technical analysis.

In fact, in technical analysis, which is very popular, traders try to predict the future price and value of an asset by examining various types of forex charts and with the knowledge that price behaviors are constantly repeating.

Fundamental analysis

In fundamental analysis, traders do not pay attention to the price chart of currency pairs, but pay attention to the basic and fundamental issues that play an important role in evaluating currencies.

For example, if interest rates in the United States change, the same can affect currency pairs that include the dollar and even other currency pairs.

The unemployment rate in the country that you intend to analyze the fundamental analysis of its currency, along with the amount of production of that country and other economic factors are similar to those that are taken into account in the fundamental analysis.

Sentiment analysis

Sentiment analysis is another type of analysis in the forex market, which may be less discussed than technical and fundamental analysis, but despite the lack of attention, this type of analysis, which examines traders’ emotions and forex psychology, will help you make better deals.

One of the prominent websites for conducting sentiment analysis is the Forex Factory, which provides users with many facilities, including checking the amount of buyers and sellers.

Of course, the Forex Factory website is also useful for people who intend to do fundamental analysis or analysis based on Forex news.

Understanding forex market symbols

Before you decide to invest in this market, you should first get familiar with the major and main symbols of forex and know the trading pairs and the importance of each one.

Unlike the stock market, where investors can choose from hundreds of different stocks, in the currency market there are only eight major symbols.

These symbols make up the majority of forex trading. In general, the most important symbols used in Forex market transactions are:

- US dollar or USD

- Euro or EUR

- British pound or GBP

- Japanese yen or JPY

- Swiss franc or CHF

- Canadian dollar or CAD

- New Zealand Dollar or NZD

- Australian Dollar or AUD

These economies occupy the most extensive and complex financial markets in the world, and the currencies related to them have largely taken over the forex market.

For example, the US dollar accounts for 88.3 percent of all forex transactions, and the euro is used in 32.3 percent of transactions.

Less popular currencies such as the Australian dollar, Canadian dollar and New Zealand dollar are also considered as commodity blocks. Because these currencies indicate changes in the global commodity market.

By focusing on these eight countries, we can benefit from making money in the most reliable and liquid instruments in the financial markets.

Economic data from these countries is updated daily, helping investors stay ahead of the game by assessing the health of each country’s economy.

Digital currencies are also among the most popular symbols in the forex market. For example, we can mention crypto symbols such as Bitcoin (BTC/USD trading pair), Litecoin (LLTC/USD) and Ripple (XRP/USD).

Among non-currency symbols, the names of heavy metals such as gold or silver, shares of reputable companies such as Apple (AAPL shares) and various forms of energy such as Brent oil can be seen.

Currency pairs in the forex market

In the forex market, currencies or financial symbols are always bought and sold in the form of trading pairs.

For example, when you want to convert your dollars to euros, you will be dealing with two financial symbols, and therefore you should consider the price of these two currencies in comparison with each other.

Each trading pair in the forex market has its own value, and this price is defined as how much to buy each unit of the first symbol (for example, in the EUR/USD trading pair, the euro is considered the first symbol).

The second symbol is what you need. For example, the value of the trading pair EUR/USD means how many US dollars you will need to buy each euro.

So when we say that each EUR/USD currency pair is supposed to have a value of 1.3635, we mean that we will need 1.3635 dollars to buy one euro.

Conversely, in order to obtain the value of each dollar in Euro units, we must divide the number 1 by 1.3635, which results in 0.7334.

That is, to buy one US dollar in the current market, we will need 0.7434 euros. Be careful that the price of the trading pairs is always fluctuating and the prices are directly affected by the transactions made during the day.

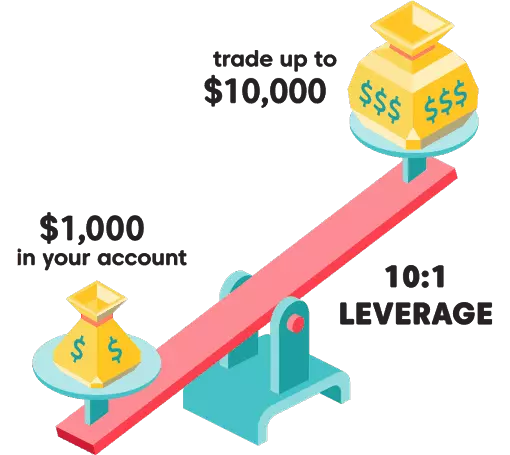

Definition of Leverage in Forex

Leverage refers to the use of borrowed capital as a source of financing in an investment. In this way, leverage plays a role in expanding the asset base of companies and increasing production efficiency.

In fact, leverage can be considered an investment strategy for the use of financial loans and especially the use of various financial instruments or borrowed capital to increase the potential return of an investment.

The forex market also shows significant leverage potential. This potential is estimated to be 100 to 1 in most cases. It means that you can manage an amount of 10,000 dollars by only having a capital of 100 dollars. While stock market traders can only look at Leverage at the level of 2 to 1.

However, you should be careful that leverage acts like a double-edged sword. So if you use it right, it can bring you significant profits, but if you make one of the common mistakes in forex investing, it will leave you with a huge loss.

Even with a relatively conservative leverage of 10:1, a 7.5% profit from buying and selling the NZD/JPY trading pair will turn into a 75% profit within a year.

So if you were to take a 100,000 position in the NZD/JPY trading pair using a $5,000 deposit, you would receive a profit of $9.40 per day.

This figure will be equivalent to $94 profit within 10 days or $3,760 within a year. Of course, unless the value of the New Zealand dollar falls and the trader loses the entire amount of his deposit. While investing in bank accounts will result in a small profit, it will be free of any risk in return.

The use of leverage causes any changes in the market value to have multiple effects. However, these losses can be avoided to a large extent by using stop orders. In addition, almost all forex brokers are covered by software called margin watcher.

This software monitors your position and automatically withdraws your capital as soon as the margin trading requirements are violated in Forex.

This process guarantees that your account will never have a negative balance. In other words, by using Margin Watcher, your risk will be limited to the amount of money you have in your account.

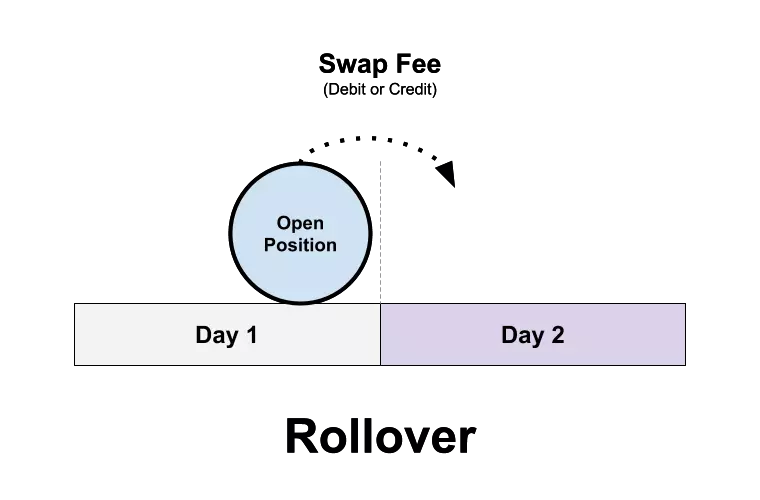

What is swap in the forex market?

The concept of swap in the forex market is one of the least understood concepts in the financial markets. A swap is a fee charged for keeping a position open within 24 hours.

Understanding how Forex swaps work and calculate greatly overshadows the potential profit from trading.

Depending on the swap rate and position received in various forex transactions, the swap value can be negative or positive. In other words, in exchange for holding your financial position, you may have to pay the swap amount within 24 hours or this amount will be deposited into your account.

The swap rate is basically defined for transactions that are done with leverage. Because by opening a leveraged position, you are actually financing that position with borrowed capital. For more clarification, consider the following example:

In the forex market, every time you open a new position, you are actually making two trades.

Buying one currency of the trading pair and selling the other. In order to sell one of these currencies, you are effectively borrowing that amount.

This, in turn, causes you to be charged an amount as interest on the borrowed amount. However, on the other hand, by buying the second currency in the trading pair, you will receive a separate profit.

If the profit rate from buying one of the currency symbols is higher than selling the other symbol, you may receive a profit for holding the position during 24 hours.

However, due to other issues such as broker markup, it is possible that regardless of the position opened (for buying or selling), an amount will be deducted from your account as profit.

Therefore, the swap rate depends on the market and subsequently your trading instrument.

For example, the forex swap rate for the EUR/USD exchange pair will not be the same as the USD/CAD swap rate.

The swap fee depends on the following:

- Online broker

- Position type: buy or sell

- Financial instruments

- The number of days the position remains.

- Position value figure

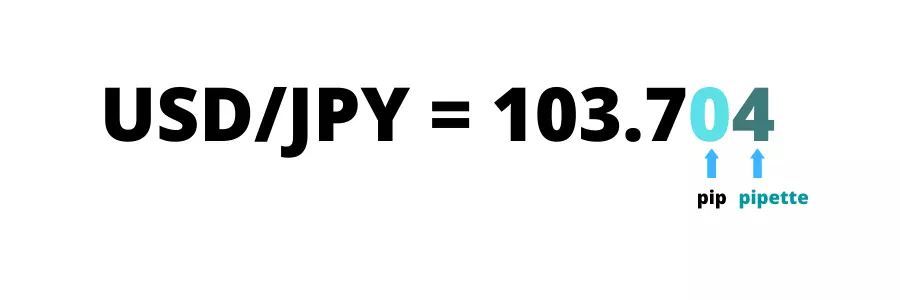

Unit of changes, Pips, points and ticks in forex

In order to estimate risk and reward and better understand how to determine profit and loss, it is necessary to be familiar with the concepts of pip, point and tick.

These are terms that traders use to describe price movements in the financial markets. Although most of these concepts are used interchangeably, each reflects a certain degree of variation and has a unique application in financial markets.

In this part of Forex training, we are going to briefly introduce these concepts to you.

Point means the smallest possible price change on the left side of the decimal point. At the opposite side of the point, we have the tick, which shows us the smallest unit of price change to the right of the decimal point.

Pip, which stands for “points in percentage” is similar to tick and indicates the smallest changes on the right side of the decimal point. with the difference that the use of this unit in the forex market is more important than any other market.

Therefore, pip can be considered as a vital tool in the forex market.

Point in Forex

Among the above three tools, the point shows the most amount of price changes and is calculated only about the changes on the left side of the decimal.

In the stock market, the total increase or decrease in the dollar value of a specific stock or stock index is known as a point. In the case of a particular stock, each point is almost always considered equivalent to one US dollar.

For example, if the stock price drops from $53 to $48, this change can be considered a five-point drop, but what is the purpose of defining this indicator?

Although the dollar value of one point is the same among different stocks, the percentage change in the value of the stock that represents one point will be different according to the value of the stock in question.

For example, if the value of a $30,000 stock decreases by three points, each point will be equivalent to a negligible 0.01% drop in the value of the share (formula: 3.30,000 times 100), but on the other hand, if a $10 stock decreases by three points experience the value, the same three-point value difference causes the stock value to fall by 30%.

Several indicators have been introduced to track price changes. For example, one of them is called IG (investment-grade) index, which considers price changes up to four decimal places.

However, when announcing price changes, it moves the decimal to four places to the left. In this way, the price of 1.23456 is considered equivalent to 12345.6

Tick in forex

A tick refers to the smallest possible price change on the right side of the decimal point. Based on the IG index, the price change from 1.2345 to 1.2346 is considered equivalent to one tick.

For example, in a market, price movements may be measured with changes of 0.25. In such a market, the price increase from 450.00 to 451.00 will be equivalent to four ticks or one point.

Until April 2001, the smallest tick size was considered equal to one sixteenth of a US dollar. That is, stock price changes were only possible in units equal to $0.0625.

The use of the above decimal units has greatly helped investors by providing a narrower supply-demand spread. However, at the same time, market making has become a riskier and less profitable activity.

Pips in forex

As we said, pip stands for point in percentage unit. In fact, a pip can be considered as the smallest amount of price change that is considered based on the market contract for the exchange rate.

Most trading pairs are priced to four decimal places, and the smallest change is considered to be the last (fourth) decimal place.

A pip is equal to one hundredth of 1 percent or one basis point. For example, the smallest change that the USD/CAD trading pair can make is estimated to be $0.001, or one basis point.

Different types of orders in the forex market

In a wide and volatile market like Forex, choosing a risk management system is very important and minimizes the loss of your capital.

Here we want to introduce you to the main types of orders or orders used in the forex market and tell you how you can use each of these orders to avoid losses and increase your chances in investing.

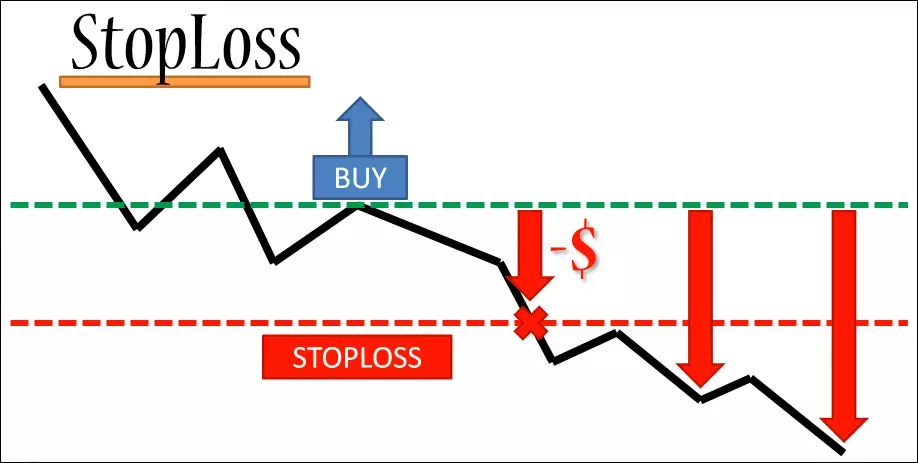

Stop-loss order

A stop loss order refers to an order that you enter with your online broker to exit the transaction if the price reaches a certain level. The purpose of this order is to limit the amount of loss of your capital in the investment.

Determining the stop loss limit in the forex market is mandatory. However, some traders do not use this order due to the fear that the direction of the market will be reversed again.

Some also refuse to use it because this order is not compatible with their forex strategy. However, forex traders should focus on preventing losses before thinking about profitable opportunities.

A stop loss order not only protects your investment from significant capital losses, but also removes the emotional factor that may influence your decisions.

Limit order

A limit order means an order that you give to your broker to make a transaction (buy or sell) only when the price reaches a certain limit or higher.

A limit order can be used to buy a currency below the market price and sell it at a price above the market price.

In general, the purpose of this order is to limit the risk of sudden price fluctuations. Therefore, you should also consider this order in your risk management system.

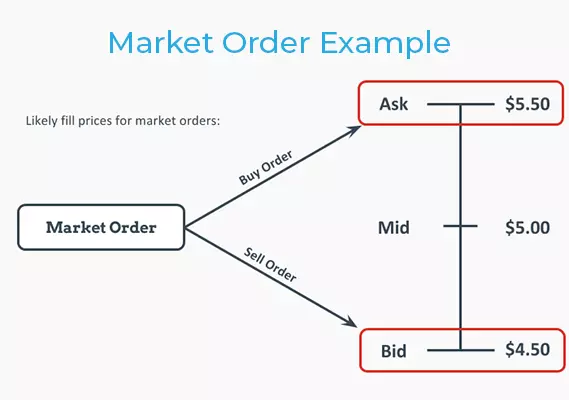

Market Order (Instant Order)

A market order is an order that you give to your online forex broker to exit a transaction at a certain time and at the best possible price. In such high-speed markets, sometimes there is a difference between the actual price and the capital price when defining a market order.

As a result, this type of order may have several pips of loss or profit for you. Always make sure to choose the right strategy and ideal market conditions before placing an order.

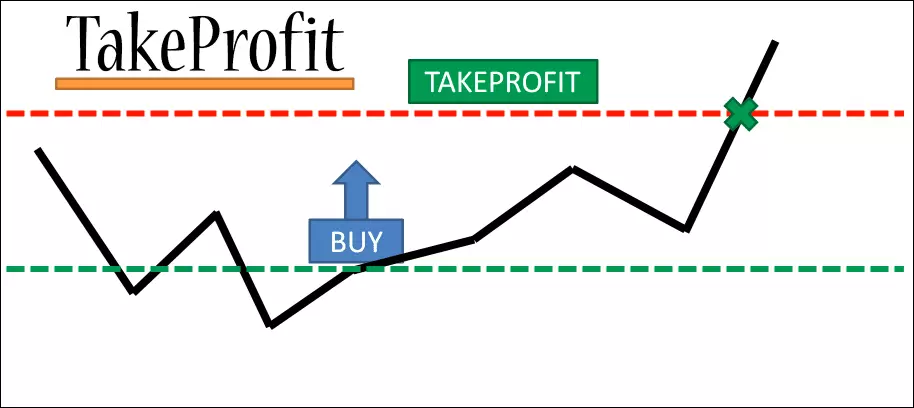

Take profit order

A take profit order is recorded when you instruct your forex broker to automatically close a trade as soon as a certain point is reached in the desired direction.

Considering that the price may reverse against your expectations, you should set a certain amount for take profit that will automatically deposit this profit into your account before the price changes direction.

Usually, this order is used together with the stop loss order, and the ratio of pip take profit to pip stop loss is called the risk-to-reward ratio.

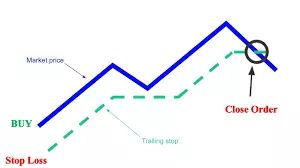

Trailing Stop order

Unlike Take Profit Order, Floating Limit Loss Order, also known as Trailing Stop order, means that whenever the currency moves against your desired direction, the forex broker automatically buys or sells capital according to the situation.

Trailing stop order is similar to stop loss order, with the important difference that the floating loss limit changes along with the price changes.

This will help you profit from your trades while minimizing the potential loss of your capital in the event of a market failure.

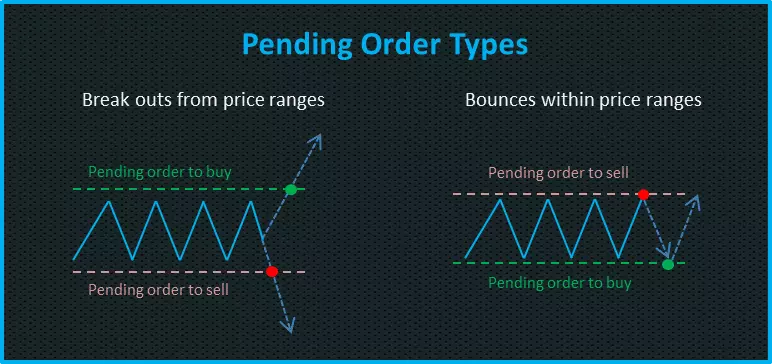

Pending order

Pending order in foreign currency transactions or forex market means that the broker automatically buys and sells a currency when it reaches a certain price.

The difference between this order and the market order is that the market order, as its name suggests, buys and sells capital at its current price.

While the pending order allows you to enter the trade whenever the conditions for investing are in line with your strategy, thus preventing you from being left out of the market.

Although trading software and methods of entering orders may differ between different brokers, generally the types of pending orders are similar.

Trading volume and lot in the forex market

Usually, transactions in the forex market are done in specific units called lots, which can be considered a unit for measuring the volume of transactions.

A lot in Forex is a standard unit for measuring the volume of a financial position. In fact, the amount of money used to buy a currency to be sold at a higher price later is measured by the lot unit.

LOT calculation is considered a key element in the risk management system.

As a standard, each lot is considered equivalent to 100,000 units of a special currency. Similarly, mini, micro, and nano lots are defined as 10,000, 1,000, and 100 currency units, respectively.

In the forex market, each trader can only define financial positions in certain volumes per lot unit. For example, traders cannot buy and sell exactly 1,000 euros, but must trade an amount as a fraction of a lot.

In this article, we introduced you to some general and basic concepts of the forex market and the prerequisites for entering this popular market.

Familiarity with the above materials will help you to step on this path with a clearer view and increase your chances of success in investing in forex market and also shorten the learning period of forex in terms of time.

In general, the concepts mentioned in this article can be summarized as follows:

- Foreign exchange market is a market where currency pairs are traded.

- Currencies are mainly traded in pairs (such as the EUR/USD pair) and traders take different financial positions depending on their predictions of price movements.

- Currency price changes in the forex market are measured by the pip unit, and traders can use this unit to determine their trading positions.