It is true that Bitcoin and cryptocurrencies revolutionized the financial industry by introducing peer-to-peer and decentralized payments. But the extreme and constant price fluctuation was a big weakness in digital currencies, and a digital currency that has a fixed value became one of the essential needs of this field.

Stablecoins are originally designed to reduce price volatility and are used to store value and other things that volatile cryptocurrencies like Bitcoin lack.

In the past, Bitcoin and altcoins were traded against each other, and because they were highly volatile, traders faced significant gains or losses and lacked sufficient security.

In this article, we will try to have a comprehensive introduction of stable cryptocurrencies and we will discuss the issues of what is a stable coin? What are the reasons for price stability? What are the uses of stable digital currencies? Are these currencies supported? And what methods do they use to keep the price constant?

Let’s dive in and explore together:

- What is a stablecoin?

- But what is stable digital currency or stablecoin?

- Applications of stable currencies

- Different types of stable coins

- Commodity backed stablecoin

- Stablecoin backed by digital currency

- Algorithmic stablecoin

- How do stablecoins work?

- Advantages of stablecoins

- Disadvantages of stable digital currencies

- The growth of stablecoins

- Frequently asked questions about stablecoins

What is a stablecoin?

Bitcoin has a lot of fans in the cryptocurrency industry, but there are some applications that BTC cannot fulfill.

For example, you might rarely see someone buy coffee with Bitcoin. Of course, the conditions may change with the development and expansion of the Lightning network. But for the following reasons, Bitcoin is not suitable as a payment method for small and numerous purchases:

- Bitcoin transaction fees may range from a few cents to $50 (during peak network activity such as the 2021 bull market). $50 fee for buying $1 coffee?! Definitely not logical.

- Bitcoin transactions may take up to 1 hour to complete. Suppose when you buy a coffee with Bitcoin, you have to wait 1 hour to make sure that the transaction is successful.

- Bitcoin is a volatile digital currency and many sellers and merchants may not accept it. If 100 people buy their coffee with bitcoins, a 10% fluctuation reduces the seller’s profit. Also, business owners can’t accurately budget for fluctuating and volatile assets, and can’t determine how much Bitcoin to set aside for salaries, wages, bills, etc., for example. In fact, a currency should act as a store of value and medium of exchange and its value should remain stable in the long term. People refuse to accept currencies that they are not sure of their future purchasing power.

- Ultimately, most Bitcoin fans believe that this digital currency is a “legendary asset” and the most important and valuable thing invented by this generation. Many people use Bitcoin as an investment and a hedge against inflation, believing that Bitcoin is more valuable than using it for day-to-day purchases.

This is one of the fields and applications where stablecoins can be substituted for Bitcoin. Providing liquidity needed for transactions, protecting digital asset investors from volatility, providing a convenient way to store and preserve the value of sold digital assets, and providing a digital purchase method are some of the benefits and uses of stable digital currencies.

Currently, we are witnessing a massive increase in the adoption of stablecoins in e-commerce sites, online businesses, and countries whose currency has been devalued due to inflation, and people are turning to stablecoins to maintain their purchasing power.

But what is stable digital currency or stablecoin?

Stablecoins are digital currencies that are multiplied or issued (Mint) on the blockchain platform, and their price is usually dependent on a physical asset such as fiat currency or gold, which is called price dependence or peg.

Having a price dependency or backing of a physical asset keeps the price of the stablecoin stable. As with other digital currencies, users can buy, sell, trade stablecoins with other currencies, or store them in their digital currency wallets.

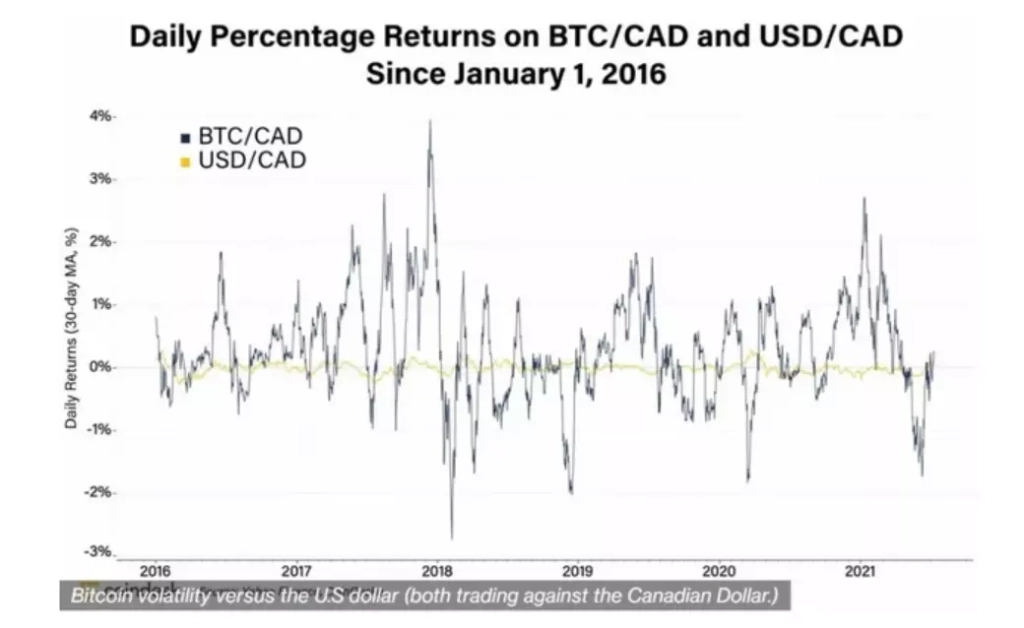

Look at the interesting chart below. This chart compares the daily percentage returns of Bitcoin / Canadian Dollar and US Dollar / Canadian Dollar and shows how much Bitcoin has fluctuated against traditional currencies from 2016 to 2021.

USDC and USDT (Tether) are two of the most popular stablecoins that have a 1-to-1 price dependency or parity with the US dollar and are backed by cash, cash equivalents, commercial paper, bonds, loans and other types of collateral.

In general, the various collaterals used for stablecoins are:

- Fiat currency. The most common type of collateral for stablecoins. The US dollar is the most used type of collateral, but the national currency of other countries is also sometimes used.

- Precious metals. Some digital currencies are dependent on the price of metals such as gold or silver.

- Digital currencies. A number of stablecoins use other digital currencies such as Ethereum as collateral. The collateral of these types of stablecoins is usually more than required (over collateralized) to remain stable against price fluctuations.

- Other types of investment. Companies developing stablecoins often use a combination of different collateral such as commercial paper, bonds, loans and other approved investments.

Applications of stable currencies

Just like other digital assets, the primary use of Stablecoins is as a store of value and medium of exchange. These currencies temporarily postpone price fluctuations so that traders can access a safe position.

Also, stable tokens can be used to grow the world of decentralized finance (DeFi) such as yield farming, lending and borrowing, and liquidity provision.

These are the two main reasons why people choose stablecoins over other cryptocurrencies like Bitcoin. Investors can be sure that they can sell their tokens for $1.

Coin prices react to emotions. That is, if traders and investors believe that each of their stablecoins is worth $1, the price will react to it and remain around $1.

Stablecoins are a safe haven for worried investors. Many exchanges, such as Binance, allow traders to buy with fiat currency, but not trade with them.

This is a bit of a challenge for traders who have fiat currency. This is exactly where stablecoins come in, and because they are cryptocurrencies, they are available on almost every exchange.

In the following, we will introduce the types of stable tokens and their different supports.

Different types of stable coins

There are different types of stablecoins. As we said, various collaterals are used to prevent their prices from fluctuating, but there are also other types of stablecoins that have no backing and their value is kept constant algorithmically.

In this section, we are going to examine the different types of stablecoins and introduce examples of each category.

A fiat-backed stablecoin

Fiat currency is one of the most common methods of backing and has been used in many stable cryptocurrencies. The US dollar has been used as a backing in stablecoins more than any other fiat currency.

Keep in mind that the central banks of different countries are looking to create a digital equivalent of your values, which we call Central Bank Digital Currency or CBDC.

CBDC has similarities and differences with stablecoins, which is beyond the scope of this article.

In the following, we will introduce some stable coins with the support of fiat currencies:

Backed by the US dollar

- Tether (USDT)

- BUSD

- TrueUSD

- Gemini Dollar (GUSD)

- USDCoin

- Pax Dollar

Support for the British pound

- Binance Pound (BGBP)

Euro support

- EUR

- EURt

Turkish lira support

- BiLira

Introducing Tether (USDT)

Tether is the most popular stablecoin in the market and has the largest market cap, even Dominance Tether is used to analyze the digital currency market.

There has always been skepticism about the reserves of Tether Ltd, the issuer of Tether, as the backing of USDT. However, as of this writing, this stablecoin has continued to function without issue.

If one day the lack of support for Tether is proven, it will definitely cause a big crisis in the crypto space and may lead to the destruction of digital currencies.

The chart above shows that the Tether stablecoin completely dominated the market during 2022, and as new stablecoins emerged, Tether’s market share decreased.

Also, there were various rumors and news that Tether did not have enough reserves to support USDT, which caused some people to convert their capital to USDC.

Introducing USDCoin

USDCoin is another popular stablecoin. USDC is the official stablecoin of the Coinbase exchange, which was created with the aim of being more regulated and transparent than Tether.

This stable token has an economic license and official authorization to operate. The company and the bank accounts that hold USDCoin currency reserves have been subjected to legal audits so that customers can be sure that their assets are in a safe place.

Like Tether, USDC is backed by US dollars and is on the Ethereum blockchain.

Introducing TrueUSD

TrueUSD is another stable dollar-backed currency. This stablecoin is not as accepted as the previous two, but it has a lot of potential.

TUSD is more transparent than other stablecoins and has fully met the regulatory requirements. To buy this cryptocurrency, users must go through the authentication process or KYC completely.

Commodity backed stablecoin

These types of stable digital currencies are pegged to the value of commodities such as precious metals, industrial metals, crude oil, and even real estate.

The use of this type of stable coins allows investors to trade and invest in goods easily without the need for resources and storage of goods. Investing in a cryptocurrency that is tied to oil is definitely better than buying barrels of crude oil and keeping them at home.

Many investors believe that one day it will be possible to store and invest in any type of asset on the blockchain.

Commodity-backed stablecoins have various features such as:

- Their value is fixed in relation to one or more goods and can be redeemed according to demand.

- It is possible to pay by different individuals, companies and even legal financial organizations.

- The amount of the commodity that is considered as the support of these stablecoins affects the amount of its supply. That is, tokens are produced in proportion to the available amount of the product in question.

Holders of commodity-backed stablecoins can redeem their tokens according to the conversion rate to receive real assets. The cost of keeping these types of stable currencies is the same as the cost of storing and protecting the desired item.

Digix Gold tokens are an example of a gold-backed stablecoin.

CACHE Gold with symbol CGT is also one of the most popular gold-backed stablecoins. Each CGT token is backed by 1 gram of pure gold stored in various locations around the world.

Sending each CGT token is equivalent to sending 1 gram of pure gold that can be redeemed for real gold anywhere in the world.

Tether Gold (XAUt) and Pax Gold (PAXG) also work in the same way. But instead of 1 gram of gold, they are backed by 1 ounce of gold.

There are other assets like Tiberius that are backed by a mix of precious metals or SwissRealCoin. SwissRealCoin itself is a stable digital currency that is tied to the value of a portfolio of Swiss real estate stocks.

Stablecoin backed by digital currency

The support of these stable currencies are other digital currencies. Since cryptocurrency reserves can be highly volatile, such stablecoins have more than necessary collateral. This means that a larger amount of cryptocurrency is pledged to produce a smaller amount of stablecoin.

For example, 2000 dollars of ether is used to produce 1000 dollars of stablecoin which is backed by ethereum. This will cause the ether fluctuations to be halved. DAI is the most popular crypto-backed stable token, referred to as a decentralized stable coin.

Introduction of Dai (DAI)

Dai is a stablecoin that is completely different from other stable cryptocurrencies that are backed by fiat currencies. Each die is equal to 1 dollar. But the way it keeps its price is unique. Instead of exchanging DAI tokens for USD, this stablecoin is backed by Ethereum and is an ERC20 token.

Dai uses a complex system that runs automatically and with smart contracts. Besides DAI, there is another token called MKR, which is used to ensure the stability of DAI’s $1 price. If the price of Die moves away from $1, tokens are bought or sold to stabilize the price back to $1.

Algorithmic stablecoin

Algorithmic stablecoins have no backing and their supply is regulated by an algorithm based on market demand. Based on the changes in the current demand for stablecoins, the algorithm burns stablecoins or issues new coins.

Amplefort (AMPL) is one of the algorithmic stablecoins and instead of using a physical support to keep the price at $1, it uses a process called Rebase. Rebase automatically adjusts supply according to supply and demand.

It is interesting to know that recently a new type of stable digital currency called Hybrid Stablecoins or Fractional Algorithmic Stablecoins has been introduced.

In these cryptocurrencies, fiat currency, digital currency and algorithm may be used simultaneously to keep the price stable. Frax is an example of hybrid stablecoins.

How do stablecoins work?

Usually, the entity or company behind a stablecoin creates a reserve and stores an asset or a basket of assets that is the backing of the stablecoin.

Companies issuing stablecoins such as Tether, Circle, and Paxos are regularly reviewed to ensure they have enough assets in their reserves to maintain the value of their stablecoins.

These revisions ensure that stablecoins are pegged to real assets. The money in the reserves acts as collateral for stable digital currencies.

As a result, when stablecoin holders cash out their tokens, the amount of coins cashed out is taken from the asset in the reserve to maintain a 1 to 1 stablecoin parity rate.

The price peg or dependence does not always remain constant and balanced. The price of stablecoins also fluctuates around 1 or 2%, which is insignificant compared to the fluctuations of other digital currencies.

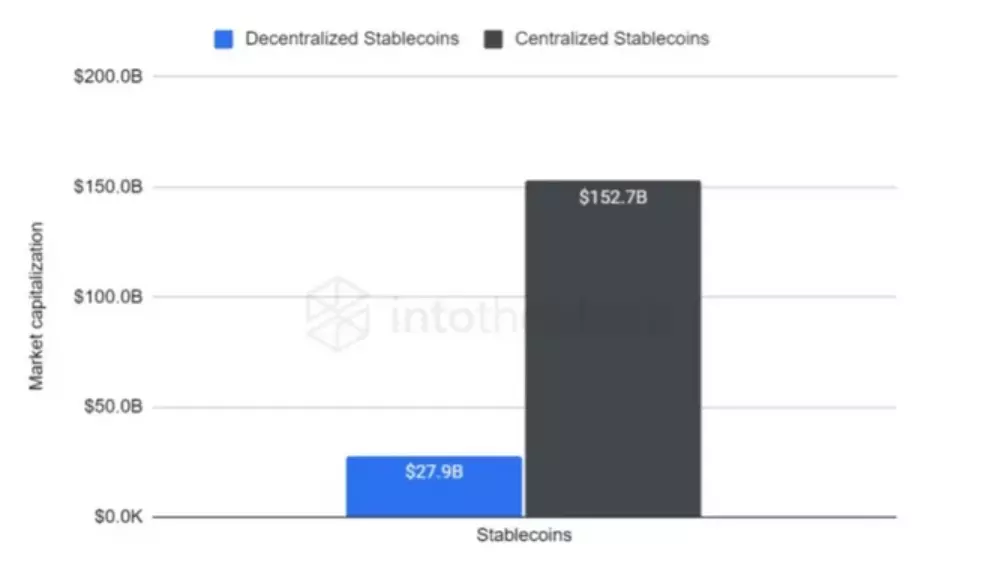

It is interesting to know that a large share of the stable digital currency market is held by centralized stablecoins and decentralized stablecoins have a smaller share.

MakerDao has introduced one of the best stable decentralized digital currencies. Dao Maker is run by an independent decentralized organization or Dao and lends its Dai stablecoins to users.

This ensures that its reserve assets are always over-collateralized. As we said before, being overcollateralization means that the assets in the reserves are more than the total value of the supply of Dai. Maker has digital currencies such as Ethereum and USDC in its reserves.

Users of the Maker cryptocurrency platform lock their collateral into a smart contract, and once the collateral is locked into the contract, the user can borrow new Dai tokens from the platform.

Algorithmic stablecoins have no collateral. Instead, some coins are burned or new coins are issued to keep the price stable.

The way stablecoin works is an algorithm that if its price drops from $1 to $0.75, the algorithm will automatically destroy some coins to make the stablecoin more scarce and the price will return to $1. If the price goes above $1, the algorithm issues new tokens, increasing the supply and lowering the price.

It may seem that stablecoin is a completely stable algorithm and the control of supply and demand by the algorithm is an interesting idea.

But the evidence shows that this type of protocol can hardly maintain its efficiency.

In the past, we have seen many times that algorithmic stablecoins have failed and billions of dollars of user capital have been destroyed.

The collapse of UST cryptocurrency with the stability of the Terra network was the most visible example of these failures, which led to the loss of life capital of many people.

Luna’s historic downfall will go down as one of the worst and darkest days in cryptocurrency history. About $60 billion in capital was lost in the crash, prompting regulatory action, panic among investors and regulators around the world.

Due to the failure of this project, many people believe that algorithmic stablecoins have no chance of success. Of course, time will tell everything.

Note that stablecoins may fail due to market fluctuations or update and maintenance costs or during legislation. One of these stablecoins is NuBits, the reason for its failure was the inability to maintain price stability.

Another one of these projects was Basis, which was closed in December 2018 in violation of US laws despite raising $100 million.

Most of the stablecoins introduced since 2017 are still in the launch phase. Also, two-thirds of these failed projects were backed by gold. Because these projects had to prove that the gold backing their stablecoin is stored somewhere and kept safe.

Advantages of stablecoins

Stablecoins help grow the global economy and develop the digital age of our world. Stable coins are a suitable solution for some important problems in the field of transactions and money exchange:

- Users do not need international banks and accounts to send money to other countries. All they need is a digital currency wallet, and with that they can send funds instantly. In a slow, costly and constrained financial system, this is a significant improvement.

- Stablecoins provide the possibility of transferring money digitally and peer-to-peer without the need for intermediaries and third parties.

- Stable cryptocurrencies reduce money transfer fees and time and eliminate much of the red tape involved in international exchanges.

- The use of most stablecoins does not require authentication, which preserves privacy and anonymity. Of course, you need to know that blockchain transactions are traceable and centralized stablecoin transactions can be stopped and controlled. Despite this, stablecoins still have more privacy than the banking system.

The main goal of stable digital currencies is to provide the benefit and utility of blockchain-based digital assets in a currency that is not affected by price fluctuations.

Disadvantages of stable digital currencies

Stable digital currencies are not perfect and have disadvantages that you should be aware of. If the company issuing the stablecoin keeps its reserves in a bank or with a third party, there will be counterparty risk.

If the bank goes bankrupt or there is a security problem, people’s capital is at risk. Of course, this is not specific to stablecoins. Any time you trust and entrust your assets to a trusted entity, there is third-party risk.

Regulatory risk is another problem of stable digital currencies. Governments and regulators around the world are closely monitoring stablecoins. Because stablecoins disrupt the traditional financial system and considering the transfer of billions of dollars of capital from the traditional banking system to stablecoins, these currencies are considered a serious threat to this system.

It is not yet clear what approach regulators will take to stablecoins, but they are certainly reluctant to lose control of the financial system, and governments’ plans to introduce central bank digital currency (CBDC) may have a significant impact on the future of stablecoins.

On the other hand, American lawmakers are more dangerous. Because the global acceptance of stablecoins dependent on the US dollar makes the world more dependent on the dollar.

This is good for the US dollar, but the world is adopting a version of the dollar that is not under government control, which worries regulators.

Lawmakers have a tough road ahead of them to strike a balance between the world’s dependence on the US dollar and control of the financial system.

One of the main features of digital currencies is review and verification instead of trusting intermediaries. Thanks to blockchain technology, all features and aspects of transactions and token issuance details are completely transparent and anyone can view and review it.

This means that digital currency users do not need to trust other people or entities and rely only on codes, algorithms and blockchain. Users have to trust the issuing company to use centralized stablecoins, and this causes concern.

A custodian and controller is usually needed to monitor stablecoins and manage fiat reserves. This means that users should trust the stablecoin issuing company in their deposits and withdrawals.

Most stablecoins are centralized and require trust in a third-party company. Custodian companies can block or control the transactions of these stablecoins. These features of a centralized stablecoin are at odds with the basic nature of digital currencies, and for this reason users are strongly demanding the release of a successful algorithmic stablecoin.

Finally, algorithmic stablecoins also have problems. When a large amount of liquidity is rapidly removed from the stablecoin market, price dependence is lost and the price is likely to fall.

This causes investors to panic and sell their stablecoins. As a result, the price of stablecoin will decrease further and eventually lead to its price collapse. This process is called the “cycle of death”, which is what happened to the Luna token.

People who had invested in Terra lost their capital and had nothing to do but watch the price fall. Until a more efficient and successful model of algorithmic stablecoins is introduced, one should be cautious about these stablecoins.

The growth of stablecoins

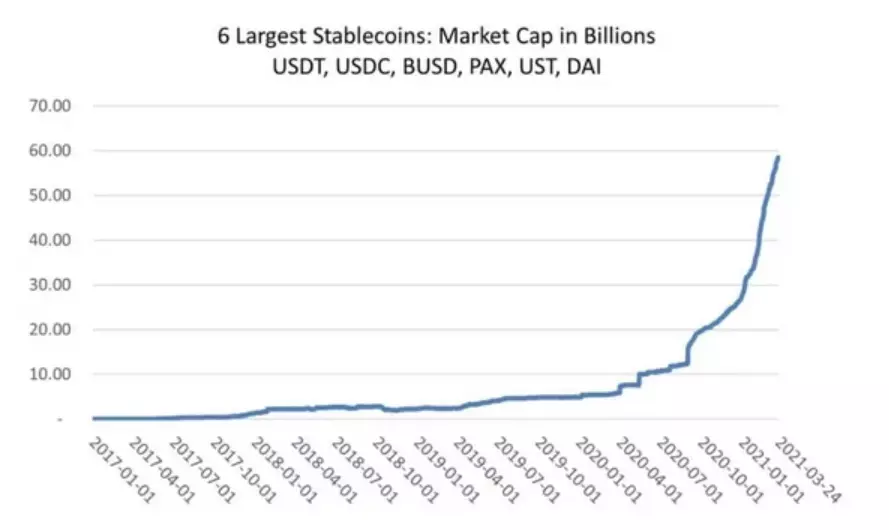

A large part of the liquidity of the digital currency market is provided by stablecoins. In 2020, stablecoins grew dramatically. According to data from the platform CoinMetrics, the market capitalization of popular stablecoins grew astronomically.

In the first quarter of 2020, the USDC market capitalization grew by about 700%, and the overall market value of the 6 popular stablecoins increased by billions of dollars.

The CEO of Circle, the USDC issuer, said that a large part of the demand for this stablecoin has not come from cryptocurrency traders, but from regular businesses. Because companies quickly realized the benefits of stablecoins. Stable digital currencies have been widely adopted by online and electronic businesses.

The deeper we go into the bear market, the more dominant the market value of stablecoins will be. Because in a bear market, many people suffer losses, and in this situation, investors are looking for a stable asset.

As you can see in the chart above, in September 2022, the dominance of stablecoins is almost equal to that of Ethereum.

Frequently asked questions about stablecoins

What is a stablecoin?

As the name suggests, stablecoins are designed to stabilize the value of money in the volatile digital currency market.

Stablecoins have different types, such as stablecoins backed by fiat currencies, stablecoins backed by gold or other precious metals, stablecoins backed by other cryptocurrencies and algorithmic stablecoins (unbacked).

Is it possible to make money with stablecoins?

Investing in a stablecoin is like investing in a fiat currency like the dollar or a commodity like gold. If the value of these assets increases, you can earn profit. Also, on various DeFi platforms, you can earn by locking stable cryptocurrencies.

What is a decentralized stablecoin?

Most of the big stablecoins such as Tether or USDC are issued by a central institution after creating the necessary support, therefore they are centralized and even its trustees can block the assets of some users.

There are other stablecoins that are algorithmic and have no backing or are backed by digital currencies and issued by smart contracts.

We call this category of stablecoins decentralized and no intermediary entity has control over them. Dai is the largest stable decentralized digital currency.

Do stablecoins have a special wallet?

The wallet of stablecoins is different depending on the blockchain network on which they are mounted. For example, ERC20 volts can be used to store Tether, Dai, and currencies based on the Ethereum blockchain. Wallets like Metamask, MyEtherWallet and Ledger are among the best and most popular wallets for these tokens.

What is Binance Stablecoin?

BUSD is the stable token of the Binance exchange, which is backed by the dollar. This currency is available as ERC20, BEP2 and BEP20. Currently, BUSD is the third leading stablecoin with a market capitalization of about 22 billion dollars.

What are the famous stablecoins?

At the time of writing, Tether is the most popular and largest stablecoin, followed by USDC and BUSD. Dai is also the largest decentralized stablecoin, ranking fourth among stablecoins in terms of market size.

Stable digital currencies are an important part of the cryptocurrency ecosystem and without them the world of digital currency would never have reached its current position.

Stablecoins are a bridge between the traditional financial system and the decentralized financial system (DeFi), and their existence is necessary to provide liquidity and expand the global adoption of digital currencies.

In the first half of 2020, the supply of stablecoins grew by 94%, and in June of this year, their transaction volume reached 11 billion dollars. Of course, the legislators were also ready. In September 2020, the OCC allowed national banks and the Federal Reserve to review the reserves of stablecoin producers.

The main problem with stablecoins is their over-centralization, and this feature is slightly at odds with the decentralized nature of digital currencies.

Are stablecoins the future of digital currencies? Or Will CBDCs Displace Stablecoins? Only time will tell.

Many cryptocurrency users believe that one day the spell of inefficiency of decentralized algorithmic stablecoins will be broken and a strong and reliable decentralized stablecoin will be introduced once and for all.

In this article, we have answered the question of what stablecoin is and how it works in detail. What do you think about stablecoins and their future? Share your opinion with us.