The main digital currency exchange platforms or digital currency exchanges, which are divided into two categories: centralized and decentralized.

Bitmart exchange is a centralized market with a history of activity since 2018 and has more than 9 million active users.

This exchange, in addition to buying and selling, has provided the possibility of performing more advanced financial activities for its users in order to earn more money.

But how to register and operate in Bitmart? What are the features, fees and advantages and disadvantages of this platform?

In this article, while answering these questions, we will briefly describe the history of this market.

Finally, we describe the special considerations of using the Bitmart exchange. Continue with us and get to know the 19th best centralized exchange in the world in Coinmarketcap ranking.

Let’s dive in and explore together:

- General introduction of Bitmart exchange

- Bitmart exchange history

- Features of the Bitmart platform

- Passive income generating methods in Bitmart exchange

- Futures trading on Bitmart

- Margin and leverage trading

- Bitmart NFT Market

- Authentication, registration and deposit to Bitmart

- Bitmart registration procedures

- Digital currency deposit to Bitmart wallet

- Bitmart exchange fees

- Advantages of Bitmart

- Disadvantages of Bitmart exchange from the point of view of users

General introduction of Bitmart exchange

Bitmart is a platform for trading cryptocurrencies and other financial instruments such as derivatives and futures contracts.

This platform provides the possibility of buying and selling more than 1000 digital currencies, including almost all known currencies and more than 700 trading currency pairs.

Bitmart exchange can be accessed through its website and mobile applications. This market allows its users to make spot transactions and earn money through staking, margin transactions, buying and selling in the NFT market, as well as leveraging transactions.

Comprehensive educational articles and a dedicated and secure wallet are the advantages of this exchange market.

Bitmart ranks 19th among 228 centralized exchanges with a score of 6.2 out of 10 in the Coinmarketcap website ranking.

After this platform we see familiar names like MEXC, BitForex, Crypto.com, Bitrue and DeepCoin. Bitmart’s daily trading volume at the time of writing this article is about 432.5 million dollars and its liquidity is 625 billion dollars.

This exchange also supports two fiat currencies, dollar and euro.

Bitmart exchange history

The construction and development of the Bitmart exchange began in 2017 and was put into operation in 2018.

The headquarters of this company is located in the Cayman Islands, which belong to the United Kingdom. This company also has offices in China, South Korea and America.

The founder and CEO of Bitmart, Sheldon Xia, studied computer science at the Stevens Institute of Technology in New Jersey, USA.

Mr. Xia has the experience of founding and managing the SVIEF (the host of annual conferences of investors, scientists and politicians in Silicon Valley, USA) and Women4Blockchain projects.

He has registered the Bitmart exchange in the US as a money service company, or MSB.

Among the most important events in Bitmart’s short history, the following can be mentioned:

- 2018 – Introducing the native Bitmart token of the same name with the symbol BMX, which is ranked 599 in CoinMarketCap with a market cap of $18.2 million and a price of $0.1.

- December 2021 – Hacking and losing 196 million dollars of digital currency due to the security challenge of two major wallets. The company itself took the damage of this incident.

- 2020 – Adding leverage and futures trading

- November 14, 2022 – The suspension of FTT token future contracts in a measure to protect its users due to the collapse of the FTX exchange that hosted this token.

Features of the Bitmart platform

Bitmart digital currency exchange has provided numerous trading facilities and income generating opportunities for its users.

In this section, we examine the most important of these facilities.

Passive income generating methods in Bitmart exchange

Bitmart exchange has provided several methods of passive income generation for its users, the most important of which are:

- Staking, in different ways from fixed to very flexible with the possibility of withdrawal at the desired time, with an annual profit of at least 1%.

- Bonus for inviting friends, with 40% profit from transaction fees for one year.

- Affiliate marketing for influencers and companies with 50-100% profit from spot and futures transaction fees.

- The Earn Interest With Holding program that pays the user 1 to 100% interest for holding a certain amount of any asset.

Futures trading on Bitmart

Bitmart also allows its users to trade futures contracts. Professional traders use this financial instrument to cover their possible losses.

Futures trading on this platform has attractive advantages over the same type of trading in other markets:

- Not having a delivery date. So there is no time limit to hold the position.

- Following spot market rules. Therefore, the price of the underlying asset of the contract will be traceable.

- Use rational pricing methods to avoid forced liquidation of positions due to lack of liquidity or market manipulation.

- Having automatic credit reduction mechanism or ADL. This feature also prevents severe losses caused by the failure of large positions.

Margin and leverage trading

One of the most important facilities that Bitmart exchange provides to professional traders is margin trading.

In this type of transaction, based on the amount of your collateral, you can borrow from Bitmart and open trading positions with it. The amount of your loan also depends on the amount of your collateral.

In addition, you can leverage your trading profit on Bitmart up to 125x in both cross and isolated positions. In this respect, the Bitmart platform competes with the best decentralized exchanges that are usually famous for this feature.

Keep in mind that these two methods will increase your potential loss as much as your profit.

Bitmart NFT Market

The Bitmart non-exchangeable token market is not yet complete and does not have features such as sorting the token list or searching.

However, unique and valuable projects are seen in this market. Bitmart has also created a presentation platform or launchpad for NFT developers.

In this market, you will be able to buy, sell and exchange NFT.

Authentication, registration and deposit to Bitmart

Before registering at Bitmart exchange, you should know that this platform has limited its services without the need for authentication to deposit, withdraw and buy and sell up to 0.06 bitcoins per day.

Bitmart registration procedures

To register in Bitmart exchange, follow the steps below:

- Download the app of this platform from known markets or its website. You can start the registration through the Bitmart website at: https://www.bitmart.com/ and by clicking the Get Started option in the upper right corner of the image.

- Open the application, after specifying the email address and password, confirm that you are over 18 years old.

- Open your email and click on the confirmation link sent by the exchange.

- Your account has been created. If you want to authenticate, you can do so after logging into your account.

Digital currency deposit to Bitmart wallet

In order to deposit coins to your account in the Bitmart exchange on the website of this platform, follow the steps below:

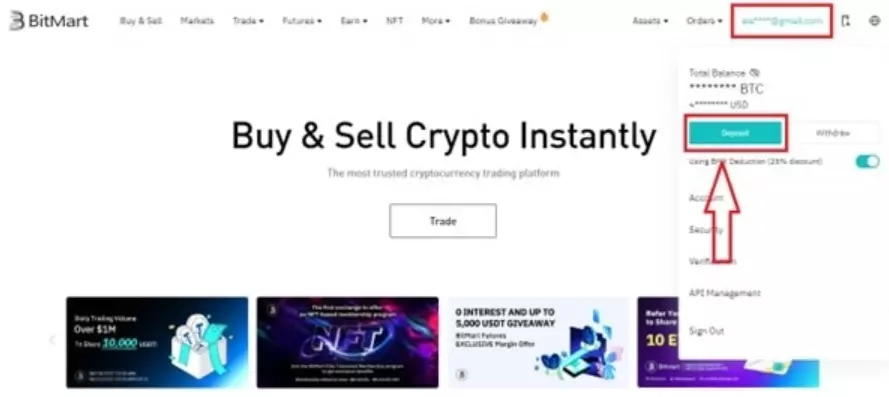

1. Log in to your account and after clicking on your email, click on the Deposit option.

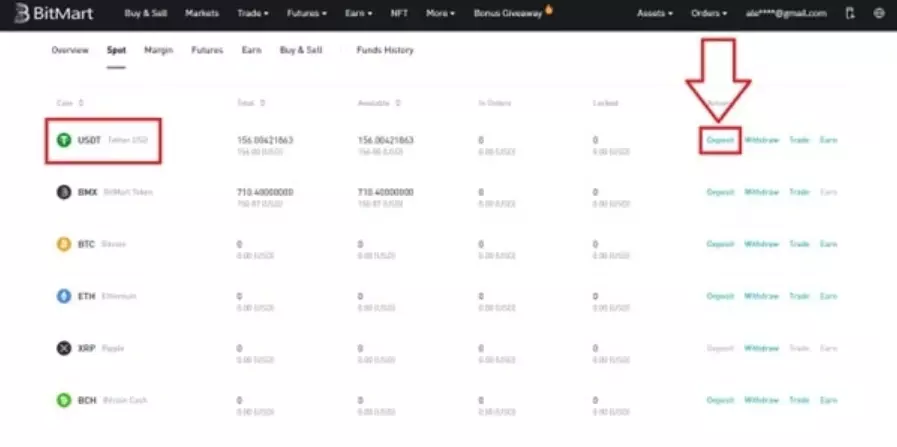

2. Click on the desired coin and click again on the Deposit option opposite it.

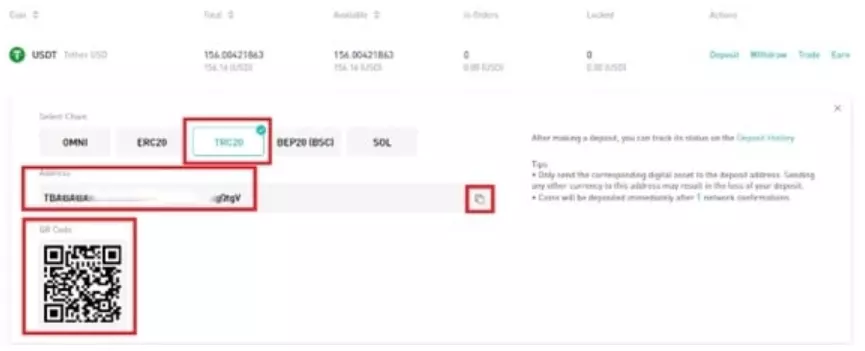

3. Select your deposit network and then copy or scan your wallet address.

4. In the source platform, you must enter the same address of your copied wallet and choose the same digital currency and network.

If you are using the Bitmart exchange application, after logging into your account, you must click on the Assets section. The rest of the steps are similar to depositing coins on the website.

Bitmart exchange fees

Fees have a tiered structure and use the taker/maker model. The higher the user’s 30-day transaction volume in terms of bitcoins, the lower his transaction costs will be.

The maximum fee of this market is 0.25%, which is paid by both sides of the transaction.

BMX token holders also receive tiered discounts of at least 25% on their spot trades. The Bitmart exchange fee is as follows until the transaction volume is less than 150 bitcoins per month.

| User level | Amount of BMX held | Maker fee / Taker fee | Maker fee / Taker fee after 25% discount for BMX holders |

| 1 | 1 – 500 | 0.1 / 0.1 | 0.075 / 0.075 |

| 2 | 500 – 2,000 | 0.09 / 0.1 | 0.0675 / 0.075 |

| 3 | 2,000 – 10,000 | 0.08 / 0.09 | 0.060 / 0.0675 |

| 4 | 10,000 – 50,000 | 0.07 / 0.09 | 0.0525 / 0.0675 |

| 5 | 50,000 – 100,000 | 0.06 / 0.08 | 0.0450 / 0.060 |

| 6 | 100,000 – 200,000 | 0.05 / 0.06 | 0.0375 / 0.0450 |

| 7 | 200,000 – 500,000 | 0.04 / 0.05 | 0.030 / 0.0375 |

| 8 | 500,000 – 1,000,000 | 0.03 / 0.05 | 0.0225 / 0.0375 |

| 9 | 1,000,000+ | 0.03 / 0.04 | 0.0225 / 0.0300 |

Other details of Bitmart platform fees are as follows:

- Margin trading: minimum 0.002292%

- Futures: Maker 0.020% and Taker 0.060%

- Withdrawal fee: It is floating and varies depending on the amount and network fee. However, according to the experience of Bitmart users, it charges 0.0005 BTC for each Bitcoin withdrawal.

- Deposit and storage fees: Zero

Advantages of Bitmart

In addition to the features we discussed, the following are the most important advantages of Bitmart exchange:

- Payment support with Visa, MasterCard, Apple Pay and PayPal credit cards

- Provide step-by-step instructions for use

- No need for authentication for basic services

- High speed of transactions

- The possibility of receiving staking interest in two different currencies with dual investment feature

- Possibility of copy trading

- Identifying the identity of the founder and the history of the company

- Applying advanced security solutions such as multi-signature technology and cold wallet, especially after the 2021 hack.

- Support in four ways: email, Support Center, ticketing and chatbot

- Low fees, especially for futures

Disadvantages of Bitmart exchange from the point of view of users

By reviewing the forums and reviews of different websites about the Bitmart platform, the following disadvantages can also be considered for it:

- KYC required for staking, spot and futures transactions.

- The user interface is a little complicated and, according to some users, unattractive.

- The high purchase fee of digital currency with currency and the dependence of the purchase fee on the payment method in general.

- Having a history of hacking that may cause traders and investors to lack confidence in maintaining liquidity in this trading platform.