The maker project is very creative and at the same time has many technical complications. If you want to know the details and technical explanations of this project, you can find useful information on the website of the makerDAO project.

But if you are just a consumer and only intend to buy Dai digital currency, you can trade it with dollars, won, bitcoin, ether and other currencies in different exchanges and you don’t need to understand the details and how to create this currency.

But to get this digital currency, you have to multiply it on the maker platform. The first question is what does the maker produce? And what is Dai digital currency?

In this article, we will try to explain to you how this system works in a simple way and instead of focusing on its mechanism, we will introduce you to the first product of this project.

let’s dive in and explore together:

- What is Dai digital currency?

- What is the purpose of the Dai?

- Dai digital currency use cases

- The birth of Dai digital currency in maker protocol

- How to set the value of Dai digital currency

- How to secure DAI digital currency collateral

- Dai features

- How to create a dai on the Oasis platform

- The best Dai wallets

- Prediction of the future of Dai digital currency

What is Dai digital currency?

“Dai” currency is a type of stablecoin. The concept of stablecoin is very simple. A token is like Bitcoin or Ether that is on a blockchain. But unlike Bitcoin or Ether, it has no price fluctuations. Of course, volatility is a relative concept.

A stablecoin is a digital currency that is designed to maintain its value based on another asset and its value is linked to these less volatile assets such as fiat currencies, bonds, other digital currencies, a basket of goods in the consumer price index, precious metals or oil.

Of course, their prices are usually linked to the US dollar or another traditional currency.

As mentioned in the white paper, this currency tries to be stable against the US dollar. So one dai digital currency will always be equal to one dollar.

You are most likely familiar with stablecoins such as Tether. Tokens issued on a blockchain and backed by dollars stored in bank accounts.

This legally backed cryptocurrency is called IOU. If those bank accounts are blocked or accountants defraud token holders, token holders can eventually gain access to the bank accounts through legal action.

What is the purpose of the Dai?

Relying on the banking system to hold crypto tokens introduces an untrusted intermediary into the blockchain. The dai currency introduces a better solution. This currency is a stable coin that is completely based on its blockchain chain and its stability is provided without the intermediary of the legal system or any other intermediaries.

Dai is set to be the first consumer-based stablecoin that differentiates itself from both its predecessors and competitors. Today, Dai digital currency is one of the most popular stablecoins and has more active addresses than USDT — the largest stablecoin in the market.

Dai digital currency use cases

The most important use of dai is to avoid market fluctuations. Every application and platform needs a low volatility threshold to be able to run on a blockchain.

Loans, for example, simply cannot be paid with a currency like Bitcoin, which fluctuates 10-20% daily in price. A loan issued in crypto may lose value, or if you are using Bitcoin to send money from one country to another, it is possible that the price movement during the confirmation period of your transaction block will be more than the fees charged.

Most importantly, DAI stablecoin allow decentralized exchanges to set trading pairs in USD instead of Bitcoin. This makes crypto trading accessible to the average person as a medium of exchange.

Another use of digital currency is earning money. Through the Die Savings Rate (DSR) system, users can lock additional collateral in Maker Vaults and receive Die. The amount of DAI received depends on the amount of collateral locked.

The birth of Dai digital currency in maker protocol

To understand this, we need a little background on blockchain and Ethereum in particular. A blockchain allows you to do things that you previously needed an intermediary to do on your own, and all the trust is in a blockchain that is not controlled by a specific person.

Ethereum takes this concept a step further and allows users to add instructions to these transfers. These instructions are called smart contracts.

A network of smart contracts is used to meet the need of trust between parties. With smart contracts, monitoring or approval by a central authority is not necessary.

You also don’t have to wait for external audits or company statements. These systems allow a community to run the organization in a transparent manner. The entire network is traceable through the blockchain.

The Maker ecosystem is built on smart contracts, CDP being one of them. The Maker protocol is managed by its sovereign token holders.

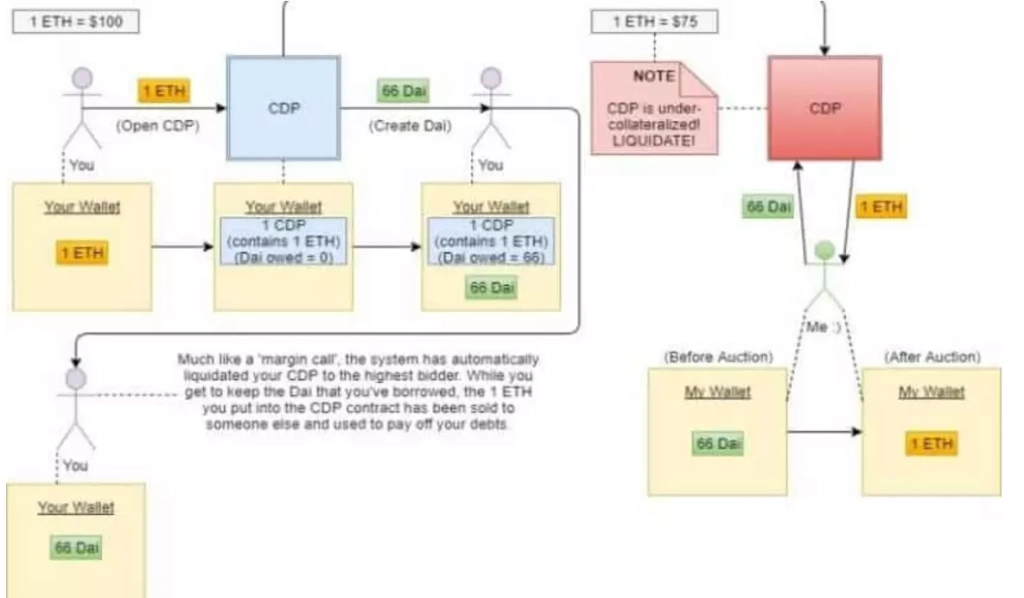

Collateralized debt position, abbreviated as CDP, is a type of smart contract software that runs on a blockchain.

Suppose you want to get a loan from a bank. First, you put up something like your house deed as collateral, and they lend you cash in return.

If the value of your home decreases, the bank will require you to repay the loan. If you fail to repay the loan, your home will be foreclosed.

The mechanism of the maker protocol is exactly based on this. You are an Ether holder and you send your Ether to a CDP on the Ethereum blockchain to run in the Maker ecosystem.

The system allows you to borrow this currency. If the value of your Ether falls below a specified threshold, you either have to repay the smart contract like a bank, or it auctions your Ether to the highest bidder.

It is basically a loan currency taken on Ethereum. In short, this currency is backed by collateralized tokens, specifically ETH. CDPs are where ETH stakes are held in the Maker system.

Once your Ether is in the CDP smart contract, you can create this currency. This process begins with the conversion of the user’s Ether holdings into ERC-20 tokens called WETH.

After that, WETH is sent to Ethereum pool to issue PETH token. PETH is then locked to create a Collateralized Debt Position (CDP) and users receive Dai tokens.

Initially, these steps were performed by the user, but now the process has become simpler. The Maker team has created a separate dapp to generate this currency from ETH holdings. By connecting a wallet to your dapp, you can easily follow these steps and generate dai currency to spend and trade freely.

The value of assets locked in this protocol maker system will always be higher than the total debt value of this existing currency at any given time.

Each token in circulation is backed by additional collateral. This is a measure that helps prevent the system from collapsing due to outstanding debts. The amount of currency you can create is a fixed proportion of the amount of Ether you put into the CDP. The amount of dai it can generate relative to the ETH pledged is called the “collateral ratio”, which can change over time.

Suppose the collateral ratio is 150%. This means that at the current value of Ether, each dai created must be backed by $1.50 worth of Ether collateral.

In the Maker system you don’t lose your Ether, but you can’t control it. The Ether you sent to the CDP will be locked there until you pay back the entire amount.

To liquidate the collateral, the entire debt to DAI plus its interest calculated in MKR must be returned, both of which are subsequently burned.

All CDPs come with a fixed annual interest rate. This interest is only payable for using MKR and goes directly to MKR token holders to maintain the system.

However, escrow for dai allows you to use your assets while still being able to profit if they increase in value.

How to set the value of Dai digital currency

In fact, this currency uses economic incentives to maintain the link with the US dollar. The further the price of a dai moves away from $1, the more incentive there is to create or burn a dai.

Users can always earn when the value is not exactly equal to one dollar. The more this currency deviates from the average, the more incentives are created.

- If the value is more than $1: The creation method is that each DAI created costs only $1, which means you can create DAI for $1 and immediately sell it on a digital currency exchange for more than $1. This type of arbitrage is actually one of the methods that the system uses to keep the DAI price fixed at $1.

- When the price drops below $1: This position acts as a discount on loan repayment for people who have already opened a CDP and can pay off their debt with a DIE of less than $1. This mechanism ensures that the Dai digital currency will be liquidated if necessary to bring its price closer to $1.

How to secure DAI digital currency collateral

When Ether goes up, the support of the system increases and this currency becomes stronger. Maker has mechanisms that encourage users to create more Dai. If the price of DAI is trading above one dollar, there is more demand for Dai than there are people willing to create it.

If price feedback indicates to the CDP that the value of Ether held as collateral has fallen below a certain threshold and is less than the amount of dai it is supposed to back, then the currency will not be worth a dollar and the system may crash.

If you don’t return the DAI you borrowed to the CDP quickly, the system will cash out your collateral. In this case, the CDP will be dissolved and the Ether inside the CDP will be auctioned for Dai.

As long as there is enough DAI to repay what was mined from the CDP, the auction will continue to sell Ether. This ensures that the die always has sufficient collateral.

A “black swan event” involves a situation where the price of the Ether collateral token falls within a short period of time. so that it becomes much lower than the ratio of collateralization of the system.

Maker System has a solution for situations like this. MKR holders act as a last resort. If the collateral in the system is insufficient to cover the amount of DAI available, MKR will be created and sold on the open market to raise additional collateral.

This provides a strong incentive for MKR holders to responsibly set the parameters by which CDPs can generate DAI. Because in case of system failure, their capital will be at risk and not the dai holders.

In fact, oscillation cannot be eliminated, it can only be transmitted. In the Maker system, volatility is fully transferred to the CDP holder. We will only own our collateralized Ether if its price is higher than the liquidation ratio.

To avoid strong black conditions, this collateral is carefully managed by MKR token holders. Exchanges between MKR, DAI and ETH are done using the Oasis Direct system.

Oasis Direct is a decentralized token exchange platform in the MakerDAO ecosystem.

Dai features

Stablecoin Dai has managed to attract a lot of attention due to some of its features. Some of the features of DAI that distinguish it from other stablecoins are:

MCD multi-collateral system

Sai or Single-Collateral was the first stablecoin issued by the Maker platform, which has now been replaced by Dai or Multi-collateral. Unlike Dai, Sai only supports Ethereum as collateral. Currently, to generate Dai based on the new maker protocol, users must deposit assets supported by the maker ecosystem as collateral in their personal Maker Vaults.

Technically, any asset on the Ethereum blockchain can be used as collateral. Maker has plans to support other assets to allow any ERC-20 asset to be used to create a CDP. The community of MKR token holders can vote to add a new collateral asset type (precious metals, commodities, etc.).

Savings Rate (DSR)

The multi-collateral mechanism will have a feature called Dai Savings Rate (DSR), which will create a whole new dimension to balance supply and demand for this currency.

DSR helps balance this protocol system by fine-tuning DAI supply and demand. You are essentially locking up your asset to help the system.

DSR enables holders of this currency to automatically earn Dai currency by locking their Dai in a DSR contract. You can consider DSR as an investment, hodlers are probably the best people to use DSR.

However, it allows all investors to have a steady, predictable income while they wait for better market conditions. The reward rate you receive from DSR is determined by the community of MKR token holders.

You can access the DSR interface through the Oasis Save portal.

Global settlement is the final layer of security

To keep the system as secure as possible and avoid the unpredictable, the Maker team has added a process called global settlement, which ensures that all Dai currency holders and CDP users receive at least the net value of the owed assets.

When the global settlement begins, the entire system will be blocked. CDP generation is stopped and the price is locked at the current value until all order positions are processed. The initial deposit is then returned to all Dai holders.

Collateral held in CDPs will also be available to its owners in the same way. The worst case scenario in a global settlement is that you are exposed to fluctuations in your collateral until you receive your property.

A global settlement can be initiated by a select group of trusted individuals who hold the keys to the global settlement. If these signers see that something is going uncontrollably wrong, they will enter their keys to start the process of quickly breaking down the system.

Of course, the only thing a global settlement team can do is return your deposit. Their access is not to the extent of stealing your Ether or Dai or interacting with the system on your behalf.

Rewarding feature with decentralized leverage

This currency is practically a loan against ETH. You guess the value of ETH will increase. When you lock your ETH in a CDP, you get Dai in return.

If you predict that the value of ETH is going to increase, you can use that currency to buy more ETH on an exchange. In the continuation of this cycle, increase your CDP volume again and so on.

By doing this, we are essentially buying Ether without the need for a centralized exchange with secure margins. This brings us to an interesting conclusion: fully decentralized leverage.

Now when you trade on a decentralized exchange that is compatible with Maker, you can leverage the price of Ether by 2x, 3x or more than your real value.

How to create a dai on the Oasis platform

It is possible to easily generate a die at oasis.app/borrow. To connect to Oasis, you must first connect your wallet to it. Oasis supports Metamask and Coinbase Wallet and Wallet Connect, wallets as well as two popular hardware wallets Ledger and Trezor.

Next, you need to choose a type of collateral. If you have the desired asset and cryptocurrency in your wallet, you can continue. Specify the amount of collateral you intend to deposit as well as the amount of Dai you wish to generate.

To open your wallet and generate DAI, you must follow the instructions to pay some transactions. Your new DAI will then be sent to your wallet within minutes. Remember that you cannot withdraw your deposit until you return the received die.

The best Dai wallets

DAI are tokens on the Ethereum blockchain, and ERC-20 compatible wallets such as Metamask, MyEtherWallet, Atomic, Exodus, Jaxx, and Mist can be used as wallets for Dai money.

For an extra layer of security, you can also use Ledger or Trezor hardware wallets. Anyone from anywhere in the world can receive and send it just by having an Ethereum wallet.

Prediction of the future of Dai digital currency

MakerDAO, or the Maker Platform, is one of the most influential projects in the DeFi space and was at the top until Compound took their place. Maker may have lost its spot as the number one DeFi app, but it’s still one of the main platforms in the space.

Since the release of Dai in December 2017, the market cap has been steadily increasing. Given that Dai is a stablecoin, this growth in market cap is a strong sign of adoption.

This currency can be pegged to the price of any other fiat currency or asset for that matter. The Maker team plans to eventually connect DAI to Digix. Digix is a token backed by physical gold.

In the future, other stablecoins could be created that would be pegged to other major currencies, commodities, or even stocks. That is why it can be said that the future of digital currency is bright and it can be a good option for investment.