The best time for swing trading is always one of the most frequent questions of users in the digital currency market. Swing trading, is considered as one of the trading strategies in the cryptocurrency market, which is based on profiting from the fluctuations of a currency in a specific time frame.This strategy has attracted the attention of many traders in the highly volatile market of digital currencies.

In this article, we are going to comprehensively discuss the concept of fluctuation and while referring to the concept of time frame, we will introduce the best time frame for the fluctuation of digital currency.

Let’s dive in and explore together:

- What is meant by time frame?

- Different types of time frames in terms of strategy type

- Short term time frame

- Medium-term time frame

- Long-term time frame

- Understanding the concept of “swing trading”

- Advantages of swing trading

- Disadvantages of swing trading

- Different methods of swing trading

- What is HODL and how is it different from swing trading?

- What time frames are reliable for swing trading?

- What is the best time frame for swing trading?

What is meant by time frame?

Time frame is one of the most important concepts in analyzing the price fluctuations of a digital currency. Any user of the digital currency market who intends to profit from the price changes of a cryptocurrency, must determine a time frame for this and examine the price fluctuations of the desired currency in the same period.

The time frames start from one hour or several hours and continue to the time frames of several months. Each user should choose one of the time frames according to the strategy he has chosen.

Note that each short-term, medium-term or long-term strategy requires its own time frame. By choosing each time frame, the digital currency candlestick charts will also change accordingly.

For example, in a candlestick chart of a digital currency with a daily time frame, each bar or candle represents the price in one day for that cryptocurrency.

Therefore, with the help of the fluctuation chart of the price of a currency in the daily time frame, it is possible to determine what changes the price of the digital currency in question has had on a daily basis.

By doing this, we can analyze the price trend in fluctuation and reach the buying and selling points.

Different types of time frames in terms of strategy type

Time frames are classified into three types, short-term, medium-term and long-term, according to the type of strategy we may choose.

Short term time frame

Shorter time frames are more popular among traders. These time frames are chosen as the best time frames for volatility in daily analysis.

If we want to check the price trend in the short term, we should choose a short time frame. In short-term time frames, candles and dots represent short-term (for example, daily) data.

Medium-term time frame

Medium-term time frames are among the most reliable time frames to swing and are chosen as the best time frame to swing by many professional traders.

In medium-term time frames, one-month, two-month or three-month periods are selected. These time frames are usually used to pay attention to price fluctuations in the medium term.

Long-term time frame

The long-term time frame is less useful in volatility. The long-term time frame is usually one or two years, and people who use it take a relatively long-term view of the market.

Understanding the concept of “swing trading”

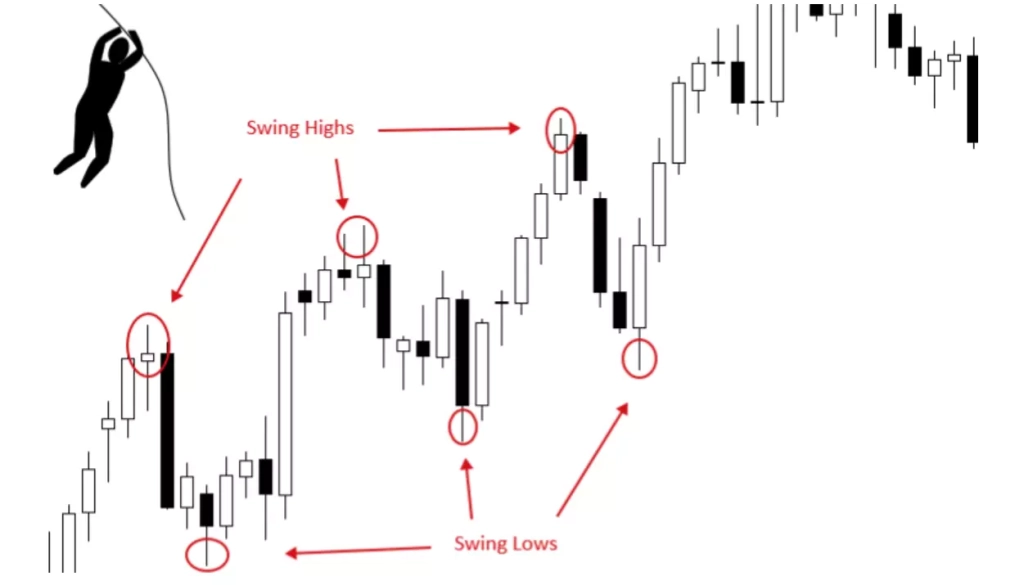

Swing trading is one of the trading strategies that has become very popular among digital currency users. In this method, traders focus on specific and limited time frames to check the price changes of a digital currency.

The purpose of this work is to profit from the fluctuations of a currency in a relatively short time frame.

The time periods in the fluctuation are usually chosen from daily to weekly, and the swing trader, taking into account the price changes in this time period, reaches significant profits with the help of various tools.

In fact, in swing, the trader first predicts the price trend in a specific time period for a digital currency with the help of technical and fundamental analysis, and then waits to trade the desired cryptocurrency at the obtained buying and selling points.

Swing traders are also used to profit from this method from various tools such as indicators and candlestick patterns.

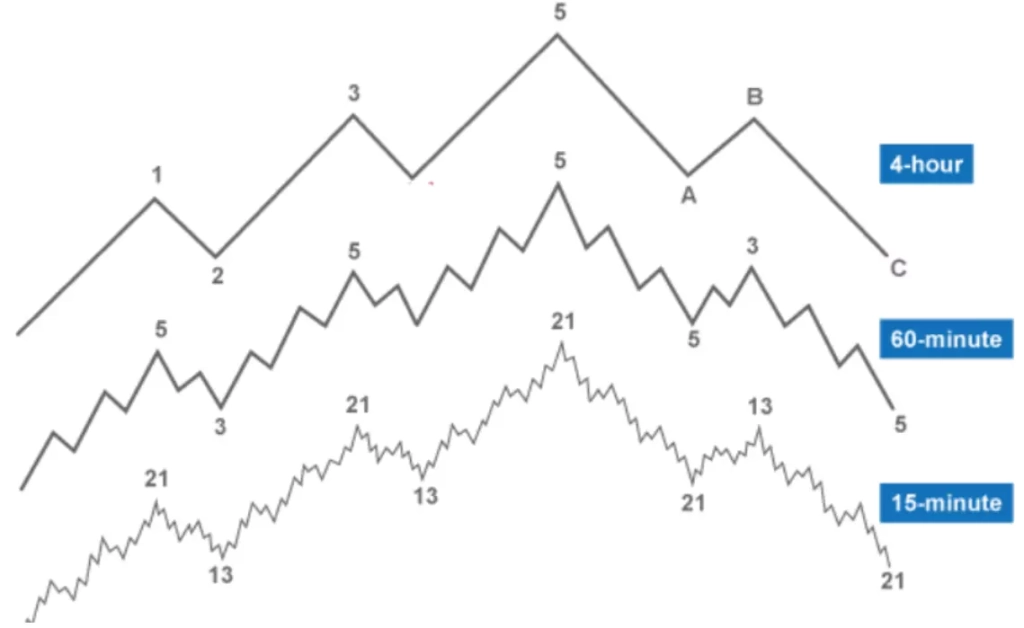

Among the time frames that are mostly used by swing traders are medium to long time frames. This is because the results of strong and reliable trends are usually determined in the long term.

For this reason, the use of daily time frames in the trading strategy of swing trading is less important. Of course, one-hour, four-hour, twelve-hour, and even daily time frames may be used according to the specific strategy that is chosen.

Therefore, the best time frame for digital currency fluctuations is different in each strategy.

Advantages of swing trading

Volatility trading has many advantages that we are going to discuss in this section. One of the advantages of volatility is to earn profit in a shorter period of time.

Choosing the daily time frame as the best time frame for swinging can get you results in less time. This means you can increase your short-term profit potential by taking swings. Of course, this is possible with the correct use of technical analysis.

Another advantage of swing trading is having confidence in the market. Whenever you use accurate tools and various indicators to analyze a trend, you will get more accurate buy and sell signals. This means that each swing can personalize the way to profit.

Disadvantages of swing trading

Along with the many advantages of this type of trading, there are also disadvantages such as risk taking and overnight losses. Choosing the best time frame for swinging, if not accompanied by accurate technical analysis, may blow the trader’s capital overnight.

Also, the market may suddenly reverse due to fundamental reasons. In this case, those who have invested a lot will suffer huge losses.

Another disadvantage of swing trading is holding on to long-term profitable positions. Usually, in the long run for some cryptocurrencies, there is the possibility of huge profits that swingers lose.

Another problem with volatility trading is the high commission cost and the experience of successive fluctuations. This parameter may not be very pleasant for many digital currency users.

Different methods of swing trading

After choosing the best time frame to swing, now you need to choose the right way to swing. Below are some of these methods:

Using neutral positions in the price trend

When the price trend goes through a horizontal mode, professional swing traders try to place a buy order near the support level and a sell order near the resistance level.

Taking help from the moving average

Using the moving average (MA) indicator helps a lot in creating a support and resistance range. This will prevent you from entering a downtrend after an uptrend.

Don’t forget indicators

Indicators or oscillators are the most important tools in volatility that determine the moving and changing range along with the change in the price trend. These tools specify a support level and a resistance level for this purpose.

Fundamental analysis

Reliable news always speak first. Therefore, pay close attention to the news that comes from official sources about the desired digital currency.

What is HODL and how is it different from swing trading?

So far, we have learned about the concept of swing trading. In this section, we are going to discuss the difference between swing trading and HODL.

HODL (Hold On for Dear Life) is one of the trading methods in the digital currency market, in which some digital currency is bought and then they are kept in wallets for a long period of time, from a month to a year or more.

In HODL, the trader does not pay any attention to short-term volatility, negative or positive fundamental news and market sentiment. The purpose of this method is to earn profit in the long term.

But in swing trading, fluctuations in relatively short periods of time (daily to several weeks) are considered. swing traders try to get buy and sell signals by choosing the best time frame to fluctuate and analyzing the price trend in that time frame.

What time frames are reliable for swing trading?

One of the most common time frames in swing trading is the “daily” time frame. This time frame is chosen as the best time frame for swing by many swing traders.

With this time frame, it is possible to check price fluctuations in a short period of time. For this reason, reaching profit also happens faster than long-term time frames.

Other swing trading time frames that swing traders usually use for their technical analysis are:

- One minute

- Five minutes

- Fifteen minutes

- One hour

- Four hours

- Daily

Common time frames that are considered reliable time frames are usually one-hour, four-hour and daily.

Of course, these values may change depending on the type of strategy and the strength or weakness of the price trend. For example, medium-term time frames of one month are a more reliable time frame for strong price trends.

What is the best time frame for swing trading?

The best time frame for swing trading is different for every trader. Therefore, it is not possible to suggest a time frame for all traders.

Every swing trader must decide which time frame to use.

For example, in a one-hour time frame, you will get the results of your swing within a few hours.

There is a certain amount of risk in this time frame. But instead of one-hour time frame, if you use fifteen-minute time frames, you may get the desired result in less time (for example, one hour).

However, in the 15-minute time frame, there is more risk. But the time to reach the result is less.

For this reason, if you intend to swing trade, it is better to pay attention to these points before choosing the best time frame to fluctuate:

Attention to personal moods and feelings

See how bored you are to sit at the computer and wait for the result! It is very important to pay attention to personality traits and individual reactions to market emotions.

In choosing the best time frame for fluctuation, you should pay attention to whether your personality is more compatible with time frames with longer duration and less risk or vice versa?

For example, shorter time frames with higher risk are not recommended for highly sensitive swing traders.

Consider the purpose of swing trading

What is your goal of trading? Knowing what you are swinging for will help a lot in choosing the best time frame to swing.

One of the traders may trade with the aim of achieving a high profit in a short period of time. On the contrary, another trader wants to trade with a long-term view and delay his profit.

How much do you want to profit?

It is interesting to know that choosing shorter time frames increases the probability of earning more profit.

Of course, in choosing short time frames, you must make proper use of technical analysis and be able to reach accurate signals for buying and selling using indicators.

In this case, the short-term view can bring you more profit and can be considered as a suitable time frame for swing trading.

In general, the time frames used by a large group of swing traders are the 15-minute, 4-hour, or daily time frames. One of the reasons for this is the existence of a large amount of data in each time frame, which helps swing traders to have a more accurate and convenient analysis.

Therefore, one of the characteristics of the best time frame for swing trading is its popularity among traders.