In recent years, cryptocurrency and investment methods in digital currency have been one of the most important topics in the world. Today, most people interested in technology and risk takers have turned to investing in digital currency.

Although some people believe that digital currencies will never become big enough to form a full-fledged economy, but in the real world, what we see with the growth of digital currencies is contrary to this theory.

In the following, we will teach capital management in digital currency and get acquainted with all its dimensions including:

- What is capital management?

- Why is investing in the digital currency world important?

- With which currencies should we enter the crypto world?

- Investment process and capital management in digital currency

- Digital currency trading

- Mining digital currencies

- Capital management strategies in digital currency

- Important points in investing in digital currencies

- The key to managing your capital is in your own hands

What is capital management?

Capital management in financial markets refers to the process of effective management and allocation of financial resources in the framework of investment activities.

It involves making informed decisions about how to allocate and deploy available funds in order to achieve optimal returns while managing risk.

Financial resources management in financial markets includes various activities such as portfolio management and diversification, risk assessment and reduction, and investment strategy formulation.

The purpose of these activities is to maximize the return on invested assets while minimizing potential losses or negative effects of fluctuations in financial markets.

The key components of capital management in digital currency are:

- Portfolio Management: This involves selecting and allocating various cryptocurrencies such as Bitcoin, DeFi currencies, security tokens, tier two projects, etc. in a portfolio. The goal is to create a diversified portfolio that balances risk and reward.

- Assessing and reducing risk: identifying, measuring and managing all types of risks, including market risk and liquidity risk. This includes implementing risk management strategies such as hedging, diversifying the investment portfolio, and applying risk management tools and techniques.

- Allocation of financial resources: Allocation of financial resources between different asset classes based on risk and reward objectives, investment horizon and market conditions.

- Development of investment strategy: development and implementation of investment strategies that are in harmony with the trader’s financial goals and risk tolerance. This may include active or passive investment approaches and long-term or short-term investment strategies.

- Performance Monitoring: Regular monitoring and evaluation of investment portfolio performance. Investors should constantly review their investment portfolio so that they can get out of unprofitable transactions in time and invest their financial resources in a more profitable market.

Why is investing in the digital currency world important?

There are many reasons to understand the importance of investing in digital currencies, some of which are mentioned below:

Simplicity

Investing and trading digital currency is very easy. Maybe without exaggeration, we can say that the possibility of investing has not been so simple until today. To start investing in digital currencies, it is enough to have a smartphone and a digital wallet.

Of course, obtaining information, research and study about investment and capital management in digital currency is a very necessary prerequisite.

Keep in mind that investing without sufficient information, not only in the digital currency market, but also in other markets, will be a waste of time and energy.

Transparency

Everything is transparent in investing in digital currencies. The importance of this issue increases when you know that this level of transparency does not exist in any other financial market such as the stock exchange.

As a cryptocurrency trader, you can see all the transactions done around the world while sitting at your home. To do this, it is enough to visit trading platforms and online exchanges.

Digital currency is the money of the future

The future of cryptocurrency investment is very bright. To manage capital in digital currency, it is enough to observe the growth trend of one currency such as Bitcoin in the last few years. The result is surprising.

Some economic analysts believe that cryptocurrency is the money of the future and as time goes by, more and more people will start using cryptocurrencies.

Perhaps, in the early years of the rise of digital currencies, everything about them seemed a bit dumb, and there were limited sources of information available. But now, with a simple Google search, you can find a huge amount of information on digital currencies.

Today, some organizations and centers have made it possible for their customers to pay in digital currency. Also, many countries such as El Salvador have accepted Bitcoin as official currency.

This acceptance and understanding of digital currency and blockchain are clear signs of the future of digital assets.

With which currencies should we enter the crypto world?

Choosing a promising cryptocurrency is one of the most important factors of capital management in digital currency. One of the most important concerns of people who have decided to enter the digital currency market is what currency should they buy?

Considering that Bitcoin is more popular than other currencies, buying Bitcoin is always the first option. Bitcoin is the first and most popular cryptocurrency.

According to some financial market analysts, it is not far-fetched that Bitcoin will surpass fiat money (such as the dollar). But is Bitcoin the only profitable digital currency to invest in? The answer is no.

According to the statistics of the coinmarketcap.com, which is one of the most important scientific references in the field of digital currency, Bitcoin, Ethereum and Tether are currently at the top of the ranking of digital currencies with the highest market cap.

Bitcoin (BTC)

Bitcoin is a fully digital currency with a payment system and a decentralized network based on blockchain technology. In the blockchain system, users can make any transfer directly without intermediaries.

Although the true identity of the creator of Bitcoin is unknown, everyone knows him as Satoshi Nakamoto.

Some people mistakenly think that it is too late to invest in Bitcoin. But due to the dominance of Bitcoin, experts still believe that entering the Bitcoin market can still be profitable.

With a limited supply strategy and a countdown to the end of mineable coins, we should be looking forward to golden days for the king of digital currencies.

Ethereum (ETH)

The creator of Ethereum, who is one of the pioneers in the adoption of Bitcoin, introduced it to the world with the aim of solving the challenges of Bitcoin.

Ethereum is now much more than a digital currency. With a host of smart contracts, decentralized applications, and dozens of special features, this network has become an attractive platform.

The queen of digital currencies is one of the best investment options ahead of you.

Tether (USDT)

Stablecoin Tether is your savior from the volatile market of digital currency. This currency, which was introduced to the world with the support of the US dollar, now has one of the largest markets.

Tether, which always has a fixed price, is one of the best choices available for those who prefer to stay away from volatility, prefer to invest in digital dollars, trade on platforms, etc.

Investment process and capital management in digital currency

Investing in digital currencies is not a difficult task and does not require a complicated and special process. Anyone can start working in this field with a little training.

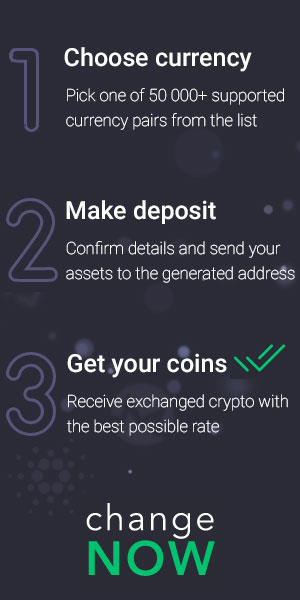

In general, the digital currency investment process includes the following steps:

- Raising money for digital currency investment

- Choosing the right digital currency

- Choosing the desired hardware or software wallet (you can also use the exchange wallet)

- Buy digital currency in a reliable exchange at the right time

- Selling digital currency in a valid exchange at the right time in order to make a profit or remove assets from the market

Two common ways to invest in digital currency and earn money are mining and trading digital currency.

Each of these two methods has its advantages and disadvantages, which we will discuss below:

Digital currency trading

Trading means buying digital currency at a low price and selling it when its price has reached its highest value. A trader is someone who buys and sells digital currency in order to make a profit.

Digital currency trading is similar to buying and selling stocks.

Digital currency transactions are done in online exchanges and traders can buy digital currency through this. Maybe you have also heard that some beginners say that luck was not with us after the failure in the digital currency market. This sentence is very wrong.

Success in trading Bitcoin or other digital currencies has nothing to do with luck. Successful traders have been people who have managed to manage capital in digital currency by learning technical analysis.

In the table below, you can see some trading methods along with their details.

| Trade method | Period | Main analysis method |

|---|---|---|

| Scalp trading | A few seconds to a few minutes | Technical analysis + use of robots and automated trading platforms |

| Day trading | Short term – Daily | Technical analysis |

| Swing trading | Medium term – 2 weeks to 2 months | Technical analysis |

| Position trading | Long term – 3 months to 1 year | Technical analysis and Fundamental analysis |

To choose the best trading method, you can first try several methods together so that you can identify the right strategy for your conditions.

Of course, it is not necessary for a trader to use only one method forever, but he can change his trading method in different periods of time according to the amount of financial resources or the market situation.

Mining digital currencies

Mining is the process of validating digital currency transactions. In the world of digital currencies, transactions are stored in a block. These blocks are added to a chain of files called blockchain.

In simpler terms, miners (digital currency miners) compete with each other to solve complex mathematical problems, and the first person to solve the problem will receive the mining reward.

The reward will also be a part of the mined currency (example: for mining bitcoins, miners are rewarded with bitcoins).

To extract digital currency, it is necessary to use mining devices. If you benefit from cheap electricity and suitable hardware, digital currency mining can be a profitable activity.

Capital management strategies in digital currency

The digital currency market, like any market, needs to formulate a capital management strategy. In fact, before involving his financial resources, the trader must examine the things that are effective in minimizing the risk and develop a perfect strategy.

In the following, we will introduce the important things that you should consider in the digital currency capital management strategy.

One of the most important cases is the simultaneous use of technical and fundamental analysis. In fact, by using these two powerful tools, in addition to analyzing the history and behavior of the price, the general conditions of the market and the desired asset are also checked.

Therefore, the trader gets a broader view of the market and the desired project for trading. Along with using these efficient tools, diversifying the investment portfolio is very important.

In fact, the trader should not invest all of his assets in a specific category such as the DeFi field. In addition to these assets, it can purchase security tokens, Bitcoin, first-tier projects such as Avalanche, gaming tokens and metaverse, and second-tier projects and create a diversified asset portfolio.

Taking advantage of exchange facilities, such as determining profit and loss limits, can help not to lose profits and prevent large losses.

Determining the limit of profit and loss is one of the points that must be observed in transactions. In fact, the trader should not enter into a transaction whose exit points are not clear.

By determining the exit points, the trader can check the risk-reward ratio of the trade and decide to involve financial resources. Therefore, the trader can have a profitable outcome of his transactions only by determining the risk-to-reward ratio.

All these things help to manage risk in digital currency and determine an efficient capital management strategy.

Important points in investing in digital currencies

All people who decide to start investing in digital currencies are looking to make a profit. But earning profit is not possible except in the shadow of awareness.

It is very important to learn the tips related to capital management in digital currency. If you are about to enter the wonderful world of cryptocurrency, be sure to read the following carefully before starting to trade:

You have to take risks

If you are not much of a risk taker, we advise you to think again about investing and managing funds in crypto. The cryptocurrency market has recently been introduced as one of the most profitable investment tools, but as the price of digital currencies is growing, there is also the possibility of their spot price falling.

Never forget this point in digital currency capital management.

Volatility is a term used in relation to the ups and downs of the market, i.e. the movement of the investment market. In the digital currency market, the mentioned fluctuations are very high.

This means that while you go to bed at night, if you have the equivalent of $10,000 in the digital currency market, this money may decrease to $3,000 in the morning or increase at the same rate.

Therefore, it is better not to invest all your capital in this market. If you are looking for a capital market for your extra money, enter the field of digital currencies.

At the same time, don’t forget to pay attention to the fear and greed index. This indicator is a good indicator for market analysis.

Don’t invest in just one cryptocurrency

When you invest in multiple cryptocurrencies, you increase your chances of making a profit. On the other hand, if you only invest in one crypto and experience a price drop, you may lose all the money you invested in it.

For this reason, it would be wise not to limit your investment to one cryptocurrency. Remember to invest in at least some stablecoins like Tether.

Before choosing a digital currency, consider the rate of return on investment.

If you lose, don’t try to make up on the same day

All investors may lose part of their assets in some circumstances. Investors of digital currencies are not exempted from this rule. Of course, this refers to capital management in digital currency.

Some people, when they lose their property in one day, start making emotional decisions to compensate immediately. The most important thing about investing in digital currencies is to keep calm and make decisions at the right time.

Remember that rushing to make a decision to compensate for a loss will lead you to a bigger loss.

Pay attention to the legal policies of the country

Although the existence of digital currencies and investing in them is legally accepted in most countries of the world, some governments have imposed restrictions on digital currency exchanges.

These rules and restrictions can change according to the prevailing conditions in the society. Therefore, it is better to always keep your information up-to-date in this field so that you can face less financial risks.

Pay attention to security issues

There are many wallets available for digital currency investment in software and hardware. But all these wallets and platforms are not valid for buying and selling digital currency.

Therefore, it is very important that you pay attention to this before starting to work in the field of digital currencies.

Another important thing in digital currency capital management is wallet password protection. Never give your wallet access key, which is called private key, to other people.

In recent years, digital currency wallets have been exposed to hacking and cyber attacks by fraudsters. One of the best ways to increase security is to back up your cryptocurrency wallet.

Also, not keeping large amounts in online wallets is another way that can save you from hacker attacks. You can use hardware or offline wallets to store large amounts of digital currency.

The key to managing your capital is in your own hands

To invest in digital currencies, you need to research and acquire enough knowledge to manage capital in digital currency more intelligently.

In the following, we will discuss an example of capital management in crypto.

Let’s say you want to invest in Bitcoin. Before entering the transaction, you find the appropriate entry point with the help of technical tools and determine the ratio of risk to reward, and after the price reaches the desired point, you enter the transaction.

The best thing to do after entry is to set profit and loss limits so that you don’t miss exit positions when you don’t have access to the exchange.

The next step will be to diversify the investment portfolio. Next to Bitcoin (as a safer asset), you can enter the field of DeFi and buy the digital currency suitable for this field.

In this way, your portfolio is formed and you can earn good profits from the digital currency market.

Also, remember that one of the most important factors to consider in investing in digital currency is choosing a valid online exchange.