One of the most important terms that beginners in the forex market and other financial markets should learn is the orders of that market.

You should make sure that you are familiar with the different types of orders in the forex market.

Failure to follow these instructions may cause irreparable damage to you.

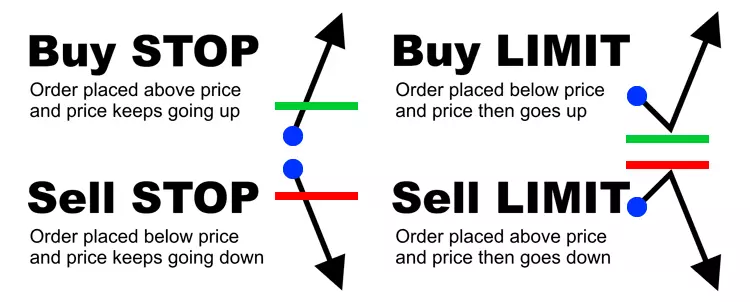

The most important market orders are Sell Stop, Buy Stop, Sell Limit and Buy Limit.

In addition, you must also master stop loss and take profit.

Do not worry. At the end of this article you will learn these commands plus:

- Forex market orders: direct buy or sell orders

- Limit Orders – buy limit and sell limit

- Stop Orders – buy stop and sell stop

- Stop Loss Order – Death or Life?

- Trailing stop loss

Forex market orders: direct buy or sell orders

If you want to buy or sell something directly and you think the current price is a good price, you don’t have to do anything complicated!

Just choose the volume you want and click on the buy or sell button!

Your trading software will immediately execute a buy order at that price.

Limit Orders – buy limit and sell limit

Limit orders are orders placed to buy below the current market price or sell above the current market price at a specific price.

For example, the EURUSD (EURUSD) currency pair is currently trading at 1.2050.

You want to sell the pair if the price ever reaches 1.2070.

You can sit in front of your monitor and wait for the price to reach 1.2070 and then click sell order at that point.

Or you can set a Sell Limit order at 1.2070.

Then you can get away from your computer and attend a calligraphy class!

If the price rises to 1.2070, the trading software will automatically execute the sell order at your target price.

You should use this type of order when you think that the trend will reverse when the price reaches the figure set by you!

The buy limit order is exactly the same, with the difference that you specify a price lower than the current price, and whenever the price reaches that price, a purchase deal will automatically be opened for you! This is also specific to where you believe based on your analysis that the price will bounce back if it reaches this area.

Stop Orders – buy stop and sell stop

Stop orders are placed at a certain price to buy above the current market price or sell below the current market price.

For example, the GBPUSD pair is currently trading at 1.5050 and is trending higher. You believe that if the price reaches 1.5060 it will rise again. Do one of the following: sit in front of the computer and buy the market when the price reaches 1.5060 or set an entry stop at 1.5060.

You should use the Buy Stop order when you feel that the price will continue in the direction it is moving.

Carefully in the image below, you can accurately understand the difference between buy-stop and sell-stop, buy-limit and sell-limit.

Stop Loss Order – Death or Life?

The fact is that a stop loss or limit loss order can be your savior! If you are faithful to it.

If you turn your back on it, it will kill you.

A stop loss order is a type of order to prevent additional losses when the price moves against you.

For example, you buy EURUSD (EURUSD) at 1.2230.

To limit the maximum loss, you set a stop loss order at 1.2200.

This means that if you misdiagnose and the currency pair (EURUSD) drops to 1.2200, the software will automatically sell your trade at 1.2200.

It means that the best available price is executed and your position is closed with a loss of 30 pips. (Life has ups and downs!).

Remember this type of order and never leave a trade without a stop loss.

Stop loss is very useful.

If you don’t want to sit in front of the monitor all day and worry about losing all your money, you can simply set a stop loss order for each trade so you can get on with other things.

Trailing stop loss

Let’s say you decide to sell USDJPY at 90.80 and set a 20 pip trailing stop loss. This means that initially, your stop loss is at 91.00.

If you have activated a trailing stop, when the price goes down to 90.50, your stop loss will move to 90.70.

Just remember that your stop will remain at this price. If the price moves against you, your stop will not change.

For example, with a 20 pip trailing stop loss, if USDJPY reaches 90.50, your stop will move to 90.70. However, if the price suddenly moves to 90.60, your stop will remain at 90.70. Your trade will remain open until the price moves 20 pips against you. When the price reaches the stop loss, your position will be closed.