Exchange Traded Funds are one of the investment tools in the financial markets. Something that has attracted the attention of users of the cryptocurrency market and even ordinary people is digital currency tradable funds.

Because with the help of these funds, you can benefit from the benefits of buying digital currency in the world of cryptocurrencies without paying high fees and with less risk.

Considering that many people are looking to learn about the mechanism of these funds, we decided to answer the question of what an ETF fund is in this article, talk about digital currency tradable funds and take a look at the list of ETF funds.

Let’s dive in and discover together:

- What is a tradable fund?

- What is the history of ETF?

- How does an ETF work?

- What are the different types of ETF digital currency funds?

- What are the benefits of an ETF?

- What are the disadvantages of ETF funds?

- Bitcoin tradable fund

- How to buy and sell ETFs

- Are ETFs safe?

- The future of exchange-traded funds

What is a tradable fund?

Exchangeable funds or EFT in simple words are a type of cryptocurrency investment fund that are traded like stocks in the stock market through the trading panel of brokers.

ETFs are like portfolios made up of different financial assets that investors can adjust their risk of loss by buying units. The price of a fund is determined by supply and demand throughout the trading day, and their net asset value changes at regular intervals.

What is the history of ETF?

ETFs are one of the most popular ways to generate income in the world. If we look at the history, we will notice that the initial idea of collecting money goes back to the Europeans. Because they were the ones who started saving in the mid-1800s and managed to create the first fund in 1924.

In 1893, the first mutual investment portfolio was created unofficially in America by one of the employees of Harvard University. The creator’s goal was to invest in profitable projects. But the first fund named Massachusetts Investors Trust was officially registered on March 21, 1924.

How does an ETF work?

The financial resources of tradable funds are provided through the collection of small and large funds of individuals. The accumulated capital is used to buy different types of stocks, which is called a portfolio.

The proportion of ETF portfolio assets is different and their amount is determined according to certain rules. The price of a portfolio will change with the fluctuation of the buying and selling prices of the fund’s assets in the market.

ETFs allow investors to spread their capital among different assets without having to actually buy them.

The mechanism of ETFs is very transparent and usually they have created a website to inform their financial statements and performance history, which investors can refer to and get the information they need.

What are the different types of ETF digital currency funds?

In the general case of ETFs, digital currency can be divided into the following two categories:

- Physically or spot-backed: The assets of these portfolios are real digital currencies. Stock prices based on spot trading mimic the price movements of cryptocurrencies.

If the price of digital currency increases, the price of investors’ shares will also increase, and if the price of digital currency takes a downward trend, the price of shares will also decrease.

In this method, the investor has no role in keeping digital currencies and can profit without the cost and risk of owning them.

- Backed by Futures: This type of ETF portfolio is not directly backed by digital currencies, Rather, it uses digital currency derivatives such as futures contracts.

The price of stocks, rather than the price of digital currencies, follows the price movement of their derivatives. As the price of future contracts increases or decreases, the stock price also increases or decreases.

What are the benefits of an ETF?

Professional traders allocate part of their assets to these portfolios because of the advantages of ETFs. But what are the most important features of ETF?

Ease of investment

Buying, selling and holding digital currencies directly requires having sufficient knowledge about the performance of cryptocurrencies, how to trade, familiarity with trading strategies to save profits, which may be a bit difficult for traditional financial market investors.

This is one of the most important obstacles to the large-scale adoption of cryptocurrencies as an asset to store value. But in ETFs, investors do not buy and hold the underlying asset.

Professional asset management

Analyzing the state of the digital currency market and choosing the best time to enter and exit a transaction is a time-consuming task for beginner users.

In addition, due to not having enough knowledge and experience in this field, they may risk their capital. Meanwhile, ETFs are managed by experts and use the maximum market capacity to earn profits.

Increase investment returns

One of the most important advantages of these baskets is having a suitable yield. The average yield is always positive and according to the reports, it has exceeded 150% in some periods of time.

That is why buying these baskets is recommended for people who want to protect the value of their property against inflation prevailing in the society.

Reducing investment risk

Since ETF portfolios invest in different assets, the risk of loss is significantly reduced. Suppose that the price of one of the digital currencies falls sharply, because there are other currencies in the capital portfolio, relying on their profit can compensate the incurred loss.

Less fees

ETF fees are lower compared to fees of traditionally managed funds.

The possibility of investing with little money

You don’t need to have a lot of capital to use the advantages of ETFs, because the aggregation of small capitals provides the possibility of obtaining large profits. This feature has made it a suitable income generation method for people who are looking to invest with little money.

What are the disadvantages of ETF funds?

Every investment method, along with its advantages, undoubtedly comes with some disadvantages. The disadvantages of ETF baskets can be ignored compared to its many advantages, and it can be said that it is only for expert and professional traders.

There are three problems with these baskets:

Less mastery of the investor on asset management

Although the diversity of ETFs is large and each one has different strategies, but the lack of mastery over asset portfolio management is not very pleasant for some traders.

It is possible for professional investors to make more profit through direct trading. Therefore, they prefer to play a role in asset or strategy selection.

Time limit for trading

Unlike the digital currency market where users can trade at any hour of the day, these baskets can only be bought and sold during market trading hours.

Authentication required

To purchase, the user must complete the authentication process. This can be a serious challenge for people who want to buy and sell Bitcoin anonymously.

Bitcoin tradable fund

Earning money from digital currencies has attracted the attention of many digital currency investment companies and people in the last few years.

Meanwhile, Bitcoin is more popular than other digital currencies. Because many people have made significant profits from buying and selling it. But the increase in the price of this currency has made it impossible for everyone to buy it.

Of course, this is not the only challenge for people looking to profit from the king of digital currencies. Because buying Bitcoin and keeping it in a digital currency wallet requires having enough information about cryptocurrency.

For this reason, bitcoin etf has become very popular by reducing the investment risk and the risks of keeping this cryptocurrency. Some important points regarding the Bitcoin ETF fund are as follows:

- Bitcoin transactions are done only during open stock market business hours.

- The price of each share changes as the price of Bitcoin fluctuates.

- All individuals and legal entities can trade ETF Bitcoin shares on the stock exchange instead of the digital currency exchange.

- Bitcoin ETFs can include other digital currencies such as Ethereum.

- The only condition for investing in these baskets is to create a brokerage account.

- Users can make their transactions through special mobile trading applications.

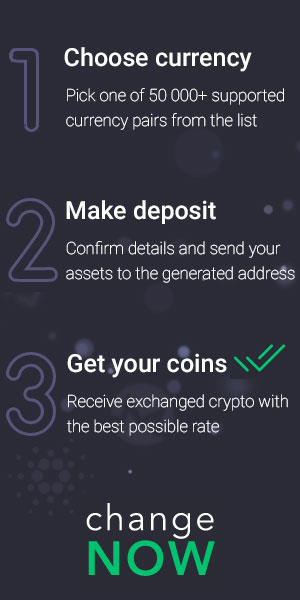

How to buy and sell ETFs

How to buy and sell shares of an ETF is very easy and most people can easily do it. It is enough to register in a brokerage to be given a stock exchange code.

A stock code is a unique identifier that is required to trade stocks or other securities. Then you can register your order in the brokerage panel after checking the list of ETF funds and choosing it.

Are ETFs safe?

One of the challenges related to ETF is its security. Since these baskets are formed by brokerage companies or financial institutions approved by the stock exchange organization, they have sufficient security and no problems have been reported in this field until today.

Also, all ETFs have an official website to inform you about how they work, how to buy and sell digital currencies, founder information and all licenses that you can read before making any purchase.

The future of exchange-traded funds

The digital currency market is growing rapidly, and this has caused venture capital funds and other investors to take a special look at this area.

The adoption of cryptocurrency ETFs as a profit-making option is an effective lever for channeling capital from Wall Street into the crypto market.

Following this, cryptocurrencies become a legitimate asset class that experiences unprecedented price growth.

What do you think about ETFs? Are the prospects of these funds clear?