The Tether White Paper was published in January 2012 and changed many things in the field of cryptocurrency trading.

In this article, we will review the white paper of the Tether digital currency so that you know how this stable coin has changed the way of buying and selling digital currencies and what factors and characteristics the price of Tether depends on.

Having a digital token backed by fiat currency allows individuals and organizations to use a powerful, decentralized way to exchange value, all while using a familiar unit of computation.

As mentioned in the Tether white paper, Tether allows you to exchange a digital currency with a familiar monetary unit.

This means that when you use Tether currency for transactions, it is just like you are using US dollars. So you don’t have to be involved in understanding the value of two digital currencies with unstable and variable value at the same time. Because the price of Tether is always approximately equal to one US dollar.

Tether Institute suggests that in order to maintain accountability and stability in transactions, a one-to-one ratio between a digital currency (called Tether) and its counterpart in the real world (US dollar) is established and digital currency transactions are conducted in this way.

It uses the Bitcoin blockchain, proof-of-stake, and other methods to prove that tokens are always fully supported and protected.

Let’s dive in and check out together:

- What is a white paper?

- Introduction

- The mass of technology and processes

- The mass of technology

- Capital flow process

- The process of proving reserves

- Weakness points

- Tether, a bridge between digital currencies and fiat currencies

What is a white paper?

What is a white paper? A white paper is a content that is designed and published to promote or advertise a company’s products or services.

As a marketing tool, a white paper uses facts and logical arguments to create compelling evidence that works for the foundation publishing the document.

In other words, the white paper will convince you by providing logical evidence that using the offered products or services is a logical decision.

As expected, the white paper of digital currencies deals with issues and problems in the world of digital economy and then they state that the currency in question is a solution to solve these issues and problems.

For example, in the Bitcoin white paper, problems such as high fees for normal transactions, the need to trust a third party, etc. are addressed and then convinces the reader that the Bitcoin blockchain will solve all these problems.

Introduction

There are many different types of assets that people recognize as a means of storing value, a medium of exchange, or an investment. It is stated in Tether’s white paper:

“Bitcoin blockchain is a better technology for transaction, storage and accounting of these assets.”

By creating a new category of digital assets, i.e. decentralized digital currencies or cryptocurrencies, Bitcoin introduced many advantages such as low transaction fees, international and borderless transfer and exchange, anonymity, etc. into the economic world.

However, there are other problems in the cryptocurrency world that need to be solved. Some of these problems are: instability of prices, insufficient understanding of mass marketing in technology and lack of ease of use for non-expert users.

The idea of asset-backed digital currencies was popularized early on by the Bitcoin community. The realization of this idea can be seen in various projects such as Ripple, Omni, etc.

Tether is another such idea that makes it possible for users to exchange digital currency with cash.

The Tether white paper addresses applications in which fiat currency is stored and transferred in an open source software platform, secure and with a distributed ledger, and is a true cryptocurrency.

Although the main purpose of cryptocurrency is to eliminate the need to trust a third party, the aforementioned functions (exchanges, etc.) are either based on trusting a third party or rely on other limitations and inefficient methods.

Therefore, Tether’s white paper states that the fiat-backed cryptocurrency (called Tether) will be launched on the Bitcoin blockchain platform, which is the most reliable and tested economic network.

In the solution provided by the Tether White Paper, Tether tokens are created on the Bitcoin blockchain through the Omni Layer protocol.

Each Tether unit in circulation is backed one-to-one with the corresponding fiat currency at the Tether Institute in Hong Kong. Tethers are redeemable and exchangeable for the corresponding fiat currency or an equivalent spot value of Bitcoin (if the holder prefers Bitcoin).

Once a Tether unit is created and circulated, it can be transferred, stored, spent, etc. just like Bitcoin, and just like the fiat currency has acquired the characteristics of digital currencies.

At any time the value of fiat currency held in our reserves will be equal to (or greater than) the number of Tethers in circulation.

In this section, the Tether white paper mentions that Tether balances the value between circulating Tethers and the underlying fiat currency through the process of proof of reserves.

Further, the Tether white paper proves that exchanges and wallets are unreliable for keeping users’ assets and suggests that the protection of users’ assets should be left to this institution to be done through the Tether digital currency.

It is also acknowledged in the Tether white paper that this method is not completely decentralized.

Because Tether should act as a center for the protection of reserve assets. However, this issue can pave the way for further innovations that will overcome these weaknesses and lead to the growth of the Bitcoin blockchain in the long run.

The mass of technology and processes

There are various technologies and processes that allow Tether to function as it should and fulfill its role in the world of digital currencies.

The mass of technology

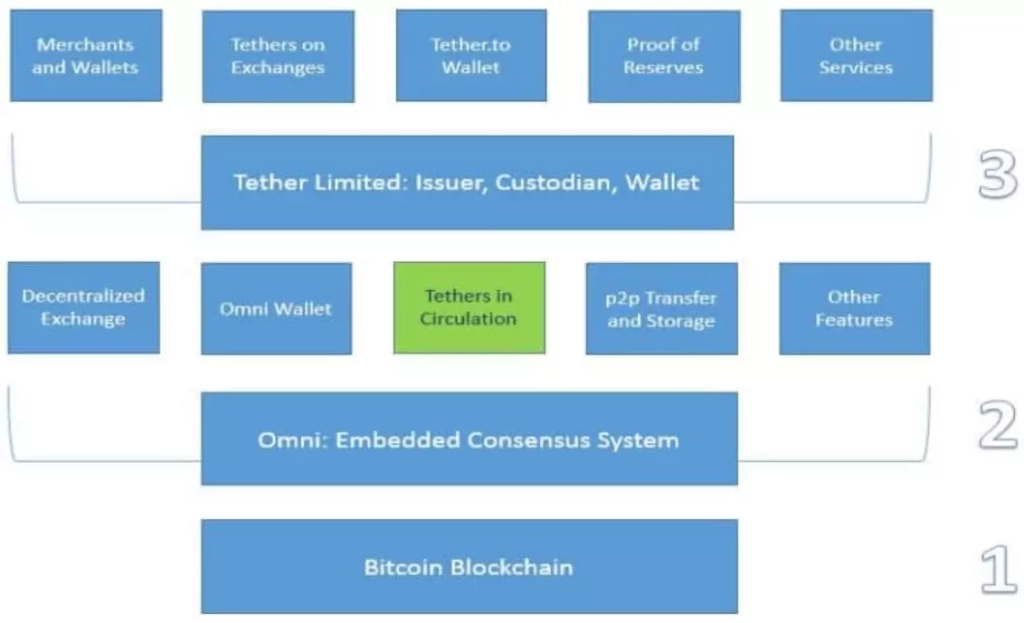

The Tether technology stack has three layers and several components that are shown in a diagram.

The first layer of the Bitcoin blockchain is where transactions are made.

The second layer of the protocol is the security layer that can create or destroy Tether tokens, track and report token circulation, and allow users to transact or store Tethers in a convenient platform.

The third layer is Oracle Tether, which is responsible for receiving and storing fiat currency and creating their corresponding tethers, protecting assets, public reporting of proof of reserves, creating and managing interactions between wallets, exchanges, and blockchain or bitcoin merchants, and finally the activity of Tether.to which is responsible for a web wallet.

Capital flow process

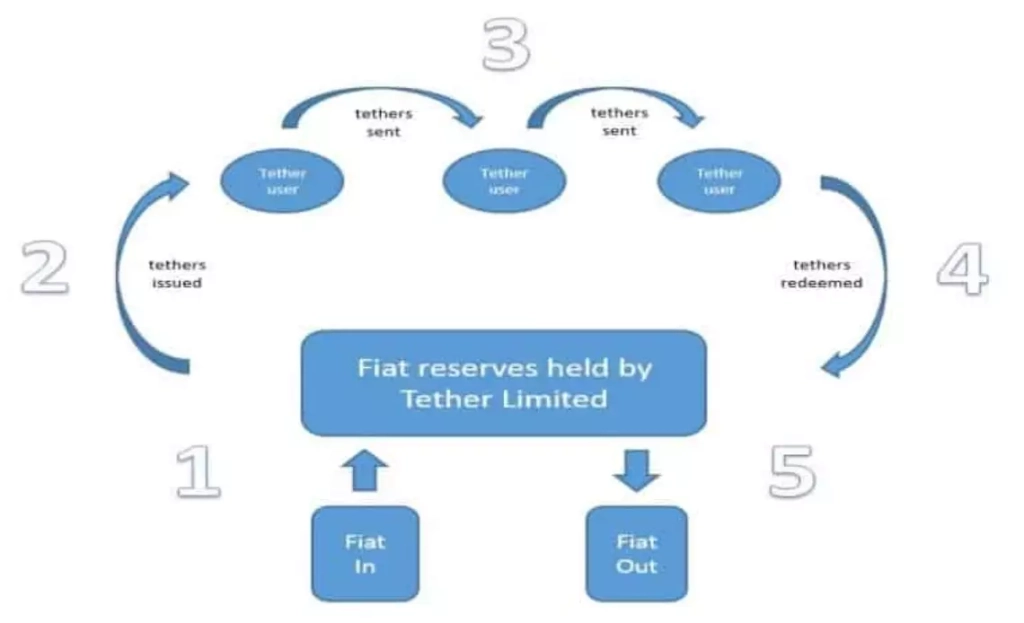

There are different steps in the cycle of creation and destruction of tethers. These steps generally include receiving fiat currency, creating Tether tokens, circulating Tethers, destroying Tethers and finally releasing fiat currency.

The process of proving reserves

Exchanges and wallets are highly unreliable for asset protection. Bankruptcy has happened many times in the Bitcoin blockchain, either due to hacking, mismanagement or fraud.

Exchanges and wallets in their current form (at the time of the publication of this article) cannot be relied upon to protect users’ assets. They cannot guarantee the protection and repayment of assets.

The process of proof of reserves in Tether is a solution to the issue of bankruptcy. In this solution, all Tether tokens are supported one by one by the US dollar, so there is no need to worry about bankruptcy.

Weakness points

Tether is not a perfect and complete method and may have shortcomings and face problems, some of which are:

- The possibility of theft

- The possibility of bankruptcy

- The possibility of freezing or confiscating property

- Ability to escape with spare assets

- Concentration of risk and risk on one point

For these weaknesses, more or less solutions have been presented in Tether’s white paper, which go back to the mentioned processes such as proof of reserves, layers of technology mass, etc.

Tether, a bridge between digital currencies and fiat currencies

Tether’s white paper argues beautifully, as expected from the most powerful stablecoin on the market. In this white paper, various aspects of the problems in the cryptocurrency market are discussed and Tether is introduced as a suitable but not perfect solution for these problems.

The capital flow process in Tether as well as proof of reserves are two important issues that allow Tether to solve the issues and problems raised well.

What is your opinion about the effectiveness of this digital currency and its advantages and disadvantages?