Robinhood is a commission-free trading platform that allows users to trade Bitcoin, Ethereum, Litecoin, and other major cryptocurrencies, as well as stocks, options, ETFs, and gold.

In this article, we discuss how to conduct digital currency transactions, the possible risks of conducting transactions in it, competitors, and the introduction of Robinhood’s development team

Let’s dive in and explore together:

- The history of Robinhood

- What is Robinhood and who is it suitable for?

- The growth of Robinhood and its impact on the industry

- Fee-free trading of cryptocurrencies at Robinhood

- Which cryptocurrencies can be traded in Robinhood?

- Robinhood’s top priority is the security of its users’ cryptocurrency

- Robinhood’s no-fee transactions are really free

- Trading without option fees with Robinhood

- Loss limit or stop limit orders

- How to trade options in Robinhood

- Minimum account balance and instant deposits

- Robinhood and Robinhood Gold mobile application

- Robinhood Gold

- The cost of using Robinhood Gold

- Premium features

- Is using the Robinhood app worth paying for?

- Advantages and disadvantages of the Robinhood platform

- Introducing the competitors of Robinhood trading platform

- Which platform is better, Acorns or Robinhood?

- Robinhood’s way of making money through order flow

- How does Robinhood charge for order flow?

- How to work in the Robinhood program?

- Is the Robinhood program efficient and beneficial?

- Is Robinhood trustworthy?

- Is it possible to profit from Robinhood?

- What is the minimum deposit in Robinhood?

- How about paying taxes and hidden fees in Robinhood?

- Introducing the production team of Robinhood

- Frequently asked questions on Robinhood platform

The history of Robinhood

The Robinhood program was started less than a decade ago by two Stanford University students. These two people considered an issue that was considered one of the most important problems in the market: trading fees in the stock market.

Robinhood has over 10 million users and has raised over $900 million in venture capital (VC) funding. Almost all brokerages now offer commission-free trading, because otherwise they would not be able to stay in business.

Many people agree that Robinhood is the main reason for the significant change in the field of stock market trading. This program is now a ready and available option for investors.

But as other brokerages, like Robinhood, started offering commission-free trading, the platform had to continue operating in other ways. As such, the app now offers no-fee trading of cryptocurrencies as well as seamless access to stock market trading.

What is Robinhood and who is it suitable for?

Robinhood is a new force in the brokerage industry and has managed to reach 10 million users since its launch in 2013. Undoubtedly, Robin Hood has made important changes with its commission-free trading of stocks, options and ETFs

But Robinhood’s activity does not end there. Crypto traders can also trade without paying commissions, and because of this, TD Ameritrade has been able to attract a lot of crypto traders.

Since Robinhood is not a full-service brokerage and does not offer all available services, it is not present in areas where full-service competitors such as Charles Schwab and Merrill Edge perform well.

However, Robinhood’s entry into the market has been an important point for young and middle-aged investors and has positioned Robin Hood as a key and influential player in the industry.

Traders looking for a new brokerage will enjoy Robinhood’s cheap and hassle-free trading. Robinhood is defined by several important points, which we summarize as the top 5 points. These points include:

1- Robinhood was launched in 2013 and has been influential in major and important changes in this industry.

2- Robinhood’s approach of conducting transactions on mobile has influenced young and middle-aged people and this program has reached 10 million users.

3- Robinhood has managed to attract 912 million dollars of capital and is considered a safe option for doing online transactions.

4- After Robinhood announced that its volume of transactions is 10 times higher than its major competitors, it made news. However, the fee structure of this program is still affordable.

5- Robinhood’s basic features make this platform a poor choice for traders looking for detailed research, analysis, and notifications.

Using Robin Hood is suitable for the following people:

- Option traders

- Smartphone users

- Cryptocurrency traders

- Beginners

- Traders looking to make quick trades

The growth of Robinhood and its impact on the industry

In December 2019, Robinhood announced that the platform’s online trading program had crossed 10 million users. This means that although Robinhood is one of the newest brokers in the market, it has more users than E*Trade.

During its 6 years of operation, Robinhood has had a significant impact on the industry by lowering prices and making investment tools more accessible to a younger audience.

With commission-free trading of stocks and ETFs and the fact that user accounts can have zero balance and no minimum account amount, Robinhood is on a fast-growing path and is quickly becoming one of the most popular platforms among users.

In fact, Robinhood is becoming a serious threat to his competitors. As such, Robinhood’s competitors have had to adapt to Robinhood’s features and change their business structure to compete with the platform. Charles Schwab Kam’s acquisition of TD Ameritrade announced in late November 2019 is proof of this claim.

This $26 billion transaction has increased the number of Charles Schwab users to 12 million users and the company’s assets under management have grown by $1.3 trillion.

In this way, the number of users of this company has reached 24 million people and the assets under its management have reached more than 5 trillion dollars.

This positive change in the industry has taken place in all sectors and retail investors have also received it very well. However, shareholders did not like this change. Transaction fees have always been the driving force of traditional companies in the field of online transactions.

Now, with the Robinhood strategy of no-fee trading, companies are forced to think of new ways to make a profit. This issue can lead to more coherence in the field of transactions.

Along with announcing the achievement of 10 million users, which is considered an important milestone for this platform, Robinhood has also mentioned the impact it has had on the industry. Robinhood said in this regard:

We pioneer commission-free trading of stocks, ETFs and no-minimum balance accounts. In this way, we have also added fee-free option trading and crypto fee-free trading to our platform.

Robin Hood offers not only commission-free trading of stocks and ETFs, but also commission-free trading of cryptocurrencies. Adding this new capability to Robinhood is considered a new threat to traditional and non-traditional brokerages and will continue to lead to the prosperity of this industry.

Fee-free trading of cryptocurrencies at Robinhood

Compared to other exchanges, Robinhood’s user interface is very simple in the field of cryptocurrency trading. But this simplicity complements Robinhood’s overall plans to provide a platform for simple and accessible transactions.

If you are looking for a more complex user interface, Robinhood is not the right trading platform for you. Interestingly, Robinhood provides access to fiat currency transactions, which can be considered a good option.

Robinhood does not offer fee-free trading of cryptocurrencies to new users who have just created an account, but offers fee-free trading of a few specific cryptocurrencies.

However, the eligibility of users to take advantage of these deals depends on the countries in which they reside and restrictions may apply.

In February 2018, Robinhood launched commission-free trading of 7 cryptocurrencies in New York, increasing its user base and becoming a serious threat to traditional and non-traditional brokerages in the industry. Unlike many other platforms in the industry, Robinhood is not interested in making a profit.

Robinhood’s interest and purpose revolves around democratizing the industry and hopes to achieve the same level of profit and loss. Vlad Tenev, co-founder of Robin Hood, said:

We will be connecting to dozens of other exchanges over the next few months. We aim to make neither profit nor loss. We see this situation as an opportunity to expand our user base and plan to increase our customers’ access to Robinhood’s capabilities.

As of October 2019, Robinhood has offered crypto fee-free transactions to 8 other states in the United States, including Kentucky, Louisiana, Delaware, Maryland, Maine, Nebraska, Minnesota, and Vermont, and thus, this type of transaction is available to users in 46 states. It is placed in addition to Washington. Robinhood has promised to offer these deals all over America.

Which cryptocurrencies can be traded in Robinhood?

In addition to buying and selling 7 cryptocurrencies free of charge, including Bitcoin, Ethereum, Dogecoin, etc., traders can monitor price fluctuations and check news related to 10 other cryptocurrencies.

Compared to other crypto exchanges, the number of cryptocurrencies supported by the Robinhood app is very limited. The coins available in Robinhood are:

- Bitcoin

- Bitcoin SV

- Bitcoin Cash

- Ethereum Classic

- Ethereum

- Litecoin

- Dogecoin

- Compound

- Metic

- Shiba

- Solana

- Bitcoin Gold

- Lisk

- Monroe

- neo

- Ripple

- Stellar

- Zee Cash

- QTUM

Robinhood’s top priority is the security of its users’ cryptocurrency

Due to the significant growth of Robinhood, the security of traders’ cryptocurrencies is the main priority of this platform. The broker’s hosting system uses superior cryptographic controls to provide a high level of security.

Robinhood has an offline wallet where most of the cryptocurrencies are stored. This means that these systems have no connection to the Internet. As a result, there is a double layer of protection and safety against any potential attack and penetration.

In addition, Robinhood has stated that it has established related systems to protect and prevent the transfer of cryptocurrencies by different individuals. It should be noted that the transfer of cryptocurrencies requires several different levels of approval.

Robinhood’s no-fee transactions are really free

Fee-free and free transactions are Robinhood’s strength. This feature allows you to trade stocks, options, ETFs and cryptocurrencies without paying any fees. The company has shown that it has a correct understanding of the needs of its customers and is well aware of them. But Robinhood not only offers free trades, it is one of the best stock trading brokers in the market.

If you are an investor and especially an option trader, free trading is a very important point for you. Although Merrill Edge is the winner in the field of free stock trading and Fidelity Investments and Schwab are the winners in the field of ETFs free trading, the Robinhood program in the field of option free trading has been able to surpass its competitors.

Option traders know how much costs can increase when entering and exiting the market. The reason for the increase in costs is that broker fees are usually imposed on traders as well as additional fees per contract. That is why traders are constantly looking for the best options trading broker.

These additional and hidden costs can be huge and significant at the end of the job. Robinhood has completely eliminated these fees and does not impose any fees on traders. As a result, Robinhood has become a very good option for investors and option traders.

Trading without option fees with Robinhood

Robinhood considers option trading, like the stock market, to be a thing of the past when transactions were done completely electronically. The purpose of brokerages is to simplify things and create the belief that advanced investment tools do not require complex knowledge.

Due to this issue, options trading strategies and capabilities offered by brokerages include relatively simple to advanced ones. With brokerages, you can buy call and put options, or sell hedging options, as well as fixed-risk spreads.

Multi-leg option transactions offered by Robinhood include Straddle or a situation in which the same amount of Call and Put options are bought or sold under the same conditions.

Strangle in which the investor It buys a call option at a price above the market price and a put option at a price above the market price at the same time on the same underlying asset with the same expiration date and different exercise price.

Iron Condor is actually a strategy Options trades that rely on low volatility to make a directionless trade with limited risk and profitability are debt spreads, calls, puts, etc.

The versatility of these strategies is great because they allow investors to short buy when they predict the stock price will rise and short sell when they predict the stock price will fall.

Loss limit or stop limit orders

The Robinhood program also offers stop limit orders for options trading. This feature allows you to have more control over the execution of your orders.

The stop limit gives you the peace of mind that as soon as the option contract reaches the price limit you specified, the limit order will be activated and executed. Of course, provided that the option contract is still available at the price you specified. Stop limit is a very useful feature that can be used to minimize risk or protect profit.

While the number of fee-free ETFs offered by Robinhood’s competitors is in the hundreds, the platform offers more than 2,000 fee-free ETFs to its users. This makes Robinhood a popular broker among passive investors.

How to trade options in Robinhood

If you want to learn how to trade options in Robin Hood, we have prepared this topic for you in 5 steps. These steps are:

1- Click on the magnifying glass on the top right of the main screen.

2- Search for your favorite stocks that you want to trade options on.

3- Click on the stocks you want.

4- Click on the Trade button on the top right side of the detail page of the stock you want.

5- Click on Trade Options option.

You can easily do option transactions. Although everyone can trade options, keep in mind that this type of trading is not for everyone.

Offering over 2,000 fee-free ETFs has made Robinhood a top choice for traders.

Robinhood also allows crypto traders to place fee-free trades in certain cryptocurrencies. Currently, this service is available in most US states.

Minimum account balance and instant deposits

Robinhood does not set any minimum account balance for investors. Fast deposit is another thing that makes Robinhood a great option for trading and investing. Every person who wants to make a deposit to a brokerage account is aware of the waiting time for the deposit and knows that there is nothing he can do about it.

Robinhood solves this problem by enabling simultaneous transmission. Robinhood has eliminated the problem of instant reporting of small deposits to the account by using the instant approval of banks.

This means that you can instantly deposit up to $1000 into your account using the Robinhood app. Since Robinhood is easy to use, it is one of the best online stock brokers for beginners.

Robinhood and Robinhood Gold mobile application

Robinhood is a mobile trading company. As a result, one of its most notable features is the Robinhood mobile app. Ease of use and simplicity of this program make it one of the best programs in the field of stock trading. This is evident in Robinhood reaching 10 million users.

Users can click on the search icon and view a selection of different stocks. In this program, you can also see the watch list, stock prices, news and important criteria, along with the list of orders and transactions.

Robinhood app is fast and hassle free. This issue is an important point for users who do not want to disrupt their activities. The Robinhood program focuses on efficiency and effectiveness, and this can be seen in the Trade button.

As you browse and scroll through this app, this button accompanies you and waits for your order to make a transaction and order.

Robinhood Gold

Robinhood Gold is an update available on the website and app. With Robinhood Gold, you can get a loan and buy securities. It’s a bit difficult to learn, but once you learn it, you’ll love it.

The cost of using Robinhood Gold

Robinhood Gold can double the purchasing power of your account. While most brokerages charge users a daily fee, Robin Hood Gold has a monthly fee of $5. This fee includes access to premium features. However, if you have no money in your account, this fee will be added to your margin.

After you use more than $1,000 in margin, a 5% interest fee will be charged on the amount over $1,000 you used. Also, after selling shares, you will have quick and immediate access to your capital. Also, all margin accounts must have a balance of at least $2,000.

Premium features

Robinhood has recently added two premium features which are:

- Professional Research: With this feature, you can access Morningstar’s comprehensive reports and research. The reports in this section are regularly updated to include important events and cover 1,700 stocks.

- Market level 2 information: With this feature, you can simultaneously monitor and track offers and requests in the Nasdaq stock market.

Is using the Robinhood app worth paying for?

There is no doubt that the Robinhood program has been well received. It is worth noting that this welcome was not only from young users, and traders who are not confused by a large amount of information and can start trading quickly have also welcomed Robinhood.

This program is not suitable for those who seek to receive a lot of information and extensive research and analysis. The services offered by the Robinhood program include:

Watchlist

Watchlists are presented in a simple and basic mode and there are not many columns other than the last price and percentage of changes. Users can also view a watchlist at the same time.

Price alerts

You can now enable alerts for all trading positions in your watchlist. In fact, there is no option to personalize alerts and focus on specific stocks.

Stock charts

Stock charts are simple and basic and cannot be changed except for the 6 default time ranges. Also, technical analysis cannot be obtained from these charts. The general state of the diagrams is simple and preliminary. This topic has different strengths and weaknesses based on the audience it faces.

Advantages and disadvantages of the Robinhood platform

Although the Robinhood program has moved the financial markets industry forward and pushed its boundaries, it is not considered as a broker that has all the services available.

This is a disadvantage compared to Robinhood’s competitors. The advantages and disadvantages of Robinhood can be summarized as follows:

Disadvantages

- Robinhood’s teaching and research tools are not complete and satisfactory.

- The customer support department is weak and the support answers users’ messages automatically and using bots.

- It is not possible to open a joint account.

- Lack of full user access to their accounts (not having the private key).

It’s worth noting that Robinhood’s primary goal is not to help, educate, guide, or prosper traders. Robinhood isn’t focused on that, and they can’t be blamed, because it does pretty well without it.

Robinhood has made the brokers offer good prices to their customers, but unfortunately proper customer support is not included in Robinood’s activities.

Customer support is simply reduced to a set of guides and automated responses by the bot. For more information, it is best to seek help from sources outside of Robinhood. If you want to talk to and get advice from a real person, Robinhood is not the broker for you.

Also, Robinhood offers only one type of account. Since Robinhood is not a full-service brokerage, it can be said that this issue is a weakness for Robinhood compared to its competitors. So don’t expect Robinhood to offer you a joint account or retirement account.

Advantages

- Easy to use and simple user interface

- Accepting fiat currencies

- Transactions without fees

- High security and continuous updates

Introducing the competitors of Robinhood trading platform

One of the important features of the Robinhood platform is to provide free services to financial market users. Therefore, platforms that have this feature can be considered as Robinhood’s competitors.

- Webull is one of the free stock trading programs that has various analytical tools and resources.

- Public.com is one of the best Robinhood alternative platforms. The use of this platform is free of charge and its monetization is through payment for order flow.

- Fidelity is one of America’s largest brokerages, managing more than $10.4 trillion in assets. This broker tops the list of best brokers for beginners because it offers comprehensive services that evolve with investors’ needs.

- Acorns is also included in the list of the best investment programs. This program is very different from Robinhood and is mostly used for long-term savings.

- Merrill edge is another platform that provides relevant experiences, investment insights and various rewards to empower its users’ financial future.

Which platform is better, Acorns or Robinhood?

Although Acorns and Robinhood are both suitable for young and beginner investors, there are significant differences between the two platforms.

While Robinhood’s features and services are the same as other discount brokerages, Acorns’ suite of tools makes it a hybrid savings platform and financial auto-advisor.

Both platforms are low-cost and beginner-friendly, but Acorns offers a passive approach, while Robinhood provides active engagement.

The answer to the above question depends on the goals and conditions specific to each person. But overall, if you need help accumulating capital to invest and have no investment experience, Acorns provides a great way to save while still enjoying the benefits of passive income.

If you have experience in investing and you know the fundamental factors well, Robinhood is more suitable for you.

Robinhood’s way of making money through order flow

Considering the commission-free trading of stocks, ETFs and option trading, many people may be faced with the question, how does Robinood make money? The answer to this question is order flow.

For various reasons, companies charge different order flow fees from wholesalers. Although Schwab, E*Trade and TD Ameritrade earn $1 million from order flow execution, Robinhood earns more than 10 times that amount.

To see the details of the order flow, you can check the companies’ quarterly financial statements (606 Disclosure). All brokerages in the US must provide quarterly financial statements detailing the cost of order flow and buyers. This provides transparency and customer protection.

Logan Kane has stated in his report that Robinhood receives $260 for every $1 million in order flow he sells. For comparison, other brokerages such as TD Ameritrade and E*Trade charge approximately $22 in order flow per $1 million in sales.

How does Robinhood charge for order flow?

Kane has acknowledged that Robinhood users are novice traders who are not aware of this and thus, Robinhood can charge the said fee. Kane has also stated that the Robinhood program guides traders in the direction of least resistance during trades.

As mentioned, the Robinhood app is very simple and has simple analysis, news and charts. Robinhood cannot provide an overview to its clients and does not inform novice traders. This does not affect long-term investors. However, those who are looking to make short-term trades see this point in their trades.

How to work in the Robinhood program?

Creating an account on Robinhood takes about 4 minutes. To create an account in Robinhood, the following are required:

- Social security number

- Bank information

- A mobile phone or tablet

To create an account and use the Robinhood platform, the following steps must be taken:

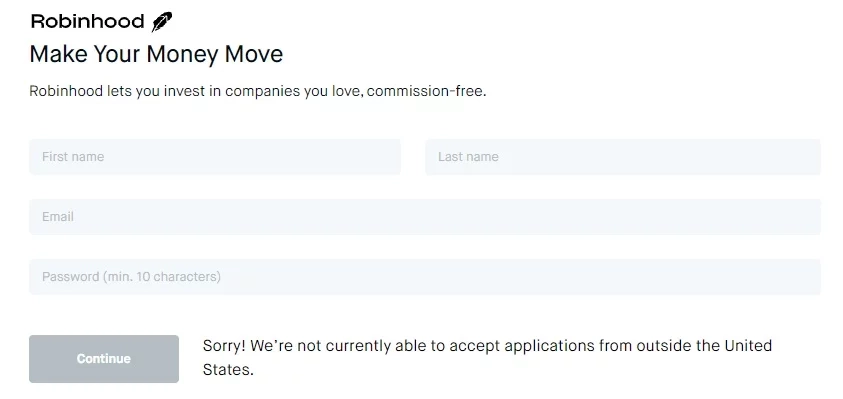

Create an account

Creating an account in Robinhood starts from the registration page. On this page there is a small form where you need to enter your information and create your account. Then you will be asked whether your mobile operating system is iOS or Android.

The mentioned question is asked because Robinhood is a mobile-based company and its transactions are done only on the mobile platform. If you want to use a computer, Robinhood is not for you.

Enter contact information

In the second step, you will be asked to enter other personal information such as your address and contact information. On the right side of the page, Robinhood has explained why he needs this information.

Identity confirmation

In the third step, you must verify your identity. This page fully explains why it is asking you to provide this information.

Deposit money to account

Transfer some money to your account. Robinhood does not charge users for any deposit or withdrawal transactions.

Request registration

After reading the rules and regulations, click on the submit button. The process of creating an account is almost complete. After accepting the terms and conditions, an email will be sent to you.

Download the Robinhood app

After clicking on record information, you will be directed to download the iOS or Android version of the Robinhood app.

Login to the Robinhood program

Log in to the program using the information you used to create an account in the first step. Click on Add Funds to enter your bank details and start investing in Robinhood.

Is the Robinhood program efficient and beneficial?

Robinhood has started its activity as a mobile-only platform. Although the online version of this platform is also available, if you intend to use this brokerage, having the Robinhood app is a must.

Robinhood app is fast and well designed. This program provides a simple, easy and suitable experience for beginner users.

This condition is also true for its web version. However, the weakness of the Robinhood program is the lack of educational and research resources, lack of customization and limited investment options.

Simply put, Robinhood is a user-friendly and uncomplicated platform, and all these advantages are well integrated into the mobile app. The web version does not offer more options than the mobile version.

Is Robinhood trustworthy?

Robinhood is approved and regulated by the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This means that Robinhood complies with strict rules regarding commercial activities.

Robinhood was founded in 2013 and its program was released in 2015. Robinhood has made a significant change in the field of brokerages and has led the industry towards commission-free trading.

Despite the fact that well-known companies began to imitate Robinhood, this company not only managed to survive and continue to operate, but also achieved great goals and managed to attract $ 912 million in capital.

Robinhood is SIPC insured and insures the protection of customer accounts up to $250,000. Thus, it can be said that Robinhood can be trusted.

Is it possible to profit from Robin Hood?

Fee-free trading of stocks and ETFs at Robinhood dramatically reduces costs. The user-friendly and simple design of this platform makes it very easy to use.

Robinhood has grown significantly over the past few years, and this can be seen in the number of users of this platform, which has reached more than 13 million people.

With enough training, you can also make a profit in Robinhood, and in this sense, users are not facing more or less risk than other platforms.

What is the minimum deposit in Robinhood?

After account verification and login to Robinhood, in addition to geographic restrictions, there are daily trade volume limits for users who trade stocks with an account value of less than $25,000. Daily transactions include buying and selling in one day.

Users who trade stocks, have an account of less than $25,000 and trade 4 out of 5 days, their account will be marked as a day trader and will be limited to 90 days in the number of daily trades, Unless they increase their account value to more than $25,000.

Users whose account value is more than $25,000 will have no limit on the number of daily transactions.

Of course, these restrictions do not apply to users who trade digital currencies in Robinhood, because there are no daily trading caps and unlike other financial and economic products, digital currencies are not regulated by FINRA or the Securities and Exchange Commission (SEC).

There is no minimum deposit or account opening balance for cryptocurrency traders at Robinhood. However, to be able to take full advantage of Robinhood Gold, the situation is a little more complicated.

Robinhood Gold costs $5 per month to use, but you must have at least $2,000 in your account if you want to access margin trading.

How about paying taxes and hidden fees in Robinhood?

Short-term and long-term profits you earn in Robinhood, as well as all profits from buying and selling stocks, are subject to tax.

Also, in general, Robinhood has no hidden fees. In most cases, stock trading in Robinhood is completely free of charge.

However, sometimes, fees are charged. Transferring an account to another brokerage is $75, domestic transfer by phone is $25, and international transfer is $50.

Introducing the production team of Robinhood

Robinhood trading platform was created by two students of Stanford University. Baiju Bhatt and Vlad Tenev are the founders of the Robin hood platform.

Baijo and Vlad were classmates at Stanford, and after graduating from university, they moved to New York City, founded two financial companies and sold their trading software to hedge funds.

After that, they realized that the big Wall Street companies were paying almost nothing for their transactions, while they were charging huge commissions from users.

So Baijo and Vlad decided to return to the state of California and design a financial platform that would allow everyone to trade in the financial markets.

Frequently asked questions on Robinhood platform

What is the Robinhood platform?

Robinhood is a trading platform, which users can use to trade stocks, options, ETFs and cryptocurrencies without paying commissions. The Robinhood platform is a suitable platform for conducting transactions in the financial markets due to its easy-to-use environment and providing services on the web and mobile platforms.

What cryptocurrencies does the Robinhood platform support?

Currently, the Robinhood platform supports Bitcoin, Bitcoin Cash, Bitcoin SV, Compound, Dogecoin, Ethereum, Ethereum Classic, Litecoin, Metic, Shiba, Solana, Bitcoin Gold, Lisk, Monero, Neo, AmisGo It supports Ripple, Stellar, ZCash and QTUM.

Robinhood has its own shortcomings and weaknesses, but considering reaching 10 million users and creating more access to this industry, it can be said that Robinhood thinks about its customers and is considered a good choice for different people.

Robinhood is more suitable for people who are looking for fast, simple and hassle-free transactions. If you’re looking for better tools, more comprehensive research, and more assets, you might want to check out other investment platforms like Charles Schwab and Fidelity.

Also, the Robinhood program allows account holders to easily trade more than 5,000 stocks, ETFs, options, gold and digital currency through the mobile application or on the Internet.

What do you think about the Robinhood trading platform? Have you ever used this platform? Do you think this platform can become one of the main trading programs in the cryptocurrency market? Share your comments and experiences with us.